NB: the author is a contributor, he’s not working at Forbes. Now, I’d be curious to know the opinion of other, hopefully succesful, investors about today’s TIPS.

It’s U.S. bonds tied to U.S. inflation. If we don’t spend in the U.S., that inflation concerns us only in that it affects the prices of goods and labor used by U.S. businesses in which we invest and that it may warrant rates changes by the FED, by which TIPS are also affected.

Running a Backtest portfolio calculation from Jan 1st 2001, they seem to mostly behave like Intermediate U.S. Treasuries, with slightly better returns but with more volativity (max drawdown of -12.5% on fixed income!):

They’re stil affected by interest rate changes by the FED and, more importantly, currency exchange rates. The USD could loose strength with regards to the CHF as inflation hits (or not, if I knew how to predict currencies trends, I’d make a killing on forex trading).

All in all, they’re US linked fixed income with protection from US inflation. Fixed income, for me, is for stability and currency exchange rates are not what I’d qualify as stable. I’d still use stocks for returns (even in high inflation contexts, with hyperinflation being a different beast) and fixed income for stability in regards to my own expenses, that is, for me, in Switzerland. Local inflation is what I want to be protected against.

So if I were going for bonds, I’d use very safe Swiss government-like ones (maybe adding Cantons, some cantonal banks and maybe some municipalities, though very few). If I were to not have a use for bonds in the current interest rates environment, I’d stay clear of TIPS too.

Is buying VT in USD on IBKR considered as spending in the US? Because if I was to have some TIPS such as VTIP in my portfolio I would probably use it only to rebalance, so in fact there would be no currency conversions here at all. Then if I want to get rid of all my TIPS one day (e.g. when inflation is not raising anymore), I guess I would simply sell them all and buy more into another ETF of my portfolio in USD.

No, you’re buying equity, that’s not goods and services like someone living in the US.

I was referring to the original article, the author of which I believe is a career journalist

I see, then I simple ignore TIPS as I don’t see any useful usage of them in my portfolio… I may investigate further on the topic of commodities.

Meanwhile, in Switzerland, we’re at 0.6% YoY (total CPI).

Edit: although, to be fair, we’re up 1.1% since the start of the year so we are trending slightly above 2% for the year for the time being.

The impact of all this in Switzerland could be that if interest rates in US & EU go up, that makes investing CHF relatively less attractive and SNB may have more freedom to raise interest rates without driving up the CHF exchange rate and negatively impacting exports.

If I recall the discussion of a few years ago SNB would’ve like to increase rates to cool down the housing market but they could not due to the exchange rate and exports. This seemed to be one of the main reasons they instead introduced more restrictions on use of own funds to buy property.

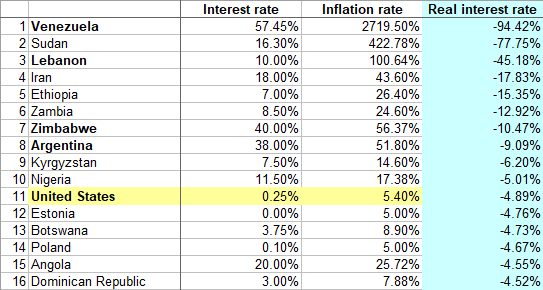

Meanwhile, central banks around the globe quietly raise interest rates, except for some desperate cases…

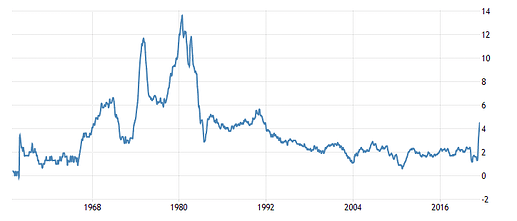

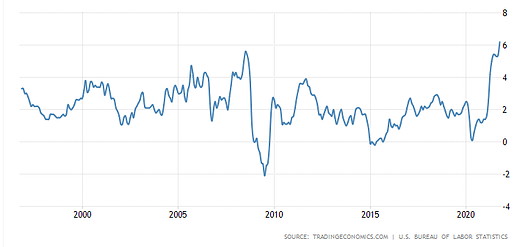

Fed Chairman Jerome Powell won’t fight too hard against this claimed temporary inflation situation. In the 1970s, the strong rise in prices however led to significant increases in interest rates (“Volcker shock”). If inflation not so temporary, it will be forced to raise the rates. In any case Jerome Powell said that there could be a key interest rate hike in 2023, whereas until May, the Fed had still ruled out any rate hike until 2024.

More on this on Bond market, Chinese mega-techs and growth stocks (Q3 2021) – Guide Finances

The situation is very different from the 1970s if you look at key figures (interest rates, inflation rate, and government debt).

Now the only practical option for the Fed (and the ECB) is hoping that inflation cools down.

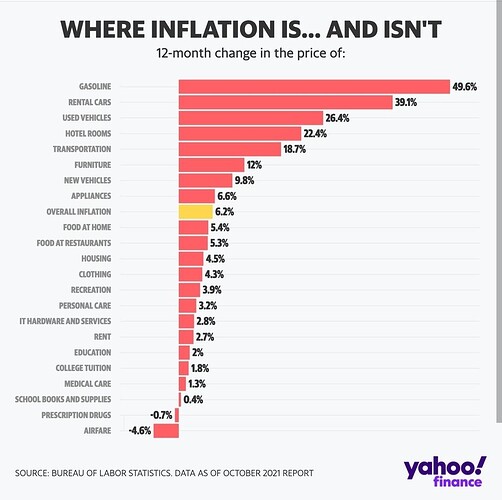

6.2% is transitory. It will be 7% soon

Can someone explained in simple terms what exactly could be the impact for us as investors? What would it mean in terms of global market, stocks, investement strategy? If there is any impact at all…

I think I understand correctly what inflation mean and how it work, but I have trouble understanding how we should react to it, investment wise…

Inflation = higher prices = higher revenues from companies = higher stock valuations.

Nothing to do here, just enjoy the ride.

Hopefully higher salary at some point as well for us. Your payrise should at least compensate inflation.

higher prices would mean higher costs as well for thoses company maybe?

Anyway thanks for the overview, sounds encouraging

as long as it’s not here or if you get also a pay rise…