I thought all banks were following the 25% rule. Are you sure your experience was not before the rule changed last year ?

Oh, I wasn’t aware that this rule changed just recently.

Indeed, I got the final offer for my mortgage back in 2019 but closed on it in 2020.

Thanks for making me aware of that. I’m pretty glad now that I was able to only put down 20%.

It’s like that everywhere except US.

People have false sense of security when taking a mortgage. Ask any debited person if she ever heard about margin call on debt. People don’t understand the risk associated with RE and with leverage in particular. If the bubble on RE will burst at some point, all of these people will be screwed, and with them all of the banks who gave them mortgages are screwed, and with the banks the entire economy is screwed.

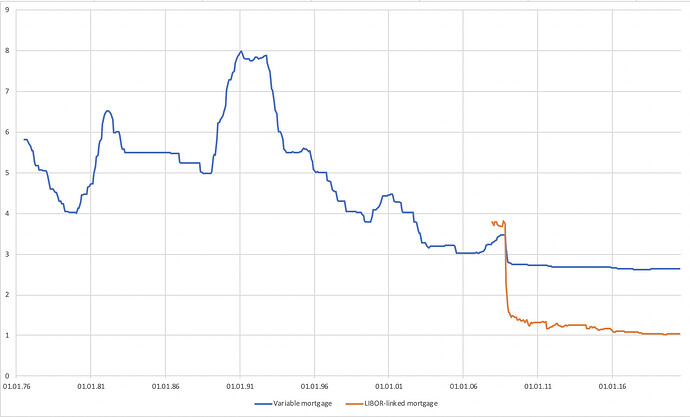

It is to the point that banks (and the SNB too) are aware of the size of the issue and will try everything to avoid a burst. They are too scared to raise rates significantly. They are not even trying to raise the down payment rule too abruptly… And people know that, which gives them a further impression of security…

I agree that people have no idea about financial instruments such as mortgages.

But given the prices and the solvency requirements a lot of people who could run into trouble can’t buy. They’re protected to a large extent from their own stupidity.

My wife and I (DINK) could easily rent a 3500 CHF apartment but we were only allowed to buy a home that would cost us 2500 now. We decided to go not even for this and now pay 1900 (interest, common cost, amortization and tax on own value).

If the bubble on RE will burst at some point, all of these people will be screwed, and with them all of the banks who gave them mortgages are screwed, and with the banks the entire economy is screwed.

That’s the only thing that keep this from happening. And as long as pretty much the whole country is mortgaged, this might stay like this another decade or so.

That’s particular case in Switzerland. It might change in the future. In other countries governments are more populistic and they tend to buy votes by giving people more stuff. I remember that in Poland before 2008 there was no downpayment requirement and any person from the street could get a mortgage (especially in CHF which was much cheaper at the time). In US it was even worse and we all know how it ended.

Yes, it can go on infinitely, or it can’t. Nobody really knows what will happen in the future.

A decent flat in Zurich or at Zürisee costs 1.5m CHF. I know it’s hard to predict, but what do you think, what would be the price if the interest rate went up to 5-6%, like it used to be?

And perhaps even harder: what would the prices be if you had to purchase in cash, no mortgage? I wonder what is the true cost of building a block of flats from scratch: purchase the land, get permissions, make a design, build. 20 years ago my parents bought land and built their own house in Poland, for around 100k CHF at the current exchange rate. Today you can still buy a house like that for 150k CHF. Around Zürich, such a house will cost 10-20x more.

If you want to buy TODAY a house you have to be wealthy and with an high income. The banks still calculate for evaluation with 4-5% which automatically puts you in a top salary category.

With the example above of a house worth 1,5 m CHF you need 300k own money and a salary of 270k CHF to be approved. If you chose a cheaper house and calculate it down, still the salary requirements (to handle the “affordability” of max 33%) are the mostl likely the killer.

If you bought a house like me 10 years ago, there is a high probabilty that this house is now 30% more worth than before. So a price correction of 30% like in the 90’ will not automatically kill you.

If you come with 500k of your own money, so that you don’t have to amortize, then the income requirement is not that strict. If a couple pulls out their 2nd & 3rd pillar, they will not need much cash to get to 500k. Then a gross income of 100k per person would even be sufficient.

It’s the land that costs (and appreciates), not the building. The building is depreciating and needs maintenance.

True, but first you need to put down 500k in cash. That’s not absolutely straightforward for most people. Plus if you cash out your second pillar, you also tend to lose the services that come with the second pillar such as death lump sum and disability/widowsers pension, etc. If one of you gets jobless when the renewal is due, the bank will margin call you on your 1.000.000 CHF mortgage, which means you need to sell (probably at a huge loss)

Also, bear in mind what you lose by not investing the 500k somewhere else (opportunity costs) just in order to save, what, 15-20k a year on living costs? 500k@5% is 25k a year, so you might not even be better off unless you save a huge amount of money per month, somehow or your property appreciates well above the 2% historical rate.

I also want to buy property as an Eastern-European, it’s somehow in our mindset… but I can’t really make a logical reasoning as to “why”, maybe only to leave some legacy onto our kids. It doesn’t seem to make any financial sense.

It truely doesn’t, even with such low interest rates IMO. It’s purely an emotional thing.

Why so sure? We’ve crunched the numbers with the help of @Julianek and in some cases mortgage can win. Even if it’s a tie, you can treat it as diversification. You can lower your fixed cost from 4000 chf per month (my estimate for rent of a 1.5m property) to just 1000 (interest on 1m) plus maybe 500 for maintenance. The 5-7% from stocks is not a given, it’s an average for a volatile asset. I think it’s the decreased volatility that brings peace of mind.

Btw when my parents built their house 20 years ago, they did not use mortgage. They were always very skeptical of loans, but back then, the interest rate was 10%, so I guess that’s why. And the land was 2 chf per sqm, so 2000 chf for the whole plot  . How much does land cost around Zurich?

. How much does land cost around Zurich?

Pray that the 90s don’t repeat themself. Rising interest rates and housing prices that crashed by up to 40%. Not a great scenario with such a highly leveraged asset.

Yes, good point. I wonder what would force such a scenario. The politicians don’t want it, the banks don’t want it, the mortgaged property owners too. I heard that the current strategy is to devalue debt by inflation. And you achieve this by keeping interest rates low and by inventing countless social welfare programs with limited expiration date, to stimulate spending. I guess they will only raise the rates when this inflation gets out of hand.

Good points Guys - I wonder if there is any other event than rising interest rates, that can trigger RE prices going down significantly? I guess hardening of initial capital requirements may lead to some changes in this matter, but I see it very unlikely.

Also - what’s the risk if you have a mortgage fixed for let’s say 15 years? Example:

You bought for 1.5m with mortgage of 1.2m. Year after the prices went down by 30%. Your house is now worth 1.05m, but you still have let’s say 1.18m of mortgage. Assuming you are still paying on time, in the worst case the bank will knock to your door anyway, to get from you additional 340k, so your mortgage is not bigger than 80%. Again, I’m not sure if they will be doing it “by default”, as it will put the prices more and faster down. Do you think in that case it will be possible to negotiate a bit with a bank? Let’s say you need to put additional 340k, but only half is possible - would bank agree?

Sorry, but as this discussion is moslty one sided, I have to remind you and drop here my positive example being a happy house owner

- living in a 6,5 room house with close to 200m2 and smaller garden

- house is 14km away from Zurich city

- paying CHF 532.- mortage for the next 10 years (0,95%)

- house price +30% in the past 12 years (700k > 1m)

- mortgage rate 54%