I care.

Totally understand if you don’t want to post monthly just for me.

And yes, most people here believe in index investing. Which is fine.† I started out that way, too, once I got serious about investing. Literally (almost) any “serious” investment book tells you to do exactly that.†† And they’re probably right, given most serious investment books are geared towards beginners (IMO).

Maybe only once you get closer to retirement, i.e. having to actually consume cash flows from investments, people open up to thinking about alternatives to “VT and chill” as they’ll actually have to sell VT and it then becomes harder to chill … and most people here seem still many years away from retirement, whether early retirement or not.

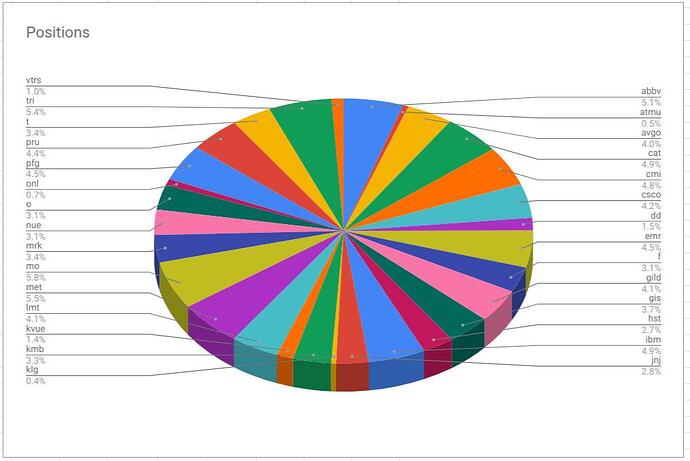

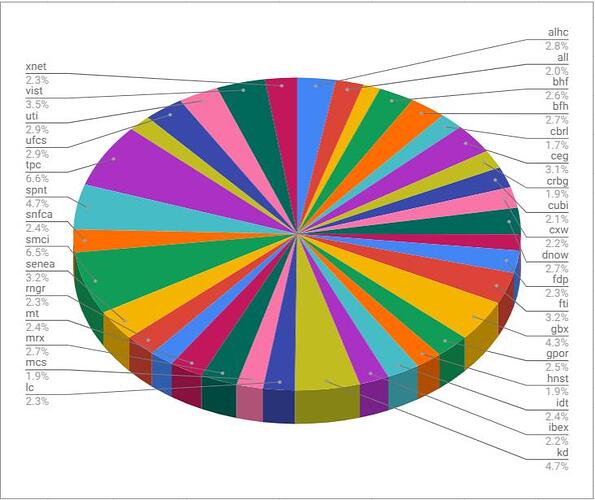

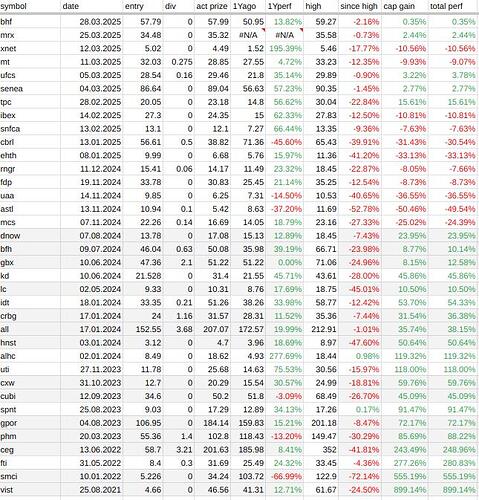

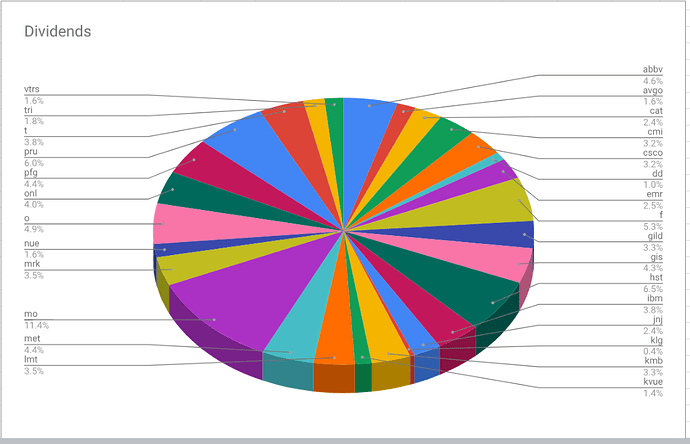

