Hi, I’m making this post because all I read is related to the best choices for people living in Switzerland. And while this country is wonderful, some expats are here only short term.

That is probably my case, as I would be returning some time in the near uture to Spain. I was checking and considering different options and I’m not entirely sure IBKR is the best choice to dump a large sum and chill if we consider too the time past Switzerland.

I’ve been suggested to choose the optimal solution while in switzerland, sell and relocate assets when I know I’m moving out, sothat too is an option, albeit not as frictionless as doing it in one go.

I will use as reference this wonderfull post:

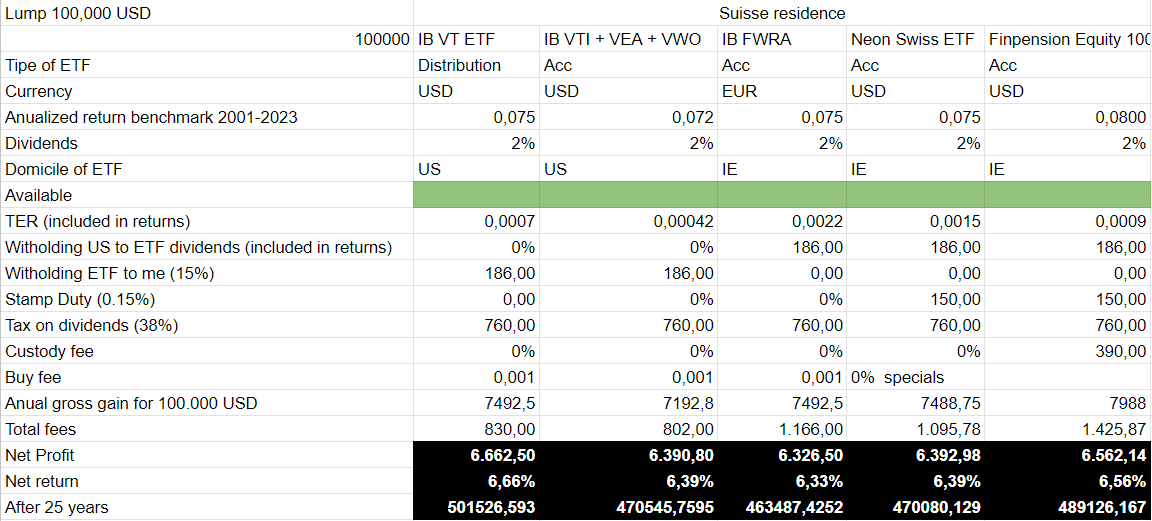

This is what I believe would happen if I lived in Switzerland, I’m considering here:

For Neon the FTSE All World Acc USD

For finpension the equity 100 plan

In Switzerland

The VT does not have the WHT in origin (from share to fund) whereas the Swiss brokers do. I have read finpension is able to recover it, but in this analysis I have assumed it does not.

Neon has a 0% specials on the above fund, so it only has stamp duty as starting fee.

With that in mind and an estimated 7.5% for the underlying benchmark index, the VT is the best performing and it has a net 6.66%. Neon slightly overperforms the Irish version of the VT in IBRK, but the difference is 0.25% between them and VT.

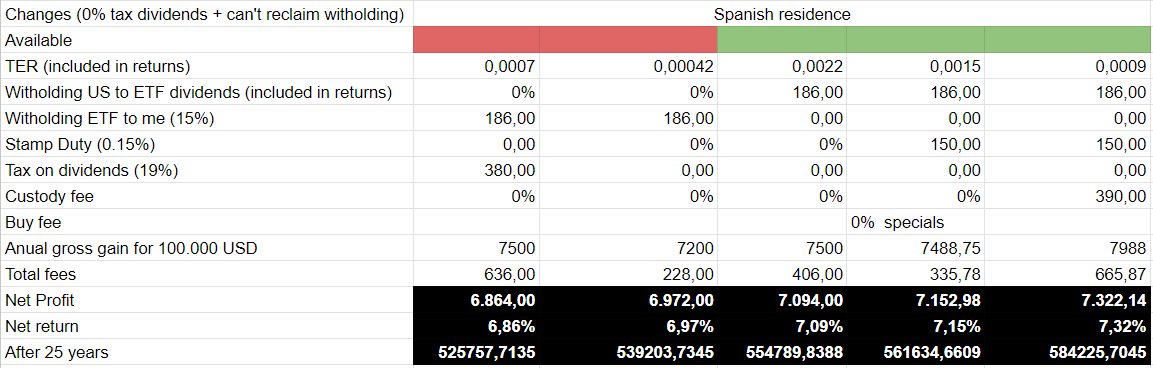

In Spain

Here the main difference is that Spain does not have taxes on dividens as long as the fund is acc. If it distributes you pay roughly 20% of them. Another difference is that you are no longer able to operate with VT. You can hold existing shares though.

You can’t either recover the WHT that the distributing funds such as VT take.

With all the above, a distributing fund performs much worse than an acc, even if the fund is as good as VT.

In this case and under the exact same conditions, VT manages a 6.86% net while Neon FTSE overperforms with a 7.15%

I have not taken into account any fees IBKR might have on buying or FX fees.

So, if you purely want to go or best performance, I guess the way to go would be:

- Buy VT while in Switzerland

- Sell all when moving abroad so as to net capital gains (in Spain those are taxed), and buy FTSE all world

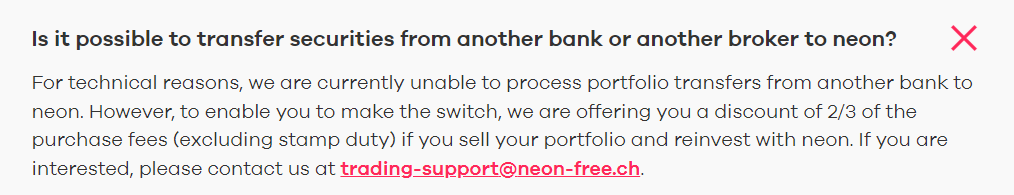

- Send the ETF to Neon

- Hold the Neon ETF for 20 years

But the thing is, is it worth roughly a 0.2% performance over 2-4 years with IBKR all the hassle that you can save with just having the funds the same place you have your payslips?

Am I missing something here? I don’t think I have, but just in case.

EDIT: Ok so I spoke with Neon guys to clarify and it seems I mixed them with the finpension guys regarding whether I can keep my account after moving out of Switzerland. Neon has told me I can’t.

While I can just not tell them I left, if 50% of the post is regarding peace of mind as argument for not investing in IB when I’m still in Switzerland, the same goes for “alegally” keeping a Neon account.

This means when I move out I should either trust a spanish broker/bank, or find a UCITS accumulative version of the VT.