The example you provided is a very far out of the money put option, strike at 5’000 when index is at 12’200. Its cheap for a reason because its extremely unlikely it will finish in the money, delta is -0.01

I mean that’s like buying a lottery ticket ![]()

And how do we know if bull market is on or we are at peak ? Maybe that’s the main challenge

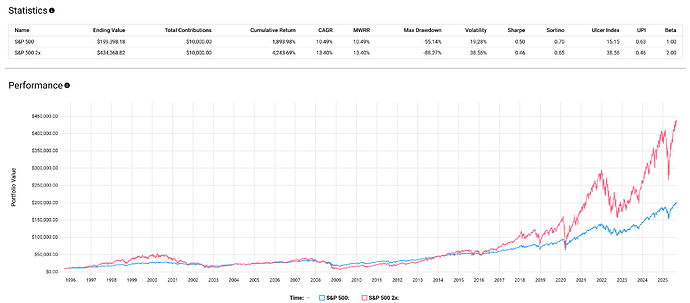

This chart is very telling … the myth of leverage ![]()

No, this chart is cherry picking. Leverage works and has done so for a very long time. I can also find you some stocks that went to 0 and tell you that the stock market is the devil’s playground.

My original question was about call options. The same 5k strike price would give you roughly 2x leverage, and the extra you are paying for volatility is low, as made evident by the corresponding put being cheap. Or is my reasoning flawed?

No, you are right, this type of warrants is basically a future with a lower leverage, which you buy outright and don’t have to deal with margin etc. The only tricky part is that you have to roll them.

I understand that. But I think leveraged ETFs are mainly a trading product. I am not sure if they should be used as buy and hold products.

Anyhow - any chart which shows how a leveraged S&P 500 product performed during dot com crash and the decade after it? I would be curious to see how far they dipped and how long it took to recover. Since the crash was so big, my expectation would be that they got wiped out completely.

Such products come up after a long long bull market. They did not exist during the financial crisis, the “dotdotcom” bubble popping or the U.S. real estate crisis. They cannot be wiped out but would probably have lost almost all value and still be around 90% loss.

I don’t understand why one want to delegate trading on margin. They have to trade every single day, always buying after a run up and selling after a loss. Every day! And always sell cheap and buy expensive!

There are tons of possibilities to use leverage for your self, the most easy being a margin account. Don’t forget to use strong money management. Because as you all know “the only good tip from your broker is a margin call…”.

Now, the mentioned book “The missing billionaires” recommends strong rules for position sizing (part of money- and position management). They do not exclude leverage, all depends on the risk tolerance. According to their rules you should be at minimum position size with stocks now I think.

I have my own rules, but they tell me to be at minimum exposition to stocks at the moment. Only, my minimum is a bit higher according to my risk tolerance. It is now between 100% and 150% depending on the strategy and may go up to 300%. ![]()

The billionaire book recommends forward Shiller P/E for sizing positions. Now that stands at like 39 at the moment I think. Think about it, 39 years until you get your investment back… without leverage.

I use the difference of the SP500 to its last high to define position size / leverage. Then I have some alarms in spreadsheets which tell me whenever I have to do something to get to my desired level again.

Simulated TQQQ would lose 99.9% value in the dot com bubble, not sure about simulated UPRO, probably around 80% or more, you can find backtests easily on reddit, hundreds of them.

You need to implement a trading strategy, there are loads of them too, I use buying when the underlying is 1% or above its 200SMA, and plan to sell when it dips below 1%, the backtests look good for avoiding the dot com and GFC crashes edit and a good part of “Liberation Day”. Whether that will play out in real life going forward…who knows.

The products have caveats that they are meant for day trading but there are members here and on reddit who’ve held them for a long time. Of course the last ~15 years are very skewed. 10k on TQQQ at inception would grow to ~2mn by 2021, crash to 400k in 2022, grow back to 2.4mn in 2024. That’s why we are all in them, for a chance to get rich with relatively little commitment. When they run…OMG they run…

It’s possible that @cubanpete_the_swiss is right that the increased interest on leveraged ETFs is a sign of late stage bull market, even in 2022 the relevant subreddit was quiet, now it’s very busy. One could check traffic on reddit subs relative to the market, I expect that when there are drops the focus shifts to dividends, ex-US, and when there are runs to LETFs etc.

Exactly. That is the problem with most simple signals: they contain parameters that give you indefinite possibilities and therefor you will always find some which did outperform. In your case it is the 200 in 200 SMA and the 1% barrier. I don’t think there is any edge in a SMA based strategy at all, just a statistically biased past that does not say anything about the future.

Maybe next time the SMA dances around your 1% barrier like 20 times and you lose a shitton of money. I wouldn’t trade that, much less with leverage.