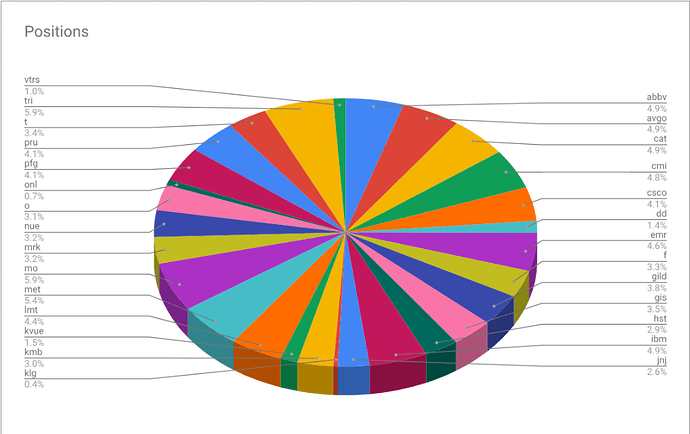

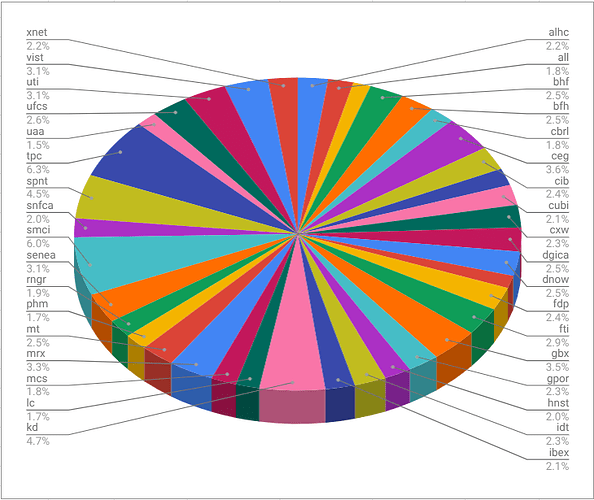

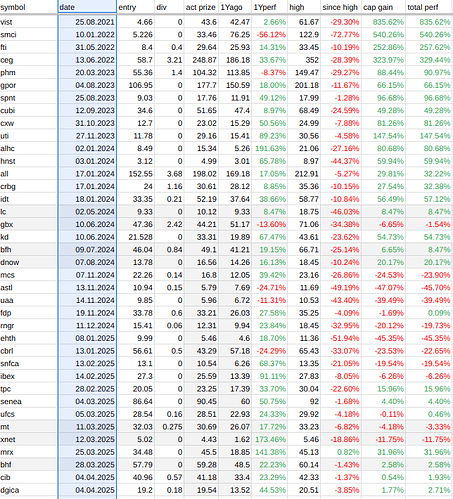

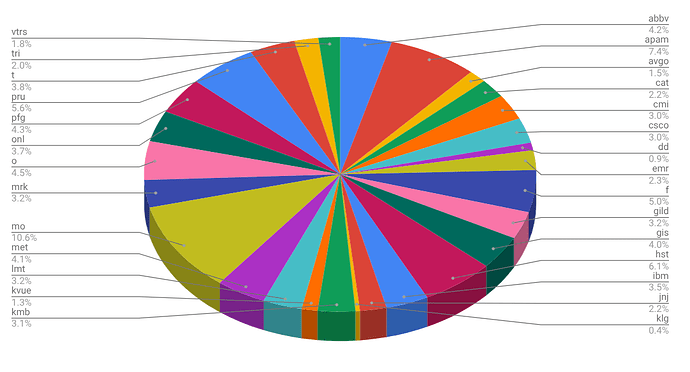

I kind of believe that it doesn’t matter much what the rules are, as long as you have the conviction to adhere to them, no matter what. I personally find it interesting to observe how @cubanpete_the_swiss manages to stick to them and now even favors his momentum portfolio over the dividend portfolio for income/cash flows.‡

Building the conviction is probably impossible by copying someone else’s rules – at least I can’t do it – but coming up with your own set of rules requires actual work. The (investment part of the) forum, however, is mostly chit-chat and opinions.‡‡

Of course, there’s still lots of value to be found in the forum, especially when it comes to practical advice on how to do task X at broker Y, etc. Actual return strategies? Not so much, IMHO.

