Thanks OogieBoogie - that’s reassuring :). Don’t get me wrong, I know the prices may go down or that it can be the other way around, for example if there will be high inflation etc. I’m just considering buying a house, unfortunately which is quite at our limits. What I would like to do is to understand what are the risks in case of major price correction, when I would be “on safe side” of having the possibility to put additional money in case of such an event with bank knocking to my door. This kind of stuff :).

That’s what I’ve been wondering. I have no knowledge of how margin calls work in practice. Initially you need to keep the loan-to-value (Belehnung) below 80% and affordability (Tragbarkeit) above 33%. How often are these values rechecked? Only when you renew your mortgage, or periodically? Does it differ if you have a fixed rate or a LIBOR-based rate (or SARON)? Let’s say you get a fixed mortgage for 10 years and right after that you lose your job. Will the bank lament and ask for their money back instantly?

And a different scenario: let’s say your 10-year fixed mortgage ends, but you are now FI/RE. Your only income is from dividends and sale of stock. You have a high net worth, could easily pay off the mortgage loan, but of course you don’t want to do that. Will the bank accept you not having a job?

The bank does not know when you lose or change the job. If you change your mortgage they will ask if anything changed in your job. With me it was only done by phone.

The bank calculates your wealth as your virtual salary with 9%. When you have 1m wealth, you get a calculation as you would have 90k salary per year.

you don’t have to drop your investment (and realize the loss) if you can keep paying your mortgage. In the 30-yrs long run afterwards that crisis has also stabilized and ended up in today’s almost-bubble territory.

Was a very good buying opportunity at the time.

Everybody I personally know who have a house had similar thoughts before buying a house. We all figured out what our budget is and we also looked at houses which where all way over our budgets at that time. We were all scared what happens if… but at the end it was all much easier than expected. If you buy a new house, you pay your mortgage, which will be normally much cheaper than renting a flat. For sure you put this new gap (flat - mortgage) to your saving or investing accounts. Normally for the first 10 years, you should not have any technical or replacement problems at all. So actually you can put that money into a FiRE account and let it grow for +10 years.

that’s also what we intend to do - buy after the next crisis. ![]()

But the situation 12 yrs ago was very different wasn’t it? The question is if it’s still worth doing the same for the next 15 yrs from today’s position?

The increase in the value of your own home is indifferent. It’s not an investment, so you can’t capitalize on the increased prices. If you were to sell and move out, well, everything else around you have also increased in pricing. The only way you can cash the appreciation is if you leave the country (but even then, guess what has happened all around Europe in the last years…)

The reason why to buy a house are totally personal. With me it was the family & kids needing more space and I looked and calculated alternatives to renting a flat for CHF 2’500-3’000.

What I read here is mostly from people who never own a house, looking for bias confirmation that this decidion is the best. I do not know anybody, who owns a house and is not happy with it. But probably this is also kinda a bias confirmation process from myside.

I’d gladly build my own house, or at least manage that. I will always remember an apartment I saw online that was about to get built. The let me pick which part to build in it. I remember the toilet-paper roll holder. It costed 300chf to switch from one model to another.

That is one of the reason prices are so high. (or better it’s upside down: people don’t really see those prices , thus costs rise).

Anyway never compare house prices abroad. Some of the materials are different. Level of insulations, type of paint, windows, wiring etc…

I can totally relate and I am also looking to buy for the same reason. Garden, kids, good neighbors, easy and happy life. - vs finding this in a rental for like 4-5000 a month on the silver coast (it’s basically not an existing market).

Where did you get that information from? If that is true that would be great as we could keep a mortgage after fire.

My bank uses 5% if assets are above 250k.

Yes, that would be cool…or maybe not? In case the only reason for the crash is higher interest rates, what would be the outcome?

Isn’t it the choice between:

House price now: 2m, so initial deposit 400k, interest 1%, mortgage calculator shows:

1’333 CHF - Interest costs

1’481 CHF - Amortisation

1’667 CHF - Maintenance/additional costs

So for new house, we can assume 1333+1481=2814 CHF per month in total.

The same house after 30% crash: 1.4m, so initial deposit 280k, but interest 5% - mortgage calculator shows:

4’667 CHF - Interest costs

1’037 CHF - Amortisation

1’167 CHF - Maintenance/additional costs

So for new house, we can assume 4667+1037=5704 CHF per month in total.

The biggest positives of the 2nd case are that initial deposit is significantly lower, total debt in general is lower too (so for example there will be also additional saving at the time of purchase - ~5% purchasing costs, at least in Vaud). Also, from taxation point of view, it is probably better to pay more interests, to be able to compensate additional “valeur locative” for the owners, not sure how to calculate it exactly, probably differs for each case. But looking at above, I’m not sure I’ll be able to buy more after the crash, considering that monthly costs will be much higher (and should not exceed 33% of the income). Some food for thought ![]() - I’m very curious about your observations about it.

- I’m very curious about your observations about it.

PS. Just came to my mind another reason of prices going down - increasing availability of building lands - but again, how probable it is?

PS2. Last example with the same crash, but also the same amount of deposit as before crash (400k):

4’167 CHF - Interest costs

370 CHF - Amortisation

1’167 CHF - Maintenance/additional costs

4167+370=4537 CHF per month.

I can tell from my parents there:

They bought an already built house in the surroundings of Paris. Right before 10y after construction (in France, there is some guarantee in that period), some huge issues with the foundation, because of water level decreasing during the drought, as well as improper built foundation. Company who built was nowhere to be found anymore (bankrupcy and new creation), and basically my family had to pay up the costs for repair. At some point my parents were wondering if they should simply destroy the house and erect another one on the land.

Got another example of people having bought a flat, and there were huge issues with neighboors + all the hassle with the meetings for planning maintenance etc.