Yes, that’s right, the strategy appears capable of shielding against prolonged and deep crashes, not snap crashes, v-recoveries or choppy sideways markets. It’s something one must know and have a plan for. There are loads of variations, including having a wider window to get back in, for instance, sitting out in cash longer etc but I am fully aware this devolves in crystal balling and wishful market timing ![]() that’s why the small commitment, it’s a bet and gives something to look at that’s simple enough for anyone, and a semblance of trading. If it works it works, if not…10k won’t break my life but it could make it!

that’s why the small commitment, it’s a bet and gives something to look at that’s simple enough for anyone, and a semblance of trading. If it works it works, if not…10k won’t break my life but it could make it!

There is a very important problem: as it is long term there is too little data. You need much more data to exclude random results.

There are libraries with access from Python that may help, I do not have any experience with any of it, just from another forum:

numpy, sci-py, scikit-learn, catboost/XGBoost/LightGBM, Nixtla, Stumpy, pytorch and botorch, statstools, pyomo

I think some of those may help you answering if your finding is purely random or if there is any chance you have found an edge. Remember, the big algo trader make fortunes with many 50.5% chances to win that are not correlated. But they must be real…

OK, back to topic: many people use options for leverage. But with options you pay for a kind of insurance (or get paid if you sell them), not only for leverage.

There are other solutions than leveraged ETF, especially in Europe, but I would not recommend using them. Some kind of certificates or warrants or more complicate constructs from emitting banks where that institution usually is the market maker too and where you can trade long only.

I would not touch such a construct with gloves. Technically they are bonds with strange payback methods and where you pay a risk premium instead of getting paid for your risk. Liquidity depends on the emitting institute and tends to go close to zero at the slightest problem. Hands-off!

And while we are at it: the in GB very popular CFD, Contract For Difference. Those were introduced many decades ago by big institutions to do trading without a market or market rules involved. Those were usually big trades between two companies.

Some clever (and now very rich) people did offer this to private investors. No need to even hedge the trades as in general the private clients lose money anyhow. The same institution that is broker, market and market maker and price finder they can do whatever they want, you sign for it in the small print. Usually they even make you win more than you would with real markets because they like to keep you on as clients. But whenever the shit hits the fan you are fucked…

There are brokers that offer real hedged CFDs, hedged with stocks or futures. That makes no sense at first sight, because the trading costs are higher. But then the broker does not need to adhere to rules like margin limits or specific market rules. You can have that at Interactive Brokers.

Easily done with testfol.io and the custom ticker SPYTR, that takes the s&p500 total return.

Here for the last 30 years, assuming a 0.5% TER.

https://testfol.io/?s=gp1foED0Qzs

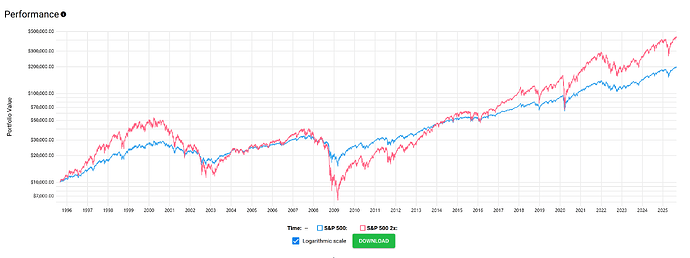

log scale:

Interesting. Probably the costs are a bit low considering that the leveraged version does need to rebalance every day. But still quiet a good result for double leverage.

Even after 2020 it would now be in the green, but after much suffering…

1987 took quiet some time too…

Now, this is staying leveraged all the times. Now imagine just leverage in a bear market…

Thanks

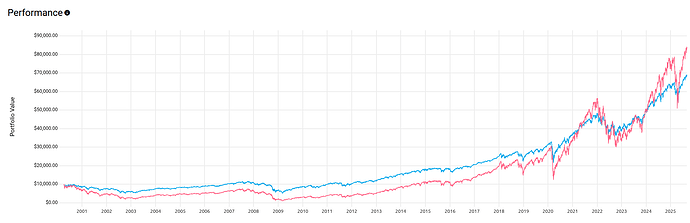

I tired Jan 2000 to Dec 2010. Green line is leveraged 2X ETF.

Lumpsum investment.

it look 10 years for S&P 500 to come back above water. Leveraged was still down > 50%

When taking your timeline and switching from lump-sum investment to monthly contributions, leveraged is “only” down by 19.7%.

Yes, LEFT can erase 10, 20 years of monthly contributions; but the following ones in a market crash are probably the most important ones, when trying to recover the portfolio.

LEFT proably should not exeed 10% of a portfolio, anyway. Somewhere in the same risk category as coins.

With a highly levered stock only strategy one also basically need to withstand starting from scratch again.

There is a whole book about leverage ratios over the lifcycle, where this is talked about and how you can make a strategy that can work for you.

„Lifecycle Investing: A New, Safe, and Audacious Way to Improve the Performance of Your Retirement Portfolio“

It‘s a pretty widely well regarded book by accomplished authors.

The whole thing here is levering highly early on in your investment career (and potentially starting from scratch again), and then delever as you get older.

The new 2x MSCI World will borrow in USD (currently at 4.34%) and have a TER of 0.60%. Don‘t understand why they dont borrow in EUR like their 2x MSCI Europe.