How do you invest? Directly or with some kind of brokerage?

Swissquote (SQ), IIRC they use UBS’ fund desk. You save on comms if you invest directly. However, it is important to me that my relatives could just pick up the phone and call SQ in case something would happen to me.

Mind you sharing what kind of funds?

I‘m still kind of puzzled how it can be tax free

Apols, I double checked a fund I don’t hold, which seems to have tax: ICTax - Income & Capital Taxes

Yes, net monthly data back to inception. Management fees, performance fees, minimums, AUMs, etc. Over 300 active and 1500 archived funds. You can graph a portfolio from your choice of individual funds. Thank you!

Yes, please note that not all funds report to IASG.

True, DBi’s Managed Futures Strategy is not on there, but it is on rcmalternatives.com. They also have similar features as iasg.com.

OK. Give me the elevator pitch:

Q1. What are managed futures?

Q2. Why should I invest in them?

Q3. What are the benefits?

Q4. What are the risks?

ChatGPT is in another window.

Ok, I’ll try:

Managed futures is a collection of strategies trading futures contracts. They also come in all kinds of legal structures. In this thread we often talked about the “systematic trend-following” strategy: Go long if prices have gone up, go short if they have gone down.

- There is significant long-term evidence of good returns across all kinds of asset classes for this strategy. The returns had low to negative correlation to stocks, especially during crisis.

- As they can go short, they can and do generate returns if everything goes down.

- The fees have come down a lot, and (or as) solid index replicators have entered the market.

Allocating a part of a stock portfolio should have better risk adjusted returns (better than just adding bonds). This can be also be used for leverage, of which you need less because they can pull their own weight.

- The premium for trend-following could disappear fully, or at least be low for a longer period (look at the 2010s).

- Buying the wrong fund. It’s a bit like stock-picking, the manager and their strategy matters. We agree that MSCI stock market weight is a rather sound methodology. Passively implementing it reduces manager risk. But the alternative funds space has not fully developed this feature.

- The track-record of the replicators is not that long. Other replication approaches have failed before.

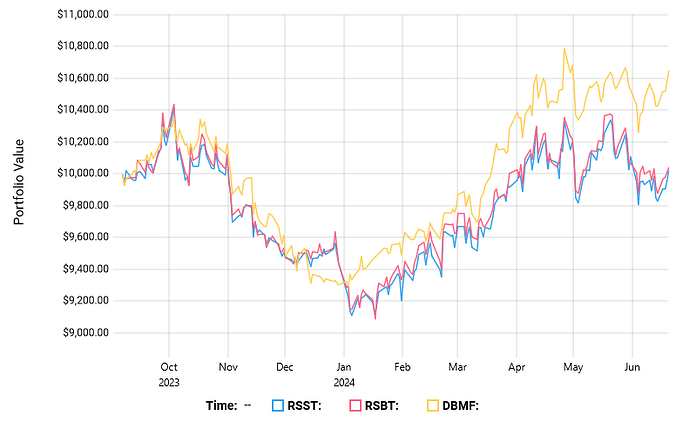

We now have about 9 months of data for RSST & RSBT, which replicate 1x the Société Générale Trend Index and 1x S&P 500 or US Bonds respectively. I thought it would be interesting to strip them of the other strategy (as accurately as I could) and have a look at the bare managed futures. I also did so for DBMF which does replicate the Société Générale CTA Index, though.

Just as an info, at the beginning there was quite some tracking error on the replication of the SG trend index for them.

The issues with that should be resolved.

Can‘t exactly remember the details on that anymore, if I remember I‘ll try to dig that up again.

Wasn’t that KMLM who first used SCHO ETF (1-3yr govt bonds) instead of cash like their index? They say so in their FAQ.

Ah, and I also found (in the presentation of RSSY) some information about which strategies are used by constituents of the Société Générale CTA Index.

I’d guess they do it depending on yield curve similar to Cambria’s new fund.

The new MFUT pure trend etf for example uses cambrias algorithm, that also the cambria tactical yield fund uses:

The Cambria Chesapeake Pure Trend ETF (BATS: MFUT) utilizes Cambria’s proprietary

quantitative model to invest the cash collateral used for margin and collateral purposes in

U.S. government securities. Cambria selects securities for inclusion in the funds cash

strategy portfolio based on current yield spreads of U.S. government securities relative to

T-Bills and their historical average yield spreads.

Currently that’s 100% t-bills as the yield curve is still very inverted.

did anyone look at iMGP DBi Managed Futures Strategy ETF (DBMF)

I am looking at adding managed futures to my portfolio but would like an ETF kind of product that is liquid and can be bought/ sold easily with an IBKR account.

this would not be more than 5% of my allocation.

I don’t know what you need the instant liquidity of ETFs for. But they have a UCITS Mutual Fund that was discussed in this thread. It can also be bought on IBKR and settles in D+2. It should be better for taxes.

yes, a Mutual Fund can also be a good option but most mutual funds have high redemption costs. Is it normal? or just that these costs are hidden with ETFs ?

For whether or not there is redemption costs for this fund, I suggest you read the thread.

The costs for creation and redemption with ETFs is hidden in the divergence of price from NAV. The market makers will only start creating/redeeming shares once they can make profit from the spread. But there are normally no additional incentive fees going to your “independent” asset manager like it can happen with mutual funds.