What’s this about?

This came from the yearly review, I haven’t changed anything from my previous data

What’s this about?

Can someone explain to me how I have thousands of unrealized gains but my net liquidation value is lower than my total amount that I have paid into IB since account inception? I have not paid out a dime since creation.

My base currency is CHF but my ETFs are bought with EUR. The nav already accounts for the EUR->CHF exchange.

I do not see “net liquidity value” on my iOS App.

I have “Net Liquidation Value” and “Current Excess Liquidity”. (If you type IBKR and either of those into a search engine an explanation comes up)

I corrected it in my text, the correct word is net liquidation value. I have also most propably found the issue becaues my time weighted return is positive but my money weighted return is negative. I think that is because I invested a lump sum from end of october 2021 to end of november 2021.

Looks like the unrealized gains are calculated from the time weighted return.

That would indeed be weird. I assumed the unrealized gain absolute value in CHF would be price today - purchase price. Will look out for it next time I run a report

You must have sold something at a loss at some point?

A simple example demonstrating how this can happen:

So, you’ll see unrealized profit of $300 in your account, even though your total net value is lower than what you’ve deposited.

Look at your reports in IBKR. For every individual sell trade you’ll see realized profit/loss there.

In other words, unrealized p/l is not about your total profit/loss since you’ve been investing at IBKR. It’s about your current holdings, the difference between what they are worth today, vs. what you’ve paid.

Realized profit / loss matter for capital gain taxation, but that doesn’t concern Swiss investors.

Or maybe USD currency losses? So technically in profit for the individual stocks but due to weak USD effectively lower when calculated in CHF?

I have not. As I have said I only invested money and am up several thousand. But my Net Liquidity is still lower than all my payins. In the picture below you can see that I’m in the green.

From my understanding it should be like this: unrealized gains/loss + total payin = Net Liquidity (propably a little bit lower because of conversion fees but should more or less be correct and not more than a thousand difference)

Only bought in EUR but with buying every month I think this should even out.

What about dividends? I think they are not included in realized or unrealized profit/loss.

Why would it even out? EUR has been losing to CHF steadily over time (though, I don’t know how long you’ve been investing for). If your ETFs have seen small percentage gains in EUR terms, it would still show as unrealized profit I think (i.e. you would be subject to capital gains tax in some countries, if you sold your positions), but net asset value in CHF terms could be going down due to currency losses.

Has to be. I can’t find any other explanation.

Hi, please let me know is there a way to setup standing instructions in IBKR to invest in ETFs at market price ? Thank you!

Check passiv.com. Quite user friendly, There is a free and a paid version

Thank you. I guess it wont be much manual effort for me as I will trade 1-2 times a month.

One question - does IBKR needs to be notified everytime we do a wire transfer ?

Or the funds get credited once i have the bank payment template correctly setup ?

Yes but you can setup a recurring transfer in IBKR for that.

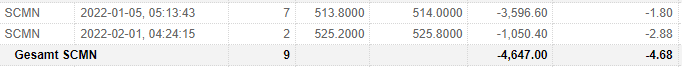

I’ve bought two times the same shares on IKBR (see screenshot). However, the provisions are quite strange: First time I bought shares for about CHF 3600 with a provision of CHF 1.80, the second time for only CHF 1050 with a much higher provision of CHF 2.88. How can this be? I haven’t changed anything in the choice of my fee-setting. I do not care that much about these low fees, I’m just curious why the fee is higher for a lower volume… (Other transactions I’ve made - all shares also on SIX - with similar amounts were all around CHF 1.50 - CHF 1.80).

Look at the Commission Details section of activity report for respective days. If it is not there, create a custom template and activate this field.

Thx for the hint. I’m not sure if I checked at the right place. Under ‘Transaktionskostenanalyse’ I’ve not found a detailed listing of the different fees being charged, however I see there that the more expensive trade was ‘Non-Marketable STK Trades’ the less expensive ‘Marketable STK Trades’. Very strange to me since I’ve bought it during normal trading times and with exact the same settings…

A non-marketable order is an order that can’t immediately be fulfilled and thus adds liquidity. You may get a fee discount from the exchange/broker if you add liquidity. The documented discount on IBKR for adding liquidity on SIX/EBS is tiny, though. Maybe there are additional discounts if certain conditions are met.

See also https://ibkr.info/article/201

I think it’s a good lesson: a) don’t buy stocks at SIX and b) don’t buy Swisscom ![]()