Nor country.

Swiss man → Man from Switzerland ![]()

I attached a manually configured statement from IBKR see here, which shows all dividends, market values at end of year, etc. to the tax statement as a single line item for the last 3 years and had no questions or complaints by the tax authorities so far.

This may be fine as long as you hold neither accumulating funds nor Swiss real estate funds. Otherwise, the dividend and/or end-of-year values will be completely wrong. I don’t know whether the reporting would also be incorrect for funds with tax-free capital gains distributions.

The tax authorities may or may not correct these issues but I wouldn’t want to rely on that.

probably a bit a contrarian view here, but I do think your asset allocation was relatively good. I would just do the below tweaks:

- CHDVD: Move to CHSPI, as stated above, you don’t want excessive dividends

- DGRO: Move this to VWRL as an Ireland based ETF and cover the full world; increase quota to 25%

- VXUS: Move this to EXUS as an Ireland based ETF, and reduce to 15% (you got the other 10% from the above VWRL already)

- Replace SLV with the ZKB Silver ETF; taxation of Silver is always a bit a tricky situation and the US tax system on Silver (and Silver ETF) could change in the future

With this, you already have a fairly solid portfolio. If you now want to do a few tweaks, you could consider:

- Reducing CHSPI from 40% to 30% and instead increasing VWRL from 25% to 35%

- Splitting the 5% Silver into 2.5% Silver and 2.5% Gold; Or even better going 1/3 each on Silver, Gold and BTC

Welcome to the forum!

I like your profile name!*

Oh, and as per advice (assuming the 200k is your main/only sum available for investing):

- I would split your 200k into tranches and invest them over time, maybe spread it out over a year or so. First tranche is invested according to what you feel comfortable with now, and as you build conviction over time (no offense, but you don’t seem to have any now), tune the further tranches towards what your level of comfort and your own – hopefully increased – conviction tells you (maybe it’s the same as the initial tranche, maybe it’s adapted based on how well you sleep).

Theory tells you that lump sum might get you better returns, practice tells you that humans … well, they behave like humans. Mostly irrationally. - Don’t be deterred by people telling you to shun dividends given your long time horizon. Some people here are quite religious about this topic. Pick what works for you.

- Definitely IBKR.

[*] Slightly amazed the forum engine let this slip through -- as I spot many actively picked ETF zoos on this forum ...

![]()

Hello everyone,

First of all, a huge thank you to all of you for your numerous, detailed, and very helpful comments.

My future self is already grateful — I really appreciate how much concentrated knowledge, experience, and different perspectives have come together here. Without you, I’d probably still be wandering somewhere between an ETF zoo and gut feeling.

Thanks to your input, I was able to rethink everything in peace, read up, and reorganize a few things. Here are some key points I’ve taken away for myself:

- Pay attention to the TER of ETFs

- Avoid an ETF zoo, keep it simple and focused

- Don’t overweight Switzerland, since it represents only a small part of the global market

- No investments in silver

- Only moderate allocation to Bitcoin

- Broader diversification (industrialized nations rather than just US-heavy)

- In Switzerland, if possible, avoid dividends (tax reasons)

My original proposal was — rightly — slightly corrected. I probably didn’t express myself clearly:

What I actually meant was mainly to hedge the CHF, as I strongly believe that the USD will likely weaken against the CHF over the long term.

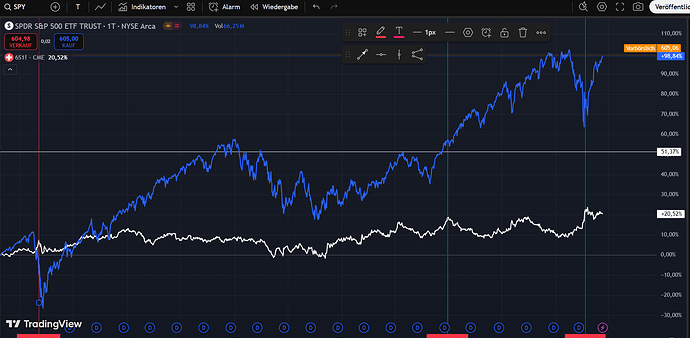

While reading, I also came across the topic of CHF as a crisis currency. I even tested it in TradingView by overlaying SPY and 6S futures. Whether the correlation is perfect is debatable — but the idea now makes sense to me.

What also became even clearer to me:

Since I work part-time, I am currently not contributing to the 2nd or 3rd pillar. Accordingly, I need to provide for my retirement much more privately. (Fun fact: VIAC also invests unhedged.)

After all the back and forth, I have now settled on the following strategy:

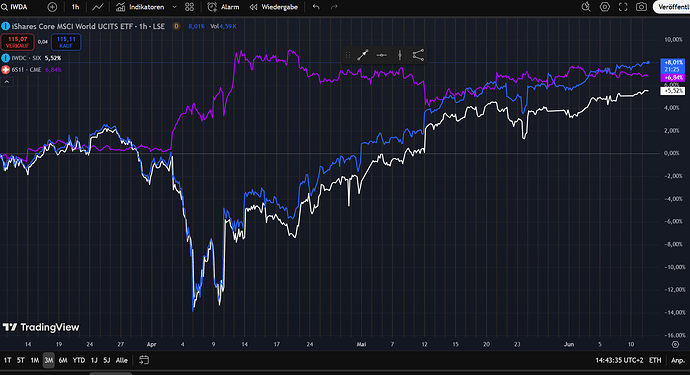

Instead of purely focusing on the domestic market, I am now following a hedged industrialized nations approach. I am aware that I may not capture the full returns in the event of a massive USD weakness, but I have better control over currency risk. See my TradingView charts for reference.

My current allocation:

I look forward to your feedback and opinions on this version!

