Thanks, did that, it worked. I update my instructions for finishing the ETF buy.

Ok thanks! The option fxconv is not available - do I have to enable that somewhere?

I am not using the webtrader, but i the tws. I think that fxconv is not available or not correctly displey on the web interface. I remembered to have read that on this forum

FXCONV is not available when using WebTrader. Can you elaborate why you “shouldn’t choose IDEALPRO”? Why not? The alternative is to install TWS. I have used WebTrader to convert CHF to USD with IDEALPRO and it worked fine.

Here is some reading material from IB on this topic:

I think the only difference is that IDEALPRO creates a virtual position for the FX trade, and FXCONV doesn’t.

That’s it, AFAIK. It just shows the confusing virtual position, but it can be removed afterwards as well. Do a search, we discussed how to remove them in the past.

If you find something confusing, you can get it out of your sight, or, you know, learn what it means so it’s no longer confusing. To me this virtual position is pretty useful, it shows what my performance would be in CHF. Just apply the P&L of the position and convert to CHF.

Finally able to buy US Stocks.

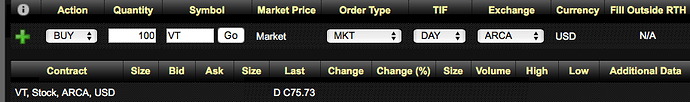

What is the best, cheapest way to buy VT. Do you buy over MKT (Market I assume, is this in the middle of the spread?). Which exchange do you use (Smart by IB or ARCA directly?).

And I assume it takes my exchanged USD for that and I also assume that if have not enough, it would create a negative Balance on my USD Balance, right?

So many questions ![]()

I’m no trading expert (contrary to my IB testimony ![]() ) but I believe that’s completely wrong.

) but I believe that’s completely wrong.

BID is the highest price any buyer is willing to BUY for.

ASK is the lowest price any seller is willing to SELL for.

If you buy at MKT then you just take the current ASK price.

But it can be more complicated. Do you know what order book is? It contains the current open orders (waiting to be converted into trades). It can look like this:

BID (Qty @ Price):

- 50 @ 67

- 30 @ 68

- 20 @ 69

ASK:

- 20 @ 71

- 40 @ 72

- 40 @ 73

Now let’s say you want to buy 100 shares at MKT. You buy the 20 at 71, but that’s not enough, so you continue buying the 40 at 72 and 40 at 73. So in the end your final price is the average of these.

You see the risk here? If the market is not very deep (not many orders) and you place a big order, you could end up with a much higher price than the current indicated ASK, especially if you don’t see the order book.

For ETFs there are also the market makers, a thing to consider. They fill your order if there is nobody else to do it. That’s especially useful for Ireland based ETFs.

Can anyone confirm if what I wrote here makes sense? What’s your best practice? Do you always use MKT orders or LIMIT?

Here’s some reading material:

Thanks Bojack, great answer - absolutely see the risk now.

I know order books, are they available in WebTrader without upgrade cost?

I am unsure if I should stick to Limit or Market Orders. I guess if you want it now and a higher price is ok for you then this is the way to go - otherwise you may have to wait or even miss out and the trade is not filled.

Also: Is it better to make on big trade or split it up (Costwise I mean, but yeah maybe this another topic anyway with dollar cost averaging and all that jazz)?

i was interested in this too. now, with your example in mind, suppose i dont place market but a limit order, 100 shares at 70.

then there would not be anyone fullfilling this at the moment, so i’d have to wait until some new market player offers a lower ask of 70 or below?

this might or might not happen, right?

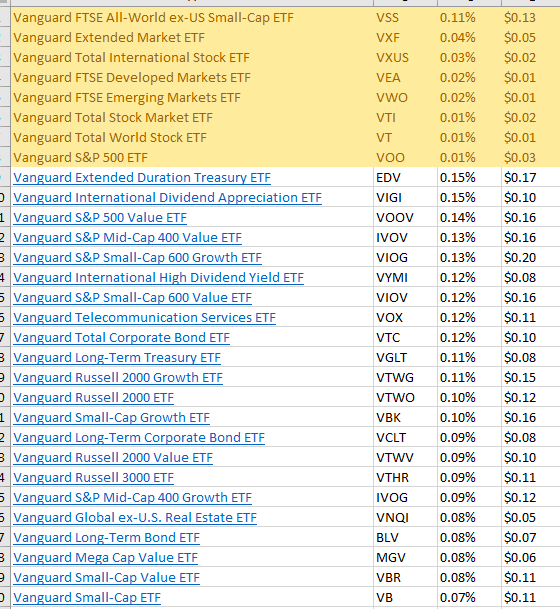

according to vanguard, VT has an average spread of 0.01% or 1 US-cent per share. in this section of the market, spreads seem to be insignificant and not worth the time bothering about

Here some sorted excel-export on spreads, as provided by vanguard

IB explicitly splits larger orders to minimize effects on the price. i cant remember where but i read it every time i turn my monthly savings into ETFs

Yes, that’s basically my understanding of it. If you place a limit order with a price below the current ASK, you might never get anyone to fill this order. That’s why the market order is so convenient, because it guarantees instant execution. Now I think with ETFs like VTI and VT, where the spread is usually $0.01 = tick size (the lowest possible spread), and the order book has hundreds or even thousands of shares for each price, there is no risk when you buy at MKT.