I guess all depends if you are lucky enough or not, whereas if you come from some trade or construction background, or you simply enjoy doing your own repairs, it can be fun.

Don’t forget, mostly people will always tell about the positive side of owning a house or trying to “forget” about the bad stuff, so there will be a huge bias from houseowners too.

What I think we all can certainly agree on:

-Everyone needs to do an own calculation, and done in a proper way without forgetting anything, which is not quite easy. Just look at the maintenance, we have numbers thrown around between 1-2.5%/a. That is quite high of a margin of error

-Risk is important, it is a highly undiversified asset for most of us, and furthermore leveraged as fuck (I guess most of us would not dare buy ETF’s on a leveraged basis, the advantage of a house is you can’t look up its trade value every second of a day.

-A big part of the value of the home cannot be expressed in numbers at the point of buy, because it is either intangible (can do whatever I want inside etc.) or hard to determine security against inflation of housing costs (what happens during deflation ?)

For the record my strategy : buy cheap according to local market. Apparently the market is not that efficient, and if you see a good deal, take it. (Just make sure that it is really a good deal by making the due diligence, meaning getting the proper expertise and everything). Until know, did not came accross anything, but then I guess patience will pay off in the long run.

Interesting.

what is silver coast? you mean Pfnüselküste? Thalwil etc?

It depends on demographics, migration and economic growth of the region. If the elderly die out, and the young don’t come because there are no jobs in the region, you will see a lot of land free up.

I always wonder what due diligence means. Obviously I’m not a real estate expert, so should I learn it or should I pay someone?

By the way, I found a really great website with statistics regarding land price in canton Zurich.

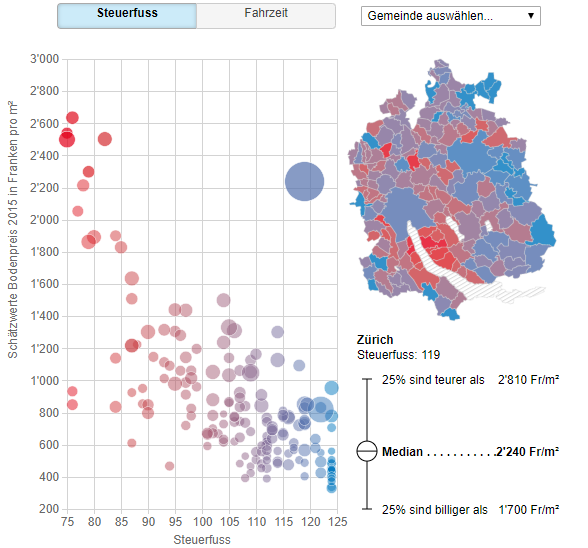

Here you can see a negative correlation between the price and the Steuerfuss:

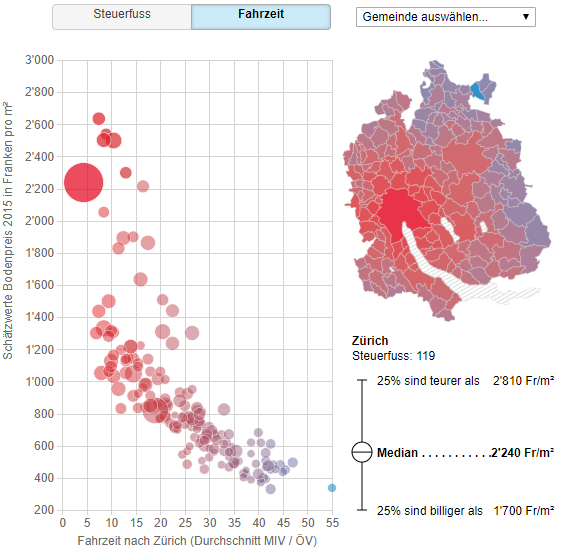

And here a negative correlation between the price and commute time:

I haven’t thought about it like this, if you buy 1’000 sqm in Kilchberg for 2500 CHF/sqm, you spend 2’500’000 just for the land. The house you can probably build for a mere 500’000, right?

If you actually find land over there to just build a single family home…

No expert here either, but what I mean is to make sure that the building is up to specs, no major repairs in the coming y. In some cases even you transfer the risk for a rather low amount of money… Haven’t looked into detail about that yet, but I guess if you are not from a construction business and know where to look at and what you will be expecting to see… might be difficult.

You forget that if you do run into a crash, the bank will margin call you for a whopping 480k (80% LTV difference between 1.4m and 2m purchase price) - that’s your price of keeping the 1% interest. PLus you just lost 600k on your property, to a total of 1M+ loss. That’s about 30 years of rent ![]()

That’s the scenario that everyone wants to avoid.

Discussion with 2 different architects shown, that it is currently quite safe to estimate the cost of building 1m3 (volume) of building to around 1000 CHF, for normal quality (whatever it means, but I guess it is neither luxury, nor the cheapest materials).

And for that one - 2500 CHF/sqm is quite a lot. From what I’ve seen in Vaud, land in quite nice places (Nyon, Morges region) costs on average around 1000 CHF and the average price of land just by the lake is around 3000.

Migrosbank, did explicity ask this question as I plan to retire with 60 and have then no income as an emplyee.

You probably won’t find empty land, but you can find some ugly old house that you can raze. The rental flats that I checked out in Wollishofen are being built in place of some older blocks from the 60s.

And how much is a cubature of a small house? Let’s say 140 m2 * 2.5 m = 350 m3. So… 350’000 CHF to build a house? Is that just the raw state, or already with painted walls, floor, bathroom & kitchen?

In Kilchberg you pay for the combination of lake view + low steuerfuss + very close to Zurich.