Ok so as I did not want to leave the thread under researched I kept on it. Some of my initial thoughts were plain wrong. For instance, I lacked proper research on available funds as there are some which are pretty nice available on IB.

I also thought that I was able to keep the Neon account when moving out. That is possible but if you don’t tell them anything, which is not ideal when talking about thousands of CH.

There is also something that I wish to clarify. I have read that IB charges you 10USD as activity fee regardless of what you do. However, other places say that is outdated, and my own experience, as I have had since summer 50CHF and nothing got deducted suggest so.

Regarding the Withholding tax I assumed:

-

US funds don’t have the L1 tax and IE funds lose it, and it represents a 15% of the US dividends, which are about a 60%, with the total dividend being aproximately a 2% of the lump sum.

-

Acc funds are not subjected to L2 tax. I’d love someone’s input here as what I found is not super clear. In Switzerland it does not matter, as you are refunded so you could say that is even, but for the Spanish numbers it does matter. I assumed that since the ETF does not give dividends, there is nothing to withhold.

-

In Spain you can’t reclaim L2 if the fund is not UCITS, so all US funds are automatically less efficiente because of this.

Not related with withholding, but in Spain dividends are taxed if distributed. If the ETF is accumulative the tax is delayed until you sell. And this is important, because Spain does have capital gains tax. Which means 2 things.

- In the event of leaving, everything should be sold and repurchased to net capital gains.

- If you wish to move funds from one ETF to another, you must pay capital gains, so rebalancing is very inefficient.

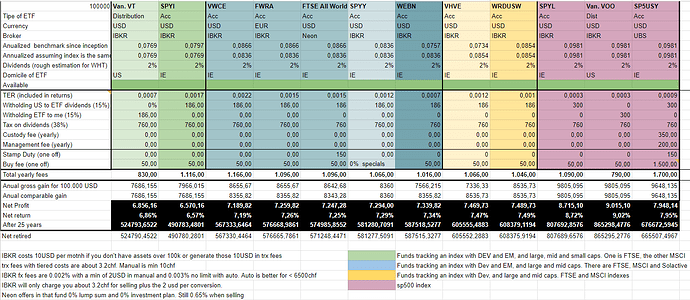

Here is the Swiss scenario, and some comments below

I hope it is self explainatory, but here are some thoughts.

- Fees should be a second tier preocupation.

The real deal is profit of the index tracked. And even within exact same index there are non negligible differences between FTSE and MSCI. I know they have some difference. Apparently Poland and SK are not considered developed world for MSCI and probably there are differences in small and medium classification, so the indexes don’t track exactly the same. However, in the very long run one would expect the differences to be minimal.

It was not really the objective of the post but the index selection (all world, w/o small caps, developed world) is more relevant towards expected profits. I would write about it later.

As I said, one would expect the same results over the very long run. Specially because unless you go for the MSCI Developed and somehow Poland and SK vastly overperform/underperform the results should be near the same.

It’s true that from a “I want to be fully diversified” perspective, considering World ex small caps, the FTSE holds about 4000 constituyents, Solactive 3434 and MSCI about 2700. This means you are really more diversified on FTSE, but assuming negligible weights I don’t believe it should be a huge difference. Or at least not so as to justify 0.15% TER vs 0.07% for the Amundi fund.

And considering the trully global indexes, we are talking 9000 constituyents for FTSE versus 8780 for MSCI (2.5% difference).

So I’d say here it should play a role personal preference when evaluating expected anual results. For me, that is MSCI. Their index has been around for longer, and to be honest I find their pdfs far more clear and informative than those of Russell. Solactive is also better at giving the info. For instance, though that’s perhaps on me, I could not find annualized return for FTSE indexes since inception, only a 10 years analysis and about 20 when consulting curveo.

I spent a not so irrelevant amount of time trying to get this info, by the way, so I’m kind of pissed at FTSE.

So, Neon is still more user friendly than IBKR and that is something that I find important for a lot of people. However, if there is no account fee of 10USD per month, I find that Neon is just still short and that is not his fault. At least partially. Stamp Duty is a heavy weight when we are competing for this milimetrical advantage.

Having a 0.65% fee when selling is also something to consider. I believe it is still a very solid contestant, but having to close accounts when moving out, plus the existance of 3 better fund even on the same category… I mean, I’m kind of forced to use IBKR either way so no point choosing and underperforming option.

There is also the purely fund part. Invesco has a smaller fund in AUE and the broker a bigger spread than the others. Significantly bigger.

I put UBS here purely because a friend of mine has a large amount in a couple of UBS funds and I wanted to see how they work. I may have not captured every fee, but I consided:

- 0.2% custody fee

- 0.5% purchase fee (It could go to 1%from what I read)

- 0.5% currency conversion fee (can go to 1%)

- 0.2% administration fee

So 1500 aprox when purchasing and 1700 per year, And still, an sp500 fund with them would have overperformed a VT one. I know, different risk, in a different time window can be different, you have VOO if you want that. Just another pointer that being right when chosing the index is more important than the TER of the fund.

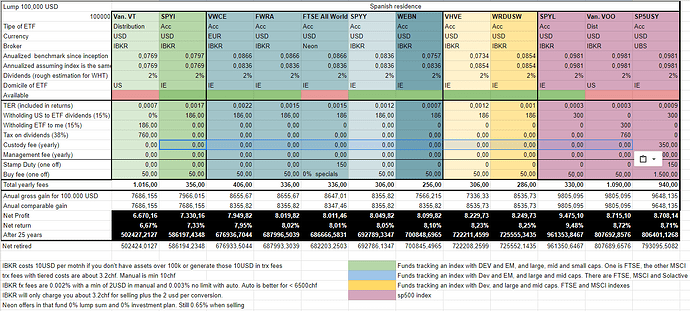

And here the Spanish scenario, and after that some comments

- Only worth commenting how different tax frame forces you to adapt. VT becomes so bad because it is distributed and a non UCITS fund.

Fund selection

What to do? I’m not supersure to be honest.

I have read in several places that sp500 is unlikely to overperform in the following 50 years. The argument is that part of its growth was not due to the companies itself but about expansion. I’m no expert and I did not understand it pretty well so I’d just say that we can’t guarantee it will overperform the global ones.

And I’m of the opinion that if you live in Europe, if US goes excedingly well you are covered, but if somehow Europe catches up, provided that you live in Europe, you must be exposed.

That kind of discards sp500 for me.

Regarding the 3 world indexes I will discard the MSCI World simply because I’m already exposed to it in Spain. So that leaves the question about whether include small caps or not.

Right now, the last 30 or so years have favoured not including small caps. MSCI ACWI has 8.36% whereas MSCI ACWI IMI has 7.97% annualized. Which kind of confuses me, because the Small caps index is very strong too so I am not sure why and index that tracks all is worse than the parts it is composed of.

I guess it is because of the years since inception not being the same.

But the thing is, even if somehow there is an explosion of small caps, I’m not sure it reflect that much on the indexes. We have already have an explosion such with Tesla. And in 3 years it got added to the Large & medium (2013).

So if things are mirrored from the last 30 years, which have included big small caps growth, we are still better without them

Conclusion

I will probably put a small amount on Neon just to diversify, but me needing to sell for netting purposes either way and finding some very good options elsewhere has left me no choice but to tame IBKR and learn how to use it.

Which means for the time being I will go for a 50% split between VT and WEBN (I still need to check if it’s on ICTax). When we decide it’s time to move back, I will sell everything and allocate it in WEBN and perhaps some smaller than 30% in SPYI.