It’s 10k but apparently they don’t enforce it immediately.

Is it me or IB changed the interface? After I login I see a new page with graphs and news. I have to press Account Management to go back to the usual one.

I can’t find the Webtrader there. Weird. Did I forget something?

Long ago already, old news

I logged in less than a month ago and I saw the new beta view, were you could open TWS and Web Trader. Now that view allow to make reports and other stuff, but not opening Web Trader. In fact I don’t know how to open it other than the demo.

There’s link to log in to webtrader right from the main homeapge

And this is not support forum for IB! Websites changes all the time, deal with it

Yeah. for some odd reasons that links opens only the Demo version.

Yes, that one opens the Demo version but I didn’t investigate much.

The Client Portal login instead opens that new page that can lead also to the Account Management page where once it was possible to open webtrader as well. I will further investigate tonight. Yesterday I was just browsing around.

Have also a look at this new, huge guide from our colleague @MrRIP !

Thanks a lot, both to you and MrRIP, just what I needed!

Dear all,

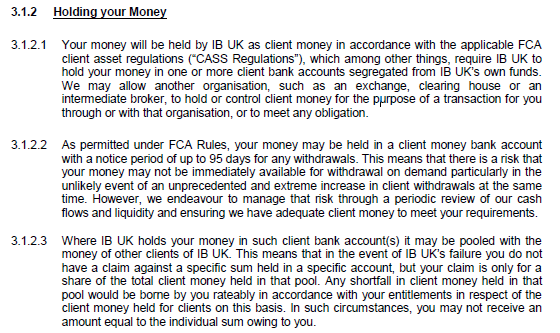

I just recieved an updated clients agreement from IB, to be found here.

IB explicitly mentioned that changes contain the following two paragraphs:

basically it says that i may have to wait 95 days for withdrawing funds, and in case of default i carry additional risks of not getting the full funds back. Are there any experts here that can comment on this?

Wow, you actually gave it a read ![]() . These 95 days and holding our money in a pool seems strange. But in the end, the Financial Conduct Authority allows it. Why it allows it be so long is a different question. Can you imagine if you had just a single money account and it got frozen for 95 days?

. These 95 days and holding our money in a pool seems strange. But in the end, the Financial Conduct Authority allows it. Why it allows it be so long is a different question. Can you imagine if you had just a single money account and it got frozen for 95 days?

I found something when I googled for “FCA 95 days”:

As it appears, this 95 days limit applies to something called “unbreakable deposit”:

the majority requested that we permit firms to deposit client money in UDs of up to 95 days (95-Day UDs), as it would encourage a wider selection of banks and building societies to accept client money

I guess IB would deposit your currency in an unbreakable deposit, because it’s cheaper this way. But at this point I’m just being creative.

you’re welcome

I recently discovered that IB automatically converted my dividend in EUR to CHF. The dividend first appeared as cash in EUR and then after some time it was converted to CHF without me doing anything. Is it normal that they do that?

i never saw such thing. but i heard they do this in case they bill fees in one currency, and you dont have enough of that currency but another. i just heard

I don’t know about dividends but I have seen them automatically convert CHF into USD (my base currency) when I had between 0 and 1 CHF in the account for more than 24h.

Just wanted to ask you if you have chosen a margin account or a cash account:

How do usually purchase your shares with IB:

First convert money and then buy the required ETF? I understand this is necessary with a cash account but not necessary with a margin account in which you have to go and “close” the amount of USD that you have borrowed.

I called them but I am not entirely sure About the possible risks of having marging account with IB. I like the idea of being able to reinvest the money from sold ETFs immediately.

Do you have a margin account? How do you manage it with the app? Do you first convert your CHF to USD and then purchase or do you buy on margin?

What is the process to cover these negative positions?

Hi everybody,

Because of the good press here I also decided to move to IB from SQ.

I’m still trying to understand the platforms and decide which one is better suited for me.

I noticed that nobody refers to the “client portal”. Though as far as I can tell it’s UI ist OK and you should be able to do all transactions you need (Transfer funds, buy USD, buy stocks and ETF’s) directly there.

So my question: Is anybody using it? Are there reasons to use the Web-Trader or the TWS?