That’s true and important to consider. I still fear that it might be a long and maybe expensive process.

A black swan scenario could also be a fraud like wirecard, the government seizes shares or something else I would never think about.

I guess you are right all of this has a low probability, but the impact could be devastating.

It might be irrational, but I feel better to have more than one basket. ![]()

My bank account got suspended some time ago (for paying my rent!). A strange experience and a burnt child dreads the fire.

Thanks for the correction!

One thing to keep in mind is that there are regulations in place that your assets need to be segregated from the ib own assets, so even in case ib would go bankrupt your assets are segregated and you should be able to get them back.

Well if transferring from IB to SQ/PF is free, you can buy on IB and transfer them there every X years. VT or whatever you buy. Even if it will costs you 50chf, it’s less than the cost of buying them there.

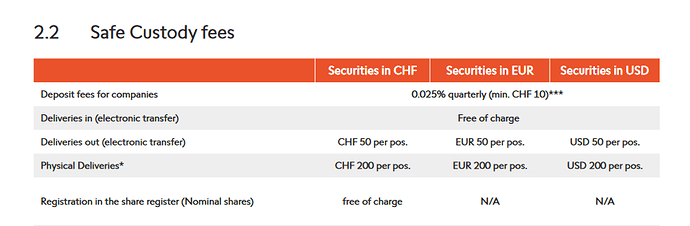

Also for SQ here are the costs :

delivery in : free

Yes that’s what I thought as well but in the interview at 25:30 it’s stated otherwise.

There are a lot of different or even contradicting information out there. I read a interpretation somewhere that you have a claim against IB like other people as well and if they file for bankruptcy you’d have to secure your part of whatever is left like everybody else. I fear that in the worst case a court will rule and that the situation is not crystal clear. Maybe it is, but I’m not a lawyer and I don’t feel competent to judge what will happen in that case. Maybe there’s no problem at all, but I really can’t tell.

Yes that’s what I plan to do. Same for my german broker, as long as there are no transactions it’s very cheap. ![]()

The actions are registered in street name to IB, but the investor is still the beneficiary owner.

https://www.finra.org/investors/insights/its-your-stock-just-not-your-name-explaining-street-names even mentions:

The street name system is designed to withstand even a brokerage firm meltdown. When a firm faces liquidation, regulators, including the SEC and FINRA, work to ensure that customers’ securities are transferred to another firm. Keeping investments in street names can actually make the process easier because all of the documentation will be in one centralized account.

FWIW there isn’t really much alternative, at least if you’re trading (if the broker doesn’t hold the share, then you’d have very long settlements, wouldn’t be able to do margin or limit orders, etc.)

Building on this. I have an account at both IB and UBS (both current account and custody). The idea is to continue to buy VT until I can. When I am no longer comfortable to have too much money on IB (e.g around 30-40% of NW) maybe moving some to UBS.

UBS is very expensive 0.3% custody fee, however As I understand in kanton Zürich custody fees are tax deductible.

- Is the above correct?

- if yes, do you see some flaw in moving funds to UBS vs post finance or brokers?

- does anyone know if I can move US domiciled ETFs to Swiss banks? Or only Irish, LUx and etc

Thanks

Yes. The fee is tax deductible, so that brings it down to perhaps an effective charge of 0.2%, (depending on your tax rate)? But in my days of dealing with UBS they had no ceiling on custody fees, and I think that has not changed. So on, say 100’000 of assets you will pay 300 Fr with UBS, roughly 100 Fr with Swissquote, zero with Cornertrader (assuming you have activity each quarter) and zero with IB (to take just a few examples). Scale it up to, say, 1’000’000 and the corresponding figures are 3’000 , 200, 0, 0.

Not much point paying more in fees to save less in tax. Don’t do it! I ran screaming from them many years ago when I realised how much those nice free coffees and meetings with “advisors” had actually cost me.

And all that is before you even think about trading fees.

PS, I’ve just checked, and it looks like UBS custody charges up to Fr 10m of assets are 0.35%! Even worse.

The fees in SQ are capped to 50.- per trimester (holiding fee, of course not counting the purchase fee).

