To all investors,

find below a list of ETFs/ Funds & products the swiss mustachians decided to be good for their portfolios!

apart from cash:

Stocks

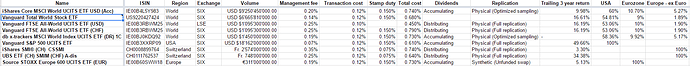

World stocks/ All-World

Vanguard FTSE All-World UCITS ETF

Vanguard Total International Stock ETF (VXUS) [ex-US]

World stocks/ Developed

db x-trackers MSCI World Index UCITS ETF (DR)

Vanguard FTSE Developed World UCITS ETF (VEVE)

iShares Core MSCI World UCITS ETF USD (Acc) (EUNL/SWDA)

Emerging Markets

iShares Core MSCI EM IMI UCITS ETF USD (Acc)

VFEM

MSCI Emerging Markets (CBMEM)

World small caps

Vanguard FTSE All-World ex-US Small-Cap ETF

US Stocks

VUSA

Vanguard Total Stock Market ETF (VTI)

Vanguard S&P 500 UCITS ETF

S&P 500 (CSSPX)

US small cap

MSCI USA Small Cap (CSUSS)

US small value

Vanguard Small-Cap Value ETF (VBR)

European Stocks

STOXX Europe 600 (SC0C)

db x-trackers EURO STOXX 50 UCITS ETF (DR) 1D

Swiss stocks

UBS ETF (CH) SPI® Mid (CHF) A-dis

SMIM (UBS ETF)

SPI UBS ETF SPI A-dis

SLICHA

iShares Core SPI

CSIF Swiss Small and Mid Cap Index Fund (CSS1)

Far east

MSCI Pacific ex Japan (CSPXJ)

Style / Sector

Technology S&P US Capped 20% (XLKS)

Bonds

World bonds

iShares Global Government Bond UCITS ETF

iShares Global Corporate Bond UCITS ETF

Swiss bonds

Swiss government bonds (iShares 3-7)

iShares Swiss Dom Gov Bond 7-15 (CH)

iShares Core CHF Corporate Bond (CH)

and I hope i can motivate some of you to pick some funds and put together the info!

and I hope i can motivate some of you to pick some funds and put together the info!