I think there is a prevailing agreement in this community that indexing approach to investing is the best when it comes to efficiency vs. simplicity, despite not everyone agrees that it is the most profitable approach. I was trying to apply this approach to investment in crypto assets and would like to share my results with the community. Looking forward to your critique.

I was searching for various existing crypto indices. First, there are some crypto indices from traditional financial institutions, for example:

https://www.wisdomtree.com/index/rtree

Their composition is not completely clear from the first sight, and I didn’t dig further (there are some funds replicating these indices and one can look deeper into the composition of these funds), but they all seems to be market cap weighted. And if you think that 30% of basket capitalization in top 10 constituents is too much concentration, 40% in one constituent won’t amuse you.

There are further reasons why I disregard these indices. First, I think BTC dominance is too high and it is not justified by anything but the fact that it was the first crypto. So I expect that in the future BTC will be less volatile than other crypto, so in an optimistic scenario it will underperform. In a pessimist scenario it all goes to zero anyway. If I to invest in one single crypto, it would be ETH. And in fact I already have a strong ETH position of over 50% of my crypto portfolio - relative to its moderate size of few k, anyway.

Second, I find fees for investing in crypto in this way too high and not justified; and crypto assets were supposed to be an alternative to traditional financial infrastructure, after all. If I would have hundreds of thousands invested in crypto I might have thought otherwise, but now I don’t need it.

To summarize, there are crypto baskets available for investing via traditional financial infrastructure, and new ones appear every day.

Let’s look further.

https://invictuscapital.com/en/crypto20

Crypto20 index.

No stable and other pegged coins, “Management also seeks to generate additional yields through futures contract”. The maximum weight of a component is capped at 10% at weekly rebalancing, which is already good. Performance of the basket is tokenized and replicated by a single token C20, which can be bought pretty much like fund units.

However: I feel 20 components is somewhat too little, but after top 20 cryptos all other coins are below 0.5% in crypto market dominance, so why not. But then there are also some arbitrary (from my point of view) exclusions such as “XRP (pending SEC lawsuit that risks a liquidity crisis on reputable exchanges”. I understand they do it to protect and/or to please US investors.

To invest, one can open an account directly with the managing company. A counterparty risk, but only one counterparty. Transfer in of fiat and crypto assets is possible, and then there are fees coming.

One can also buy C20 token directly, but it is a ERC20 token listed on decentralized exchanges such as Uniswap, and (fixed) transaction costs for such an exchange are many orders of magnitude outside of my range.

So I had left it for now. After all, if I want a capped market capitalization weighted index, I can construct one myself.

The Crypto Currencies Index CCi30 is more a research project in applied finances, so to say. It has many interesting ideas which I like. There are 30 components and no exclusions based on some external factors.

"The number of constituents was set at 30 because it is the minimum number necessary to be statistically significant. The index statistically represents the entire cryptocurrency market with a confidence level of 99% and a confidence interval of 1.11. In other words, the margin of error of the index value as an indicator of the market is just 1.11%. "

“To calculate the weights for each cryptocurrency, the adjusted market capitalization must first be calculated. Market capitalization is not computed as some instantaneous number – the volatility in the cryptocurrency market is such that this would destabilize the index composition too much. Instead, the CCi30 uses an exponentially weighted moving average of the market capitalization. The weighted average Market Capitalization helps smooth the volatility to give the most accurate portrait of market capitalization at any given point.”

So weighting is more backward looking instead of “being current”, but it doesn’t have to be extremely precise anyway.

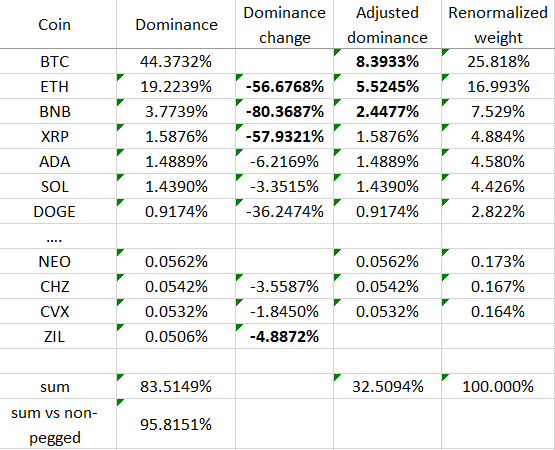

“The weight of each constituting cryptocurrency is measured by the square root of its adjusted market capitalization. The square root function was chosen as a hybrid that most accurately weights the constituents based on the current conditions of the cryptocurrency market. A simple market capitalization weighted index would be dominated by the top two cryptocurrencies, while a more slowly decaying weighting, or in the extreme case, equal weighing, would give too much weight to the tiny, illiquid cryptocurrencies at the bottom of the range.”

Weights of components (recalculated monthly) are available for free via a “Download monthly constituent weight percentages (.csv)” link. For January it has 18.8% BTC and 13.3% ETH.

They claim that there are products tracking this index, but I didn’t look for them. With 30 components one can replicated it relatively easy.

https://cix100.com/

“CIX100 is a cryptocurrency index of the 100 best performing currencies. Diversify crypto assets with AI-powered neural network algorithm.”

When I read “AI” in relationship to (equity) investing, in my mind it translates into “high fees, random outcome”. Currently this index has 38% ETH and 30% BTC (yes, you read it right), sequence of other constituents by weighting is also only broadly correlated with a sequence according to market capitalization. So I wouldn’t replicate this index.

But it has an important advantage. A portfolio replicating this index is represented by one token CIX100. It is a ERC20 token, but it is listed on Kucoin. And it happened so that Kucoin become my main crypto exchange. So it is very easy for me to buy this token, spread is highish, but nothing prohibitive. I can also live with the fact that the composition of the portfolio doesn’t exactly correspond to my expectations: all crypto coins are highly correlated anyway.

For some time I was tempted to dump all my crypto portfolio into CIX100. Extremely tempted. But this would mean 100% exposure to a risk of two counterparties (exchange and token management). Furthermore, if you replicate a crypto index, you can do much more with “blue chip” coins than with an unknown token. You can split them between different exchanges and wallets, reducing counterparty risk. You can use them as a collateral for margin lending or generate extra money by stacking, lending, etc.

So I did following. I rebalanced my existing portfolio according to CCi30 weighting (leaving ETH as it is). Coins that can be transferred cheaply went into a crypto wallet. SOL, TRX, I stacked on chain. BTC, BNB and ERC tokens stayed at Kucoin and are used as a collateral or for yield generation.

Then I started a DCA bot that buys 1 USD worth of CIX100 every 4 hours. That will result in 180 USD per month, which corresponds well to how much I want to invest in crypto. Cash for investment is coming from regular transfers and margin loans, and I can also invest additionally in case of a major downturn.

I imagine my work flow as following. Probably at the beginning of a month, when new weights for CCi30 are available, I stop the DCA bot, sell all accumulated CIX100 tokens and rebalance the portfolio according to CCi30 weights. Then I start DCA again. In between I play around with extra yield opportunities, but neither sell nor buy any coins.

Well, that’s it for now. Looking forward to your comments!