Um, the point of a rules based approach is to not have a discussion? Unless maybe you bring some experience to the table with your own set of rules that you adhere to strictly. Not to criticize you personally, but do you have a strict set of rules that you mechanically adhere to and that you have published here?

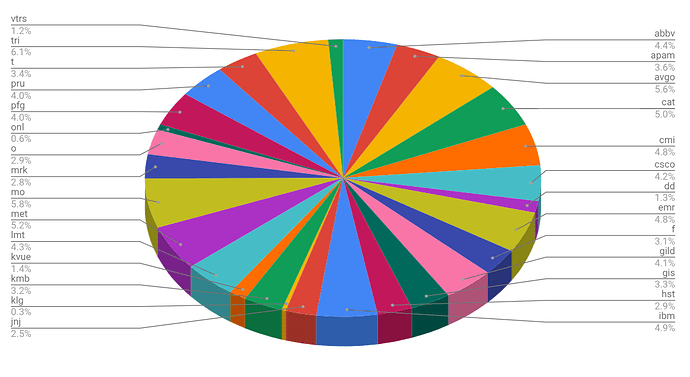

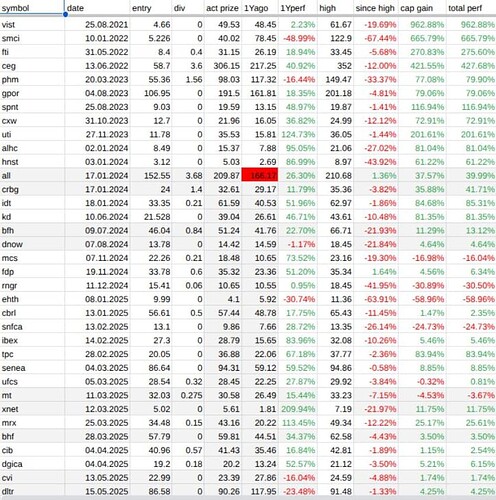

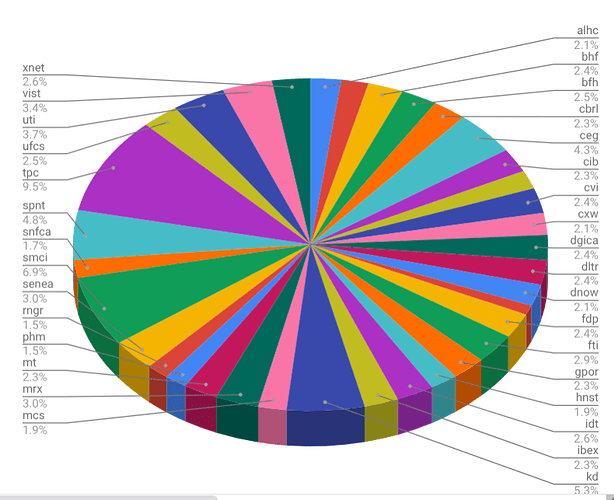

Anyway, happy investing everyone, I for one appreciate the updates, even if just looking at the tickers in each investment approach by @cubanpete_the_swiss and catching myself nodding, shaking my head, or occasionally encountering a company that makes me go “Hmmm”.

[†] Except – IMO – for those remarkable fellow forum members who, ahem, actively choose ETFs based on their macro view/feelings and “re-balance” ETFs based on market timing thoughts …

[††] Perhaps with the exception of one of the first real investment books: The Intelligent Investor, of course.

And then there’s also Peter Lynch.

[‡] Something for which I not only don’t have any conviction, maybe even … negative conviction.

But it seems to work for @cubanpete_the_swiss … so, who am I to critize the approach.

[‡‡] Which is totally fine by me! And I like it, too. It’s just mostly a not so serious discussion about different investment approaches, at least from what I seem to read.