Ok, thank you very much!

I crated a custom report (years ago), showing all the funds I have, the dividends received, plus the interests. When I run it for 2021, I get all the expected sections in the report (amount of each funds, dividends, withholding taxes), but the interests section is missing. I tried several times, also from different browsers. Maybe it’ll work tomorrow.

When I am doing it, “Broker Interest Paid and Received” is a section separate from “Dividends”. You can also list separately negative and positive interest.

For taxes I was generating a report with sections

- Account Information

- Positions and Mark-to-Market Profit and Loss

- Combined Dividends

- Combined Interest

- Withholding Tax

- Forex Balances

for the whole year. I have switched my base currency to CHF to generate this report.

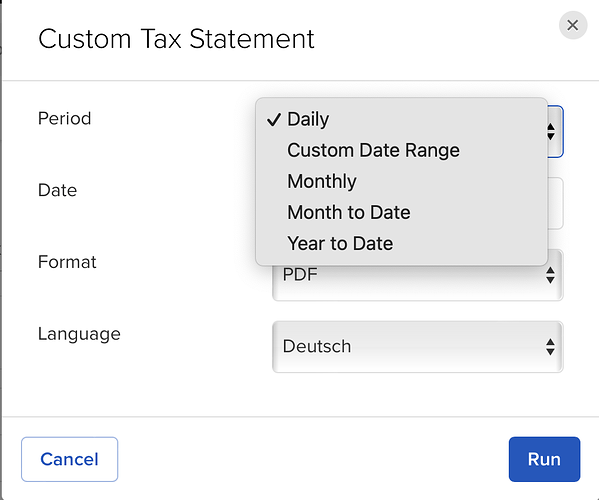

Hi, I’ve made a custom report with the values you listed for tax purposes in Canton Zurich. What ‘period’ value do you use to generate your report? E.g. December plus any months that you received dividends / monthly? Thanks for your clarification. ![]()

Custom Date Range —> 1.1.22 - 31.12.22

I‘m interested what sections you show to the tax authorities… they don‘t need all of them, do they?

Edit: whoops, should have read San Francisco‘s post regarding the sections ![]()

Yep - though I seem to remember that you may have to adjust the date range for non-trading days (such as New Year’s day).

Does anyone have a suggestion how to handle dividends from accumulating share class funds held at IB? (In acc share classes, dividends are reinvested in the fund and not distributed, but still taxable.)

My former UK based broker provided a statement which included such dividends.

In 2022 I moved my holdings of this fund to IB and I cannot find any similar statement. I sent a message to IB 10 days ago. Since then I read that the concept of accumulating shares does not exist in US. Knowing IB customer service I do not expect them to help.

I assume I will need to complete the breakdown by position and purchase date in the tax return software. Or alternatively provide some similar supporting calculation.

Good point about accumulating ETFs. I am sure I noted this once or twice but it may have been on another thread (possibly the one that this thread was split off from, see above).

If you don‘t report the individual items in the tax return, you‘d have to account for accumulated dividends/distributions in such funds manually. I‘m not aware of IBKR reporting them (though I may have seen distributions from capital gains reported - but these were actual distributions to fund shareholders).

As long as the fund is in ICTax, you simply enter the purchases and the dividends are calculated automatically. If the fund is not in ICTax, I’d suggest asking ESTV to add the fund as soon as possible to avoid problems.

Until now it was just handy to check the box in the tax return software “statement from broker” and enter the totals from the IB report.

I guess I now need to manually enter the positions and purchases for all my stocks and funds at IB.

Or alternatively I calculate it off-line for this fund using the ICtax webpage and attach it as support

Thanks @Voodoo and @San_Francisco. Yes, I see that 01.01.22, 02.01.22 & 31.12.2022 were non-trading days. So these cannot be included in the custom date range statement for 2022. So do you just submit it to the tax authorities without those dates and it would be fine?

What’s there to hide?

Of course.

If I had 20 items on my IBKR statement (including, possibly, multiple purchase transactions) and only one of them was an accumulating fund, I’d just attach a note…

“Depotauszug von Interactive Brokers U.K. weist zu versteuernden Ertrag für thesaurierenden Fonds nicht aus. Zusätzlich zu versteuernder Betrag: CHF xxx.xx (x Anteile IE00BK5BQT80 Vanguard FTSE Developed World UCITS ETF per 30.06.2022)”

…and include it in my tax return the most unambiguously looking way possible (remember, someone will be reviewing your tax return. And they’re probably neither a IBKR customer themselves nor able to read your mind. But may still wonder if and where you included it in some total or not. And they probably won’t be too motivated to make much of an effort to find out).

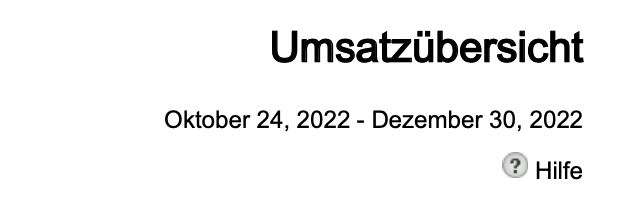

It’s a non-issue. If I choose a custom range of Jan 2, 2022 through Dec 30, 2022, the generated report will nevertheless be titled

Activity Statement January 1, 2022 - December 31, 2022

In other words: Jan 1 “activity” is automatically included in Jan 2, and similarly for Dec 31.

Which may be kind of weird from a UI perspective… but is convenient. ![]()

Strange… ![]() mine doesn’t do that. I actually just opened the account on 24.10.2022. So my exported statement shows… (german version)

mine doesn’t do that. I actually just opened the account on 24.10.2022. So my exported statement shows… (german version)

Nothing. But have you ever looked at the full report they provide? I wouldn’t want to be the guy reviewing that PDF at the tax office…

Additionally, complex things tend to promt questions, and avoiding them also helps me to save time

If I include something I only include the dividend statement (that’s what they’re interested in anyway, might even be required for DA-1 processing).

By the way, you can open up a separate second account at IBKR (which can be same or different type of cash/margin) that can be managed with the same login credentials. In fact, I did so, just a few days ago.

Do make sure to check regarding account minimums if you’re holding cash (which may be relevant for broker interest rate paid?).

But it may allow you to segregate certain positions - and from what I’ve seen, you can create separate account statements.

Now it was my turn to generate the PDF of IB for the taxes and I encountered a problem: I fail to include the cash positions.

In my understanding, they should be displayed, when „Devisenpositionen“ is selected. However, this section never shows up in the PDF. I also tried to generate a report consisting only of this section, and then IB just generates an empty PDF.

I checked out the report from last year and back then, it worked out fine.

What am I doing wrong?

Update: I figured out that the section only shows up when P&L are set to be displayed… Guess the tax office will be able to have a laugh at my performance in 2022 ![]()

Hello All,

I assume the information related to the custom tax report generation from SF is still up to date, correct?

I have two other questions related to IB…

-

How can I see how am I exactly taxed at the dividend gains per different share/ETF? Could it be that they automatically deduct the taxable part and I just get the net dividend, directly? e.g if I run a custom report for dividends what am I getting is the dividends (gross, pre tax, correct?)

-

How can I see if I am paying any monthly account fees / maintenance fees or any other types of fees by just having an account holding with IB? I am having an IBKR pro account with fixed system fees as far as I can see

Thanks a lot ![]()