They’d have to call from your number. They verify this.

You can easily do number spoofing. That’s why tax administration, normal bank and insurance ask you security question and/or personnal details.

Anyone got more details as to how much custody or account fee CornerTrader are going to introduce this year? Would be good to know what amount they will have and whether it’s

- a minimum/prepaid fee like PostFinance or Interactive Brokers

- or a percentage model like Swissquote, Strateo, Tradedirect

- (actually Stateo have also an ‘account maintenance fee’ of 50 CHF/year if not enough trades executed)

I reread my email exchanges with Mr. Patrick Fuchs (Cornertrader Relationship manager in Lugano) and:

- bonds custody fees: 0.25%

- stocks custody fees: none

- inactive account fees: not specified what ‘inactive’ means and how much they will be

And to be fair I found out he did answer my mail (but it was by mistake redirected into ‘Spam’). So I’m back considering CT a possible ‘basket’.

PS: regarding IB alternative: etrade seem to offer the relevant vanguard etfs even commission free (see here) - ok they gotta have shitty money transfer fees (sth like 25$?), but no account/custody fee. what’s the catch? (the estate tax!)

Edit: maybe the catch is that they only accept US residents…

one more thought re IB alternative: degiro. I assume some of you are already using it. I at first considered it a total no-go, so sad, as for the custody model (which is the only one that makes sense for me) they were charging 1 EUR + 3% for dividends. That essentially means round about 0.1% additional cost. That’s outragous!

Now, what if you just stick to accumulating ETFs on degiro (custody model). Wouldnt that actually be a mustachian solution?

Another one re degiro: does anyone know if you pay Swiss Stamp Duty with them? They’re dutch but for swiss you open an account with degiro.ch and have to transfer CHF if I got that right…

Yes that will bypass the dividend fee. I believe you will not be paying stamp tax as the broker is Dutch, not Swiss.

Yes, only US citizen, but you can ask

I cant seem to quote posts, but with regards to Degiro:

My only issue with this is that in the UK, dividends from accumulation ETFs are still taxed, but the broker often doesn’t supply the amount of dividend as it is reinvested. Therefore in a trading account, I only use distribution ETFs

However, with S&P500 ETF or tech shares, there are very little dividends, so the costs here would be minimal, at least probably worth the trading cost saving

Can anyone tell me the IB trading costs for USA shares - there seems to be costs listed under North America but also under UK a charge for USD-denominated stocks? The fees listed here seem to be using the North America costs which are less https://brokerchooser.com/compare-brokerage

Also, is there anyway around the inactivity fee? I dont myself and my spouse would both be over the 100,000 USD limits individually, but maybe as a joint account or collectively under their Family Office Account Structure

I think depending how you are married it doesn’t matter whose account it is as all the fortune belongs to both of you equally

I’ve paid 0.3 USD for practically each of my buy/sell orders on NYSE.

Hello, I’m trying to decide whether to use Post Finance or Interactive Brokers for my partner. She will invest around CHF 20k initially and then likely 1k per month in VT and / or a Swiss ETF.

She has a PF bank account already so would be easy to use that, and from what I can tell for a ‘buy and hold’ strategy PF is ok for costs.

One question i have is what would happen to the PF account if we leave Switzerland? Would she need to transfer the ETFs to another broker?

I assume that on IB there would be no issues when leaving Switzerland.

Cheers

It’s clear that if you want to save costs down to a penny, IB is the cheapest option, long term. Yes, you start with 20k, but I’m sure that’s not the goal, the goal is to grow.

However, if you are ready to give up on something like 100 CHF per year (I don’t have the numbers in my head, and of course it depends on the total), it would buy you a lot of simplicity to have a bank account & broker directly by PostFinance.

If you do opt for it, however, I would recommend that you buy products in CHF. If you buy VT (which is in USD), PF will apply an exchange rate that is far from ideal. If you want the minimalist solution with the fewest steps possible, go for PF and buy VWRL.CH. You will not be able to reclaim the dividend withholding tax, but it gives you an easy start and is probably a bit more reassuring.

