IB provides a dividend report later in the year, it normally has all the info that’s needed for taxes. It’s not yet available since some funds haven’t reported final numbers (the withholding you get during the year is not the final one).

- The report generated will report gross dividends under “Dividends” and withheld taxes separately.

Note that it will not report accumulated dividends for accumulating funds. Which aren’t a thing in the U.S. anyway though. And if you’re holding European ETFs, I wouldn’t hold them on IBKR (don’t do so myself).

- You can include various types of fees when setting up the report. That said, I’m not aware of account upkeep fees with IBKR - let alone ones that exceed the normal tax allowance.

Keep in mind that most if not all cantonal tax administrations allow you a deduction for “wealth management” costs on a “no-questions-asked” basis (something like 0.2% to 0.3% of your wealth per year, up to a few thousand CHF, depending on canton).

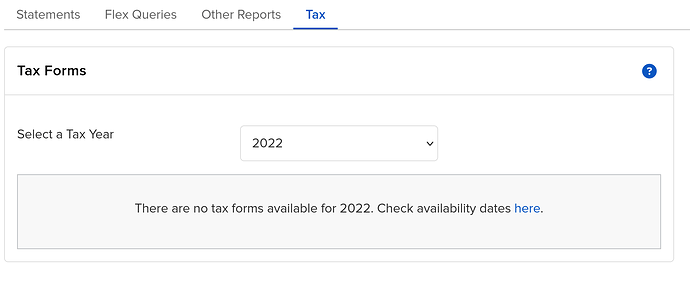

You mean the “Tax Document” under the “Performance & Reports” menu as in the screenshot below?

Because if I remember correctly from last year it takes quite some time to become available. Maybe end of February if I remember correctly…

Indeed, it takes some time. But then it has correct data for DA-1 (e.g. BND gets very different withholding than 15%).

Thanks for the confirmation. I also just checked DEGIRO and nothing there yet either…

Thanks a lot SF indeed what I was looking for ![]()

Now, I have also two other follow-up questions…

For the dividends (I don’t have any accumulating / reinvesting dividends) is there an option to choose to have the dividends deposited directly to my personal bank account (and not to IBKR account)? Because somehow I cannot really understand / realise them when they are credited in my IBKR account (disclaimer here my dividends are very low in the range of 200-300 per year so very minor impact in my portfolio …)

Also the withholding tax is directly deducted from IBKR or am I getting the gross dividend and I am paying the withholding tax with my tax returns?

Also as a rule of thumb I understand that ordinary dividends are taxed at 35% in Switzerland but is this true also for stocks from Frankfurt / Paris / Nyse for instance? Is there a way to check how much would be the withholding dividend tax from IBKR for a share before buying it?

![]()

Hello, I am pretty sure probably it is existing somewhere but could someone please briefly explain again what’s exactly the following forms:

-1042S form (IBKR)

-DA-1

-W8-BEN

For which cases are they applicable for and above which threshold makes sense to fill them?

Technically also for ZH canton, Interactive brokers platform and mainly for VT and VOO US ETFs…

Hi,

All dividends will be taxed at the same rate whatever are the country of the company.

You can simulate the tax impact on the tax software (e.g. GeTax, VdTax …).

Not to my knowledge. You can - as I have - a standing order for withdrawals - but it won’t take into account the fluctuation of dividends (dividends change).

The very reason and purpose of withholding taxes is that you can’t escape them - cause they’re deducted before you receive distributions. You pay, with your tax return, taxes on the gross dividend - and double taxation agreements are (often) in place to make sure that you don’t pay twice. But they’re usually on the basis of retroactive refunds.

This is only the withholding tax rate for Swiss securities - not the effective tax rate you have to pay.

In Switzerland you effectively pay your personal income tax rate on dividends (contrary to some other countries that tax dividends at preferred rates).

Just for my understanding withholding tax rate is 35% for Swiss securities, but I could declare the withholding dividend tax payment to my tax declaration - get it refunded - and be taxed then for the dividends gain as an income tax, at my overall income tax rate?

Or if it’s not effectively 35% how much is the tax I am paying? Is there a simple way to calculate my net profit from the dividends?

Yes, that is how it works (WRT to the 1st paragraph).

Dividends = income

Thus add them to your (net taxable) income and there’s your estimated tax rate.

Foreign investors holding US shares are normally subject to a US withholding tax rate of 30% on income from those shares (typically dividends). However, as Switzerland and the US have a double tax treaty, Swiss investors are eligible to a reduced withholding tax rate of 15%. Filling out the W8-BEN allows IB to levy 15% WHT instead of 30%. You should fill it out as soon as you hold US shares/ETFs.

The 15% WHT from the US is non-recoverable (i.e., you cannot claim it back from the US). However, Switzerland allows you to claim these non-recoverable WHT from your Swiss taxes and this is done by filling out the DA-1. Note that your tax office will not process any DA-1 with less than 100 CHF of non-recoverable foreign taxes (i.e., you must have earned at least 667/567 CHF of US dividends before/after WHT).

The form 1042-S reports the dividends you have earned and the WHT you have paid in the US as a foreign investor. You can attach it to your tax declaration in CH, but it is usually not required as your tax office will compute everything from ICTax and the trades/positions you have declared. You must however attach a report showing those trades/positions.

Just an addition to this (IIRC) -

You “fill it out” automatically through the IBKR account creation process (by answering some residency related questions); no explicit form to fill as such.

In doubt, you can always go to Account settings > Profile: Your name > Update tax forms (at the bottom of the pop up window).

At the end of the process, if filled correctly, you will have to sign an online substitute for W8-BEN.

Forget about 1042S. It’s a form to report U.S. source income to the U.S. IRS. It will - as I understand it and as it looks for me - not report income from other countries. Which you definitely should report on your Swiss tax return. Even if your only securities and income on your IBKR account are from the U.S., the form is needlessly complex, convoluted and confusing to attach it to a Swiss tax return. The only somewhat useful among IBKR’s “tax forms” seems to be the dividend report to me - though you can finde the same information in other reports/account statements created.

DA-1 is a Swiss tax form (not provided by IBKR) is used for setting off foreign (non-refundable) foreign withholding taxes against your Swiss taxes. When you can’t get a tax refund of withholding tax from the foreign tax administration, you can basically deduct the amount from your Swiss taxes. Note that this is possible for many (but not all) countries, according to applicable DTA, and not restricted to U.S. incomce/dividends.

W8-BEN will allow you a partial exemption of withholding taxes from U.S. securities (i.e. decrease the tax withheld from 30% to 15% on U.S. dividends), if you are a foreign person from the perspective of the IRS. You should definitely file W8-BEN if your online broker supports it and you’re a non-U.S. person/not ordinaraily taxable in the U.S. They will often proactively “bug you” about it though.

To me it sounds like a good proof for withheld tax to justify the US part of DA-1 (of course not for all dividends). That said tax folks are usually happy with the dividend report.

I just glanced over mine - and I can’t even show the security for which tax was withheld?

I had some differences between DA-1report from IB and when I did the calculation manually with ictax.admin data