The market is still dominated by active investors. And the more indexers there are, the less capital the active ones need to nudge the price. Since the market would be then less liquid, you would need to go up/down with the price a lot to fill a large order. I think the market is indeed very inefficient, but still more efficient than an average Joe investor can help. Maybe if he specializes in a niche, does he have a chance to make a smarter bet than market-cap based allocation.

The growth of index funds and ETFs is making the market more efficient.

Buying market cap weighted index funds just allows you to get the mean active manager fund’s return without paying the fees.

Unless you have a top quartile active manager you won’t make more (on average and risk weighted) in a market as liquid as developed world equities. Note that this isn’t true once you get into markets with lower velocity of information / liquidity such as PE, VC, EMs, etc.

I read a couple of books by David Swensen (Portfolio Manager of Yale’s ~$30bn endowment) a few years back and he had some good data on distribution of active management returns by sector.

Sure there are inefficiencies, discrepancies, and garbage in the short term (like Heartbleed for open source) but this will average out in the long run and shouldn’t be propagated by market cap weighted passive funds. Maybe the exception would be other derivations of passive funds, e.g. S&P500 derived giving incentives to pump TSLA super high before it joined.

You can try avoid some of the junk in your portfolio if you have conviction you can stick to - from my experience the mental side of this is the hardest.

Elaborate, I don’t think it’s true.

Price building is more and more left to professionals only.

