Dear all (especially _MP^^)

I am still hesitation with IB since a lot of stuff is going on and presented to me that I do not (yet) understand. This is no the besst circumstances to start putting my money there! But maybe some of you mustachians knows.

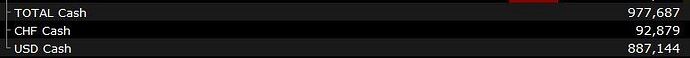

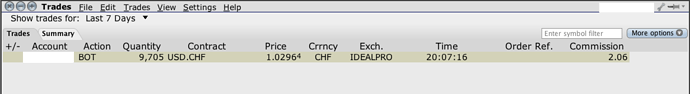

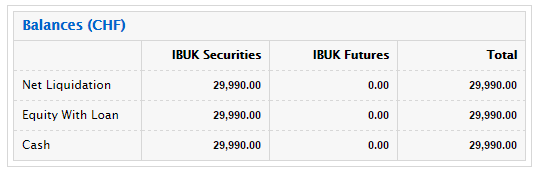

First i open a paper account (practice account with fake money for trying out), and it appears like

Ok as MP pointd out in his blog entry, the UI is not the most appealing one, but anyways, we mustachians look for different stuff than “Klickibunti” ![]()

pretty much everything besides the top-left window “Order Entry” is not so interesting to me. so I go there and start looking fr the Vanguard all world ETF by typing "vanguard all world in the small search fiel at the very top left. then a window pops up:

here i am not sure what i need - i go back and enter the ISIN IE00B3RBWM25 into the same search bar. then the following window pos up:

now i guess this asks me for via which stock exchange i want to by. I wnat USD so the top 3 options are left. I understand the three options mean selectiong london stock exchange (LSE), another one or a “smart” way to chose from them. I have no Idea on the consequences and go for LSE, the third option.

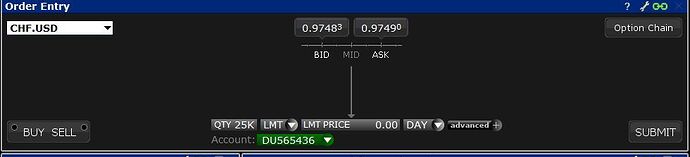

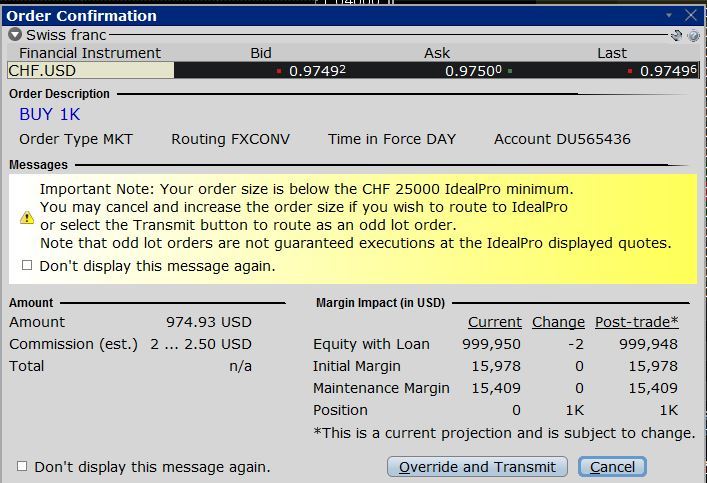

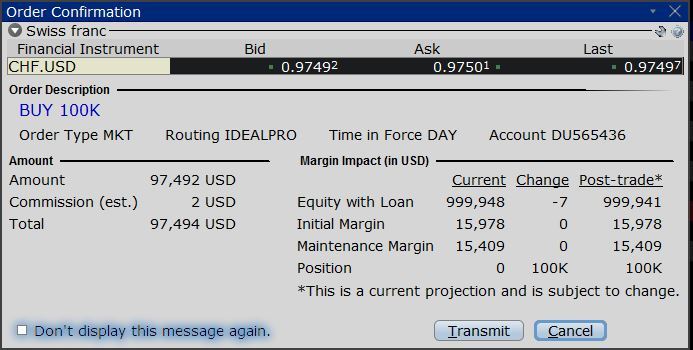

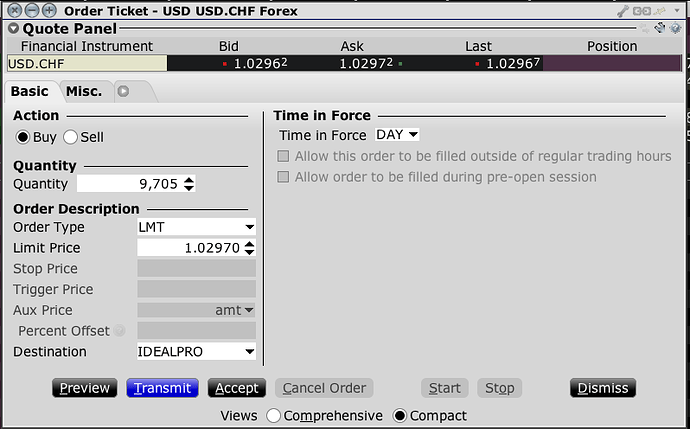

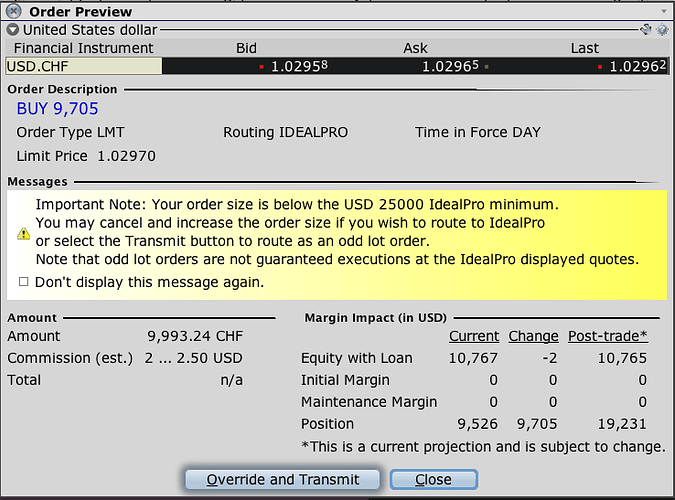

I select BUY (not SELL), leave QTY with 100 (the amount of shares i want) and select MARKET because i want to buy now and not wait…

An Audio message updates me on the duccessful purchase and VWRD and it appears in the portfolio window in the middle right.

so I kind of get it, but i still need to get more comfortable and find out what these other options mean ![]()

.

.