Down the road, once you’ve got the grasp of it and once your portfolio has grown, you can run the numbers and consider switching to IB.

You can transfer a position to another broker.

I’m reviving this thread because of the current GME short squeeze.

Am I the only one who is worried how safe brokers really are, given the fact that they might have to cover losses of short sellers and my shares are not in my name with them. As far as I know I there’s no way to get shares registered in your name with Interactive Brokers.

I have about 50% of my net worth at IB and I think I will move some money to another broker used by less option traders. I’m considering moving the positions to PostFinance, but continue buying new shares with IB.

I saw this interview some time ago and it makes me even more worried now than it did a few weeks ago.

The IB guy says no problem, we have enough money to cover everything, but I bet a Lehman Brothers guy would have said the same one day before everything blew up.

Interview mit Interactive Brokers - Brexit, Einlagensicherung nur 20k & Co.

What’s the scenario you’re foreseeing where they cover the losses of short sellers? (short sellers need collateral, I think it’s currently 300% for GME).

Some people here want to move their ETFs once there are more than a certain amount (Cortana said 200k. I’m not sure what I’d do).

No one ever showed numbers though. I think I’d move them to SQ, since they have a cap on costs if I remember correctly.

This should be the page to read:

https://www.interactivebrokers.com/en/index.php?f=14718

After 10 unknown acronyms I gave up understanding it.

afaik it’s usually ACATS (so free on IB side)

I have even more % at IB and I also consider to open brokerage account at PostFinance. Additionally, I created a thread to discuss IE vs US as ETF domicile. I know you choose IE and you were one of the persons who put doubts in my head about holding US. I was almost convinced I would open PF and start buying VWRL, but today I reminded myself of the total cost.

PostFinance transaction fee 0.35% (1)

Stamp duty 0.15%

Witholding tax on VWRL 0.20% (2)

-------------------------------------

Total per transaction 0.50%

Total per year 0.20%

(1) 70 CHF per trade up to 20’000 CHF

(2) not sure about that one

At IB the fees are negligible. So, 0.8% extra cost annually. That’s massive… I don’t know if it’s reasonable to switch.

EDIT: OK I maybe mixed two things up. First three costs are transactional only, not annual. So it’s a one-off cost (ok maybe two-off cause one day you will sell). Only the withholding tax loss is annual. Chart updated.

Some kind of black swan scenario. Maybe a short squeeze with such a high surge that the collateral doesn’t cover the losses. SNB policy change, negative oil price or something else that gets out of control.

Yeah I think it would only be the costs to transfer the positions. I also have a broker in Germany. I don’t buy there and only hold VWRL there so the costs are like 1€ per month. Well worth the peace of mind for me.

I would do the same with PostFinance.

I have about 30% of NW at IB.

I have faith that it’s safe, for now. IB has $290B of client equity. There should be something left after paying out u/DeepFuckingValue and the others, so at least expecting to get something back after GMEagedon.

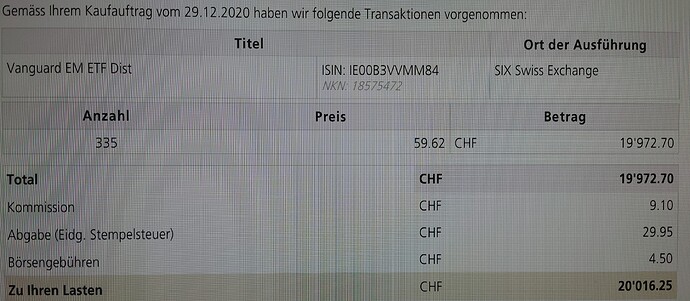

@Bojack , SIX stock exchange fee is 0.0225%

Screenshot is a real-world example, although I had some trading credits so “Kommission” is wrong.