I’m not so sure about the Irish ETFs, however. Often, when I check the order books, there is nothing going on there. You can see the order books on the websites of SIX or Euronext.

Another question: I assisted my friend who does not live in Switzerland to open an account at IB and buy VWRL. Because of big spreads (0.1%) and low liquidity, I was not confident to advise him to place market orders. This got me thinking: every ETF has got it’s NAV. NAV is the calculated current price of all the shares that go into the ETF. So, would it make sense to place a limit order at the current NAV price?

If you place a limit order slightly above ask you have pretty much instant execution with protection from unexpected price changes. Though that is not as important for VT as it is with iliquid cryptocurrencies where I learned that lesson the hard way. It will still take the lowest asks but it sops when it reaches the limit.

Also limit order have the bonus of predictable price, so if i have 1000$ on the broker I can afford 100 of stock x at 10$ but not at 10.1$ so I would put a limit of 10$ (realistically I would keep some cash int the account but this is an example).

Ok, that makes it easier - thanks.

Which exchange do you use: SMART by IB or ARCA directly? Is it important? Thanks

http://www.etf.com/sections/blog/understanding-etf-flash-crashes?nopaging=1

note: I didn’t read it.Hopefully it will talk about the crash were many MKT buyers got burned hard.

Dear mustachios, I need some help for a dummy question about the WebTrader of IB!

I tried to solve this with IB Support, but that guy was not helpful at all.

Problem: Under Market Value I find my current Values listed.

CHF 1000

USD -1000

As an example: I have a CHF position with 1000 and a USD Position with -1000. (for the sake of simplicity let’s assume CHF and USD is 1:1)

The guy told me, that I owe 1000 USD to IB. So I thought rather sell CHF to cover my USD position. But when im buy for instance 100 USD on Forex the Market Value changes to

CHF 1100

USD -1100

This drives me nuts. I expected 900 CHF und -900 USD. I think I want 0 CHF and 1000 USD at the end. How can I achieve that or what is actually the right way of dealing with this problem?

Clearly you have not bought 100 USD, but sold. If you buy USD.CHF, then the trade currency should show CHF, which means you will be paying CHF. You enter the amount of USD you want to buy, and then it will tell you how much CHF it will cost.

Note that if you want to get rid of all CHF that you have, you actually need to sell the CHF, not buy the USD. I explained it in some other thread.

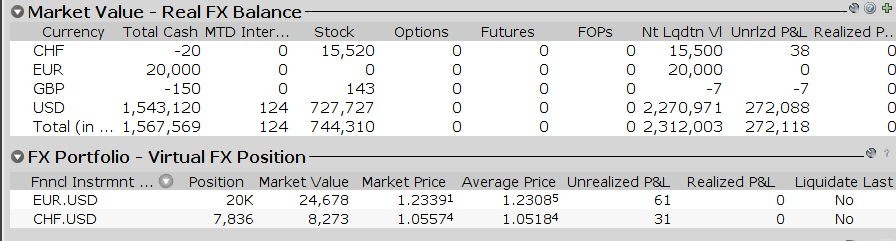

Hello, I am definitely lost in the way IB treats currencies. I opened a paper account and made some transactions. Now I have this situation where I do not know what is the difference between a real currency position and a virtual FX position. When I do the currency conversion it is also possible to chose between IDEALPRO and FXCONV. It seems that when I do an IDEALPRO currency conversion I end with virtuall FX position. If anyone could help me on this point it would be highly appreciated.

Well, you bought 20’000 EUR for 24’678 USD. It’s as if you would’ve bought 20’000 shares of this EUR company and now you’ve got a position of 20’000 units and the exchange rate is the price. So when the exchange rate changes to, e.g. 1.50, it will show a mark-to-market value of this position of 30’000 and unrealized P&L of 5’322.

Now if you sell 20’000 EUR, you will close your virtual position. So this virtual position helps you track how much you gained/lost on FX trades.

Hi guys, can anybody tell me if there is a minimum deposit on IB? I read something like 10k usd on their website.

Thanks!