My numbers is 500k. Once I have more than 500k in a broker I move to the next one.

Thanks for the basics. but I’m more interested in the “move fees”

I’m also interested in finding another place to park ETFs, just in case. I’m not a big fan of the custody fees the swiss brokers charge, though, so I’m also looking for options.

I know it’s probably overkill, but I also got out of the IB Stock Yield Enhancement Program.

I would not. I do agree they have a slick app, low fees, a good features. Just try and get client services to do something. I am trying to resolve a transfer of funds with them for two months. Really awful CS agents just quote process and give no information. If you have everything with them you could find yourself in serious problems with no access to funds.

I’m lost, which broker is this?

Interactive Brokers (now renamed to Inert Brokers)

Joining the discussion here with the same pain as the initial post, but it seems there is no solution most here agrees, so heres my propoal - please roast it!

Today I have the „VT“-replica (total 85%) with VTI, VEA and VWO and 5% in ICOM, 5% in IDWP and 5% in X03H all at IBKR and I dont feel comfortable since its approx. 60% of my NW.

From what i learned here, we ca diversify on these buckets:

Asset class: I have 15% in other asset classes than shares → seems ok for me

Asset geography: I tried always to get a world portfolio picking these ETFs → seems ok to me

ETF Vendor: 85% is at Vanguard → not ok for me anymore

ETF domicile 85% is US → not ok for me anymore.

broker: only 1 → not ok for me anymore.

Therefore I openen an account at Cornertrader and plan to do 1 of these 2 options:

A:

Keep only the VT-replica on IBKR and move the rest to CT + adding a world portfolio with iShares (SWDA + EIMI) in order to balance both accounts 50:50 long term.

B:

Keep only VTI and VWO on IBKR (54% total), replace VEA with an developed world without US ETF from iShares (do they have a similar ETF than VEA?) on CT and move the rest to CT as well (46% total).

I like the idea of B since i wont have to build 2similar setups on both places and would still profit from the low tax advantages with US stocks…

What do you guys think? How did you solve this challenge? What am I missing?

So far: The non-US domiciled Ex-US ETF.

I haven’t searched for one myself - but from observation, most ETFs excluding one particular country are domiciled and marketed in that particular country (to provided international exposure for domestic investors). Relatively common exceptions are ex-Japan and ex-South Africa ETFs but not the U.S.

Where are your 3a money? 3a invested in stock funds at finpension / VIAC gives you a diversification among brokers.

I was thinking about something similar to your plan B and decided to keep it as a plan B %)

For US stocks you need a US domiciled ETF, otherwise you get a tax disadvantage equivalent to an extra cost of 0.2 -0.3% per year. The rest of the world you can as well buy as Irish ETFs - TERs are somewhat higher, but no difference in withholding taxes. Ireland might even have tax agreements better than US with some countries.

Developed countries (MSCI) ex US are:

Japan

Europe

Pacific ex Japan (Australia, Singapore, Hong Kong, New Zealand)

Canada

Canada I decided to ignore, Pacific is small and can be also ignored until your portfolio is getting significant in size. I also ignore small caps, but the rule concerning the domicile is the same.

For an additional broker I went for flatex. It has 0 cost saving plans (executed 1st and 15th each month) on almost all European ETF and does not look as cheap as Degiro. But Degiro most probably will also work fine.

…or - and you just gave me that idea - a tax-advantaged „pension fund“ fund - such as the ones available at VIAC or finpension.

I similarly bought (outside of pillar 3a) three „Quality“ ETFs for the US, Europa and Japan, while ignoring the few remaining developed markets.

Yes, I also realized it afterwards.

(See last paragraph).

Thanks a lot for the reply

Its at VIAC and Finpension but only approx. 35% in proportion (inkl. 2nd pillar) to the account value of IBKR and the trend is negative + if something bad happends and I need access to cash, the 2nd pillar or 3a money are not easy and fast accessible, therefore I still would feel comfortable having 2 brokers. That said, I could mentally add the 3a + 2nd pillar to the diversified part here and keep VTI and VEA on IBKR, move the rest and replace VWO though EIMI on CT…

That would lead to a balance of 46:54 wich feels quite good at first sight…