In my opinion, the insurance you get with the Migros Cumulus credit card is more useful.

Both cards include up to 60K search and rescue insurance.

The Ikea card includes ambulance transportation coverage, which is good if you do not have supplemental health insurance (useless if you do). Note that ambulance transportation due to accidents is covered by occupational accident insurance (if you are employed), so this ambulance insurance is beneficial for illness. Not a bad insurance, depending on your age/health.

The Migros credit card does not have ambulance insurance, but instead, it gives you trip interruption insurance. This insurance remiburses missed flights and hotel bookings due to hazards which occur during a trip (after you have made your first flight, etc). It only covers up to 4000 francs, but I think most people are more likely to use this than ambulance insurance.

The Migros card has up to CHF 2K purchase protection, compared to the Ikea card’s CHF 1K. The Migros card has price protection, which is fantastic. The Internet insurance coverage (legal, online accounts) are

nice-to-haves.

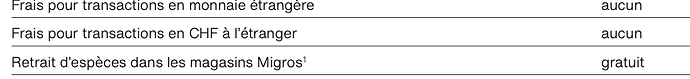

All things considered the new Migros Cumulus credit card is far superior to both the Ikea card (for insurance) and the Certo credit cards (for fees and benefits) in my opinion. It has no foreign transaction fee and lets you make 2 cash withdrawals outside of Switzerland each year with no cash withdrawal fee. You can get free cash advances at Migros supermarkets as you could with the phased-out Migros credit card. For whoever might carry credit card debt, the Migros credit card has an exceptionally low interest rate as far as Swiss credit cards go.

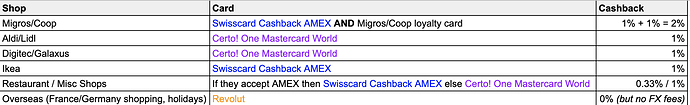

Sure, the rewards are only useful if you shop at Migros, but I believe rewards are just a nice-to-have, as they tend to motivate you to spend. The real savings are in benefits like price protection (best-price guarantee) and insurance. If rewards are important to you, the Cashback American Express from Swisscard is still the top runner, and you can use that to earn 1% everywhere, not just at 3 merchants.

It’s great to see competition in the Swiss credit card market driving up the benefits and pushing down the costs. 5 years ago credit cards with benefits and costs like these were mostly found in the US.