Again, a big thank you to everyone for your time, input, and patience — apologies if I forgot anyone, every contribution has really helped me.

I only invested in silver once in my life prior to now. That was in late 2008 when I managed to buy near the absolute bottom and sell near at the absolute top in 2011. So I’m biased towards silver and while I don’t expect to be as lucky as last time, I bought and am willing to take a gamble on this.

Also bought platinum and palladium and gold.

Please don’t take it personal, but I think you were all over the place. I woudl strongly recommend to take a step back and either re-think your investment beliefes, risk capacity and risk tolerance - or go with a robo advisor and follow the strategy they recommend you there.

Why so? Massive change from Swiss Shares to Global Shares, Increase in Equity Allocation, massive overweight in Emerging Markets and all off a sudden currency hedging (which generally doesn’t make much sense on the equity side).

Hello everyone

Perhaps I got a bit lost along the way because I tried to include too many aspects at once.

Here’s a rough outline of my situation:

- Investment horizon: 20+ years

- Risk profile: high volatility tolerance, but no total loss

- Diversification: intentionally across regions, currencies, and asset classes

- Speculative allocation: max. ~5-6%

- Tax consideration: avoid or minimize dividends if possible (Swiss tax residency, as dividends are often less tax-efficient than accumulating funds)

I really appreciate hearing different opinions. To get more specific:

- Global ETF: better with or without CHF-hedging?

- Emerging Markets: reasonable as an allocation (around 20-25%) or already too much?

- Gold/Bitcoin: still acceptable at this size or unnecessary?

I appreciate your honest assessments – I don’t want to overcomplicate things artificially, but I also don’t want to make it too simplistic.

Simplistic is good though ![]() Did you consider something like 100% VT or WEBG?

Did you consider something like 100% VT or WEBG?

I greatly appreciate the collective wisdom of this forum, but here’s what I observe, and I hope you don’t feel offended:

- you’re seeking advice for <see topic title>

- you have an initial proposal but no conviction

- you ask a forum with anonymous members

- you get some advice, mostly IMO based on who is willing to respond, and who is the loudest, regardless of their investment experience and their recognition of your situation*

- you adapt your initial strategy based on the advice you get (IMO without the capability of judging the advice you get, given your inexperience and therefore lack of conviction)

- you re-ask your initial question, phrased in slighty different questions

I stand by my previous post on how to proceed procedurally with your investment and would probably second @nabalzbhf: start really really simple (but maybe proceed in tranches so you can build up your own conviction for what works for you).

[*] Fellow forum members, please don’t get me wrong, there is good advice given here, but some advice is zen level master handing out haiku’s that’s incomprehensible to the OP (at least I think so), other posters ask questions (why this bias, why that allocation) that the OP also just cannot answer yet for themselves (at least I think so).

Way too much ![]() . The debate is usually about anything between zero and the market weight, not the double of it.

. The debate is usually about anything between zero and the market weight, not the double of it.

I support the suggestion to start with a robo advisor, by the way.

Funny enough, when I stumbled upon some German forums or books in the past, people seemed very set on 30% for EM, with finance blogs maybe picking that up and eventually citing each other.

GDP-weighted instead of market cap, backed up by some important metric, something like that.

Personally, I got 10% (used to be 15% years ago) and agree that OP should keep it simple ![]()

Without wanting to confuse further…

They’re totally not. Accumulating funds are taxed according to estimated dividends calculated by the ICTax software, so whether you receive them as cash or not they’d be taxed the same. There’s tax efficiencies to be found in US ETFs which have to distribute dividends by law, but this is another topic that maybe it’s too early to dig into.

The reasons for minimizing dividends in Switzerland are:

a) due to being taxed at marginal tax rate

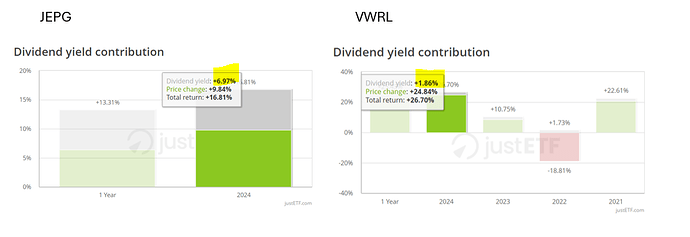

b) converting a large part of total return into taxable, as seen in the pic below, the yellow bit is what’d be taxable between JEPI and VWRL:

But again that’s another topic.

I would summarize as:

- You don’t really know what you are doing so asking for advice

- But the lack of conviction will mean that at some point (and it will happen) your portfolio will drop. You will be worried. Maybe you’ll hang on for a bit, but then you’ll sell near the bottom at a loss.

- The stocks will recover. You’ll be annoyed and swear off stock investing.

I would suggest 2 potential approaches:

- Find an advisor you trust and let them invest for you. For example, if you believe in Warren Buffet you can buy Berkshire and trust he’ll continue to work his magic

- Or, you can slowly invest bit by bit and learn along the way. Most people here seem to do this. BUT we are nerds who are so wrong in the head that we actually enjoy doing this. Just look how much time we spend on this forum discussing the minutiae of investments or trying to shave 0.001% off fees. Unless you enjoy doing this and want to spend time doing this, maybe you really want to be hands off and have someone do the work for you.

Ja, Gerd Kommer stuff, I guess. That is probably another example of recency bias: I guess these advices were floated after emerging markets had a wonderful run in 90th. Now we have (had?) “US only” and “Emerging Markets are not worth investing”.

Please correct me who can!

This! ↑ (pointing to @PhilMongoose’s response)

Much better answer than mine (but I’ll claim to have paved the way).

Huh, what? You’re such a squanderer …

![]()

See, that’s where AI comes into play … it will provide an answer for any question asked!

(I don’t have an answer myself)

![]()