They actually do have an office in Zug. It might just be for institutional customers, though.

They’ll have to take one for the team then! (jk, ofcourse).

Turning the question around, is there any reason not to use a Swiss broker?

Switzerland is one of the (maybe the) best jurisdiction in the world to bank or hold your investments in: A stable democracy that strikes a very reasonable balance between economic freedom and regulation/customer protection, with a tradition of equity investments by retail clients and a stable currency. Financial service providers speak your local language and (most) English as well, and generally provide good or at least reasonable, professional service.

It is just a bit more expensive here.

For exchange traded products this may be correct. However, if you want to buy Swiss mutual funds, Swissquote has a much larger selection, as far as I know. IBKR also doesn’t provide access to BX Swiss (“Berner Börse”), as far as I can tell.

In my address book in case they margin call me. Pitch fork ready

I don’t think it’s much about propping their own financial services sectors and its products. I think it’s more that legislators believe in regulation as a matter of ideology: First, to create a common market - and by extension a super-state - with common rules and a level playing field. And second, to “protect consumers from themselves”, that government should be a watchful nanny protecting its citizens.

I’m also not too worried about EU brokers. While there’s tension between the EU and Switzerland (as well as, on similar grounds and increasingly, the United Kingdom after Brexit), the conflicts aren’t major. Rather minor skirmishes at most. Also, when I look at neighbouring EU countries (FR, DE, AT), they’re stable democracies as well. Sure, there is or will be financial repression one shouldn’t be surprised about drastic monetary measures to support their flawed currency. But generally, these are stable jurisdictions.

The US however… Their liberal pro-business and pro-investment attitude and policies are unlikely to change, IMO. But I believe that the risk of the US descending into civil unrest or civil war is real. And possibly underestimated by many - despite the recent anniversary recent anniversary of the storming of the capitol and the accompanying press commentary (ex. 1, 2, 3). I have barely noticed didn’t read the articles yet - but the signs and symptoms have indeed been there for some years.

Personally, I only keep around half my liquid net worth with IBKR.

I expect that one to be rather slow tho. Scnr.

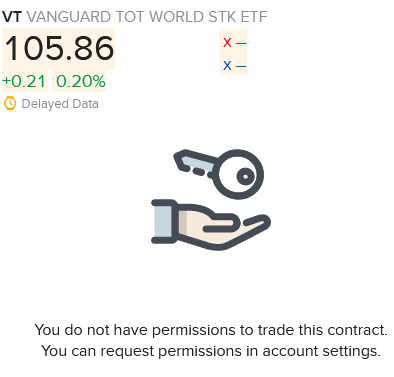

I recently set up my IBKR account. When I search for VT, a message shows up saying that I don’t have the trading permission for this asset.

Any ideas what could help?

The trading permissions for US stocks are granted (in the settings).

For these topics not much else to do than calling/mailing their support.

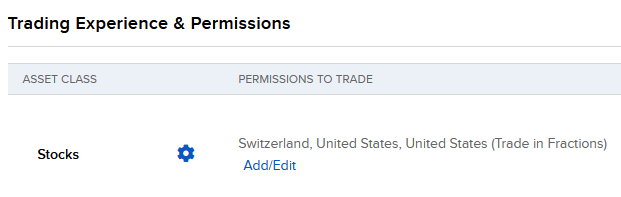

In your Account: you need to set trading permissions and answer the test questions.

Account setting / trading experience and permissions

In my german IBKR Account Setting:

→ Handelserfahrung & -berechtigungen

→ Aktien: (USA) → Handelsberechtigungen beantragen

Greetings

I already had the trading permissions for US and Swiss stocks, when I opened the account. But I am not able to trade neither US nor Swiss stocks.

I haven’t transferred money so far. Could this be the problem? Does the account need to be activated by a money transfer?

Did you double check that your account is with IBUK as it should be when you live in Switzerland, and not IBLUX, IBIE or IBCE?

I remember that when i first wanted to buy VT i had to click trough the “Handelsberechtigung” and answer the questions.

Easiest way would be to transfer a small cash amount, then start and try to buy some VT’s. IBKR will then inform you what is required to do so

I just tried to play around and learn IBKR with some 100 CHF investet at first.

I think the ETF are under category investment funds not category shares (attention: an assumption not knowledge)

No, ETFs are shares.

Well, that’s weird. I just checked 1 minute ago and all is well for me. Best maybe to ask IBś customer message by internal message in account management - they reply within one day in my experience.

I have 4 different permissions for US stocks. Try to activate them all. And it will be active next day I think.

I have already received an answer from the customer service. Funding is necessary to fully activate the account and receive trading permissions.

Hi there. I want to automate my buying of VTI in IBKR. I have already figured out how I can transfer funds on a regular basis to IBKR, but how can I make it to automatically buy e.g. specified amount of shares or the max. shares based on the available fund. Also would the CHF/USD conversion also havento be automated? Thank you

I also have been looking for that functionality in the last 3 years, but still didn’t find a nice solution.

Maybe something can be done with this: Capitalise.ai - Trading With Code-Free Automation & Backtesting ?

This was a solution I found earlier, but you still had to login in once a month to confirm the orders: Passiv | Interactive Brokers LLC