That’s their legal disclaimer, but do you have an actual reason?

That’s not correct, it’s basically the exact same.

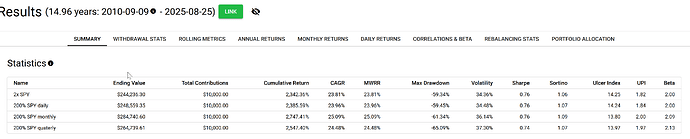

Backtest to show that, with different rebalancing schedules.

https://testfol.io/?s=ajimwTy57qr

All very similar.

And proper risk management on a portfolio level would mean rebalancing to the same leverage ratio regularly (selling during a downturn). Letting your leverage ratio drift higher in a downturn means you increase your risk. You’d need to do that willingly, an dthat’s a bet on mean reversion. That you can do of course.

But rebalanced regularly, ther eis no material difference between daily leverage etfs or leveraging your portfolio.

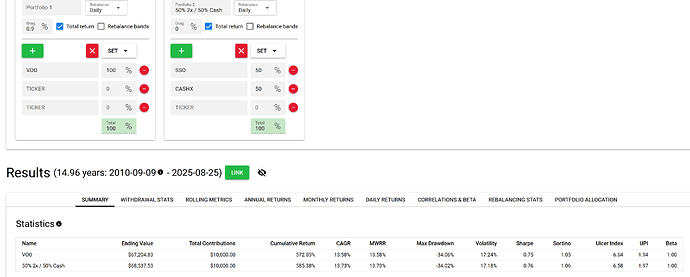

Another example to show that daily leverage is not the problem:

You’ll have volatility decay, that’s like the second post in this thread ![]()

It sounds worse than it is.

Also equity is becoming less volatile (so far) so it probably plays in favor.

Yeah, well, if held during a prolonged bull run or v-shaped recovery there’s no visible volatility decay. A prolonged flat or choppy market would see them going down over time.

That said I do hold LETFs.

I’d likely buy it over VWRL if the ER is up to 0.5%. Would employ sophisticated mental accounting to tell myself I am investing double ![]()

Look up the term “volatility drag”.

Empirically, using about 20 years of SPDR S&P 500 ETF and Nasdaq-100 ETF data, we confirm these theoretical predictions. Daily-rebalanced LETFs enhance returns in momentum-driven markets, whereas infrequent rebalancing mitigates losses in mean-reverting regimes.

See also: Leveraged ETFs: The Hidden Costs of Volatility Drag - Aptus Capital Advisors

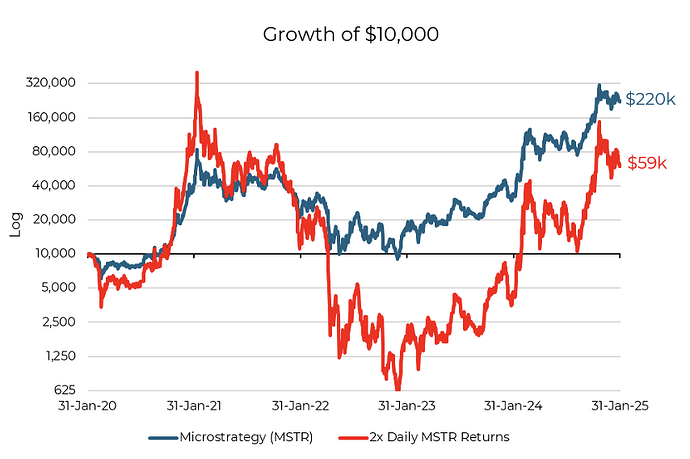

A Real-World Example: 2x MicroStrategy

Relatively new leveraged single name ETFs provide a case study on the implications of volatility drag with leverage. Let’s look at modeled 5-year annualized returns of Microstrategy (a stock with very popular levered ETFs) with 2x daily leverage, assuming no financing costs or friction as of 1/31/2025:

- MSTR (unlevered): 87% annualized return

- MSTR (2x leveraged): 44% annualized return

I would note inversing (i.e. shorting) Microstrategy at 2x leverage (yes, there is an ETF for that as well) would have lost an investor -98% of their investment annualized. But focusing on the 2x leveraged long model results; Despite MSTR’s strong arithmetic returns, 2x leverage cuts the levered return by half and nearly eliminates the inverse leveraged return.

Source: Bloomberg, Aptus as of 01.31.2025

This example shows it clearly. You have MSTR with 87% annualized return. How much does the 2x levered MSTR ETF make? Twice as much at 174%? No, actually half at only 44%.

TL:DR: would you rather have 590k or 2200k? If 2200k, then don’t buy daily leveraged ETFs.

That‘s why you use leverage only in bull markets when everything goes up. It‘s easy, just don‘t hold it when markets are going down ![]()

89% annualized return for 5 years or 22x isn’t enough of a bull market for you?! ![]()

![]()

“The stock market is easy. You buy, wait until they go up, then you sell.”

“And if they don’t go up?”

“You don’t buy!”.

In contrary. I use leverage all the time because “cash is trash” and the debt will go down in value… always. But in bull markets I use a lower multiplier and in bear markets I use a higher multiplier. That is probably the only way to make money with leverage in stocks.

But remember (Charly Munger I think): you can go broke on the 3 big L: Ladies, Liquor and (stock market) Leverage.

And my favorite, I think from Jesse Livermore who must have known because he shot himself in a Manhattan bar: “The only good tip from your broker is a margin call!”.

Follow these simple rules and you will be rich!! ![]()

That‘s on this specific example and due to the high volatility.

And again, it‘s dependend on total portfolio construction, rebalancing schedule and leverage ratio.

A 2x leverage on broad stock indixes has produced higher CAGR in the past than non-leverage.

3x didn‘t work over the very longterm and you basically get 1x return for 3x the vol.

One important thing is being ignored in these discusions. We‘re talking about someone accumulating wealth over 10+ years. The picture changes completely if you invest monthly. The dips are deeper, but you‘ll buy more shares too.

I don’t understand why the consensus on leverage isn’t options. Like, the one year ones. They don’t reset the leverage ratio, they can’t blow up your account. They are somewhat tax inefficient, but this will likely change soon with the law to scrap interest deductions.

well, with options you pay for optionality. i think futures are ideal for leverage at low cost.

Exactly. Options are bets on price and volatility, volatility being important. You pay a premium based on volatility (for long, of course for short options you get one).

To bet on price only for a broad index futures are cheapest. For single stock futures there is often too little liquidity, so I use a simple margin loan. The lower the market the higher the loan.

I’m not sure I understand the “pay for optionality” comment.

Sure, volatility is priced in, but it seems to be relatively cheap for far away, deep in the money European-style options (I hope I’m using correct terms). I’m concluding this from the put price, e.g., https://www.swissquote.ch/trading-platform/#fullQuote/XB00003629B9/21_CHF