Bonus: The ETF can also be looked up on Ictax. It can be found together with the UCITS mutual funds by searching for “imgp dbi managed futures”. It is called “Shs iMGP DBi Managed Futures Strategy Fund” from "Litman Gregory Funds Trust, Orinda, USA " and has the ISIN US53700T8273.

It had a dismal Swiss tax treat treatment in 2022 with more than 10% of its value as taxable distributions. Might be because nobody complained and they didn’t classify their distributions like KMLM.

Only dividends and interest are taxable. To some surprise KMLM dodged even those in 2022. User @johndoe1 seems to be responsible for that.

Regardless, the actual interest inside DBMF can be learned from their (iMGP = Litman Gregory Funds Trust) annual reports. They only have the last one available, but luckily the SEC will keep track of them all.

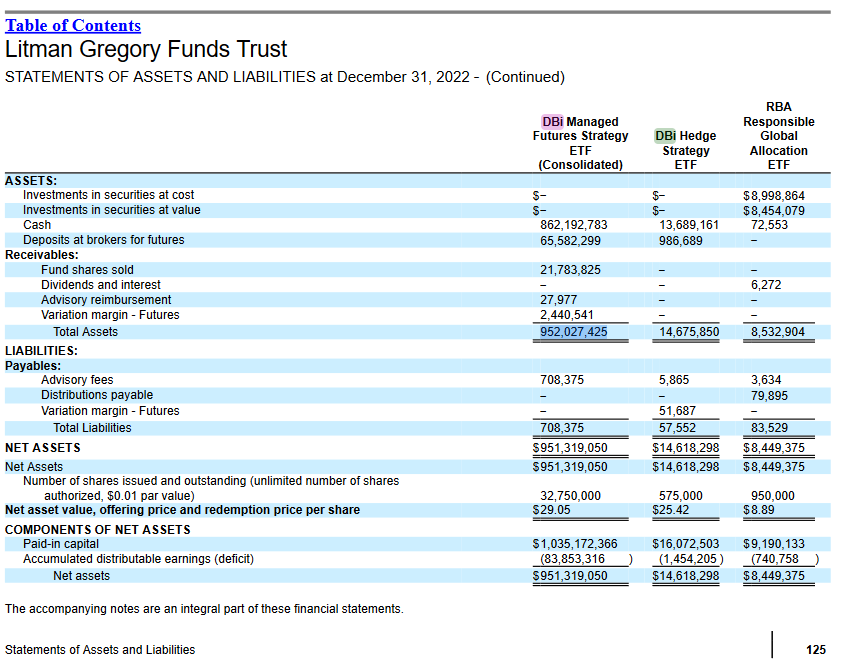

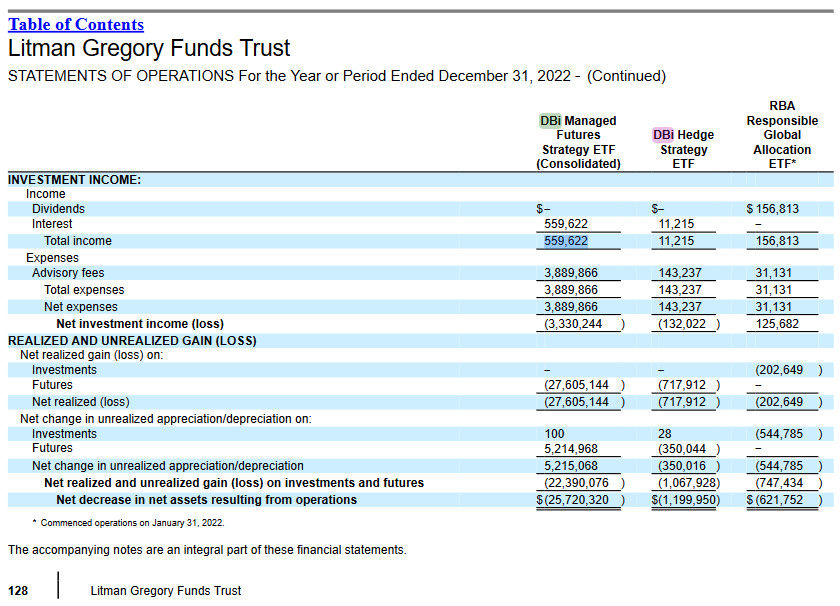

The one for 2022 states total assets of USD 952,027,425 and an interest of USD 559,622 (& 0 dividends). Which is a bit low, but I don’t know why.