you could also create a flex query with the dividends and the number of shares.

You can then execute it for the month you want to retrieve the number of shares.

In my case, I declare each VT purchase and the tax software will compute the accurate dividend amounts.

If you look at “Open Dividend Accruals” or “Change in Dividend Accruals” fields of an activity report for suitable dates, the number of shares is there.

Thank you very much everyone for the comments on this topic. It’s the first time I’m doing the actions tax declaration and took me a few hours to get it. @San_Francisco your proposal of custom layout for the report was super helpful.

A last question (& sorry in advance if it was covered already): where should I declare the cash “trésorerie” account I hold a IBKR. I’m using Vaud Tax and unsure where and how to add the info.

Thanks all in advance for your kind help

Have a look at this thread, you’ll find explanations and screenshots for Vaudtax.

Under Sections wouldn’t you also have to include “Cash Reports”? Because as far as I know you would have to declare in your taxes all cash accounts you have at IBKR just like a bank account. I suspect most of us having at least 2 cash accounts, if buying VT that would be CHF and USD.

Possibly, if you declare all items and all cash balances in different currencies separately - but I don’t.

I just declare the aggregated total from the Net Asset Value section (plus interest of course, if applicable) - which appears as a split between cash & stock (plus dividend accruals) in that section.

I think I’ve had cash balances in 9 currencies last year.

Not familiar with that particular tax software (mine’s very similar to the Zurich one, I believe), but I don’t think anything would anything wrong with declaring it as a personal or current account (that’s compte privé or compte courant, isn’t it?), as shown in the thread linked by @jmp.

That’s an excellent idea, I am all in about simplifying the tax declaration whenever possible.

Anyone ever had to provide more information to the tax office? I provided the report as specified by San_Francisco and I just received a letter asking for my full IBKR report. Whatever that is…

I sent a mail to try to clarify what they want. This is in Neuchatel btw.

I guess they want to have the activity report over a year.

I’ve always only included the dividend report (in tax document), since I figured it documents all the DA-1 relevant items.

Never had questions.

edit: but if they ask for full report, I’d send them the full activity report.

Can someone help me? I only have VT (arka) on IBKR, what would be the process to have a tax return attached to my due date on September 30th? Thank you.

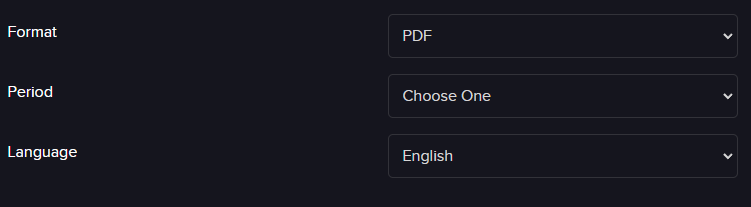

in the custom statement section where it asks for the period at the bottom of the page, it gives me only daily or monthly, it doesn’t allow me to enter precise dates.

It’s a bit confusing but you can ignore that setting and specify a custom date range when you manually ‘Run’ the statement after the creation.

As far as I can tell, the setting is relevant only if you want to have automated periodic delivery of that custom statement (and the only possible periods for automated delivery are daily and monthly).

let me bump this up as a late filer each year.

I have a bunch of ETF’s, Funds and individual stocks (20+) in my IB account that I’m also trading relatively actively.

As I found no easy way of telling “how much of what did I own on the 31.12.2022”, I’ve just taken the NLV from the 2022 tax report and have put it into my declaration without any detailing on the individual positions (I did put in “Diverse” ![]() ). Obviously I’m attaching the tax report, so not trying to hide anything, just trying to save us both time.

). Obviously I’m attaching the tax report, so not trying to hide anything, just trying to save us both time.

As long as I’m not after dividend tax returns (which were <100 USD last year), would that be enough? I guess I’m compliant with declaring my wealth, and I also assume the tax authorities are not going to actually care which stocks and ETF’s are holding that said wealth, are they?

IB send you by email a detail annual report of all your lines.

You can print it as pdf and attach it to your tax reclamation.

You can also build your annual report or flex queries with an annual frequency. Not sure if what I receive is built in or customised.

In your tax software, you can declare a fund RF for your IB portfolio and just declare the total amount in chf and annual dividend.

that’s what the annual report does as well on IB, no?

Gives you

- NLV

- total proceeds

- total dividends

But it doesn’t give you each position you had at 31st Dec of last year.

Even if the default report doesn’t provide it (I think it does), you can always make your custom report template. You need “Positions” or something like that.

https://forum.mustachianpost.com/t/tax-declaration-list-your-deductions/3103/149

I got a report by email for each quarter with the total amount for each position with the current market value.

Keep in mind that dividends of accumulating funds are not included in the IBKR reports. That’s never an issue for US-domiciled funds, though.