I hear you a2ithaka. I also read all the good press in MP and recently opened a IB account (I currently use SQ) and have decided to spend a beautiful Sat morning in Switzerland (ie. today) to read all the MP posts and get my account setup. I’m not a beginner but to be honest with all the complications that seem to be involved with IB from transferring positions (50 Sfr cost per transfer), FX exchange, to even getting IB Key to setup the secure login (contrary to the help info, I did not receive a set of IB Key temp passwords during the account application process), my finger is poised on the “Close Account” button and just sticking with SQ! Any other newbie IB’ers who can share their faith to stick with this? I need it!

To be honest till now the result is good.

I opened the account, I transferred money from my ZKB account without any costs and from my SQ account which costed me CHF 2. I bought USD and then VT and all went fine.

Without the forum here and the fabulous posts of @_MP (How to buy the VT ETF (in USD) on Interactive Brokers) and @MrRIP (INTERACTIVE BROKERS 101) all this would not have been possible and I’m really thankful for the provided know-how!

Though I still have some stuff I don’t understand:

-

Nobody seems to use the “client portal” to do his trades and I don’t understand why

-

When I tried to use the “client portal” and the “web trader” to place an order I got the feedback that I don’t have real-time data and it’s strongly recommended not to trade without real-time data. What is this about?

-

When tried to buy USD in Forex I got a notice that any amount bellow 25’000 is somehow a special order and the USD price can’t be guaranteed (or something like that). Did anybody else have this experience?

So in general I’m happy to go to IB but I don’t understand everything yet and I would like to in order to feel comfortable on the platform…

i can relate here, i was a bit disturbed by this in the beginning, too. This assumes that volatility within the 15 min (or whatever the delay of the cost-free data is) might harm you. if you are playing active trader, derivatives, etc, this is relevant. however for us buy&hold investors, this is of no concern. think of the “Franken-Schock” in the beginning of 2015:

such events might wipe you out if you are betting against within the wrong 15 mins

It’s best value for money in town if you need to get historical minute-level bars (with survorship bias though). So if you need to pull some data cheaply for your next intraday quantitative strategy i’d recommend subscribing. Normally, historical intraday data costs a small fortune at the usual places.

But if you’re just a typical retail and need to dump money onto the market every now and then and don’t particularly care about the price it’s pointless, you can get the price data for free elsewhere. Realtime for US and 10-15 minutes delayed non US data is all over the web for free.

Nonsense, I’m using it and I like it. I only open TWS for API connectivity and to get rid of those annoying virtual fx positions.

It’s what it says, you’ll get a bit worse deal, but still way better than any bank or airport exchange…

This interface is quite new, this is the reason you did’t read much about it in posts and articles

I’ve had a IB account for almost a year, but still kind of a newbie in that I’ve only done a few transactions.

Each time I had to re-read the help threads (since there was a few months between transactions), so I wrote myself the 5 easy steps on a piece of paper (10 minutes effort) & now I’m done in a few minutes each time.

Stick with it

(Oh and after a few times it feels “easier” to just ignore those strange warnings about $25000 and no real time bla bla)

Care to share those “5 easy steps” of yours with the community?

My handwritten note is not worth that much to someone else unfortunately. It’s kind of learning by doing, and the notes only help if it’s been done before, as a “reminder” of where I clicked next last time / a few weeks ago.

What I wanted to bring across is to “share the faith to stick with it”, that with a little initial work, things become easy quite quickly, as after the initial “complications” of account opening (I didn’t have any), the usual repeat transaction is done in the same 5 or so easy steps each time.

Many help threads have been written, for me the one from @MrRIP was most helpful (very thorough, not too old).

Let me share with you my list of “5 easy steps”, which you can find… on this very forum.

I thought TWS and Web Trader do have live market data for US…

For paying customers only, else you only get delayed data.

Then there are several lavel of non-live data. I sometimes have Web Trader and Yahoo opened and they are different.

Please excuse me if this has been asked before - but what fee type are you guys using at IB, fixed or tiered? Is it just a matter of choice really when you create the account or can you choose per trade?

IIUC the fixed costs 10 CHF min or 0.1% - but tiered is a combination of various fees, eg for buying 2000 CHF worth of ETF:

- Exchange Fee: 1.5 CHF + 0.015% * 2000 = 1.8 CHF

- Clearing Fee: 0.538 CHF

- Trade Reporting Fee: 1 CHF

so a total of 3.338 CHF?

So fixed is 10 vs tiered is 3.35 - why would you not choose tiered if that’s an option (not sure if it is, or is it only available after some minimum volume?)

I don’t think anybody here considered buying SIX stocks through IB. Why would you, anyway?

I’m using the fixed system, don’t know how you sign up for the tiered one, but isn’t it meant for really heavyweight investors?

Anyway, with fixed system, if you make your trade on NYSE, you pay 0.005 USD per share. So a 1000 shares would cost you 5 USD. If one share cost 100 USD, that would mean a purchase of 100’000 USD. So as you can see, you are trading luxury cars worth of stocks for the price of a coffee. Just forget about it.

That’s a personal choice I guess. For example for home (CHF) bias or just in general for swiss based assets.

And for that it seems the tiered system is better (cheaper).

Anyone have experience with the tiered system? Are there any disadvantages?

OK fair enough, sorry for judging too quick.

Don’t forget IB Commission: 2000 CHF * 0.08% = 1.60 CHF

But seriously, you want to make 2000 CHF trades? Just go up to 10’000 CHF and you won’t have a problem with fixed fees. In my opinion it’s pointless to make such funny small trades and then look for a way to save a few cents on the fees.

Good point!! So that would mean tiered on SIX (EBS) is roughly 0.1% + 3 CHF, so for amounts lower than 7000 CHF it is less than 10 CHF ie cheaper than fixed, for amounts greater than 7000 CHF the fixed model is cheaper.

Yep, I’m considering it. The idea is to split the portfolio into 60% stocks, 10% REIT, 10% gold, 20% bonds or money-market (currently you get 2% guaranteed on USD in money-market, while as getting the same in bonds is currently tricky or risky).

I know this is non-bogleheads style but suits my risk tolerance better.

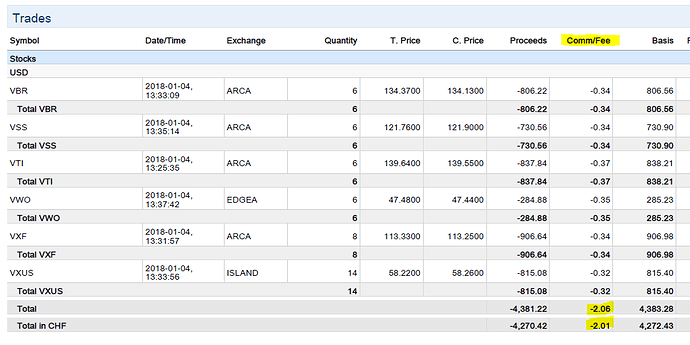

an exert from my beginning of 2018 report at IB:

it’s always close to the minimum commission of 35 cents for NYSE. this is the tiered account. prices here:

there is somewhere a choice when setting up the account that lets you chose.

I plan to set up IB beginning next year. I see myself much more likely to make monthly contributions way below 7000 CHF, so tiered will be cheaper for me. Can the pricing be changed to fixed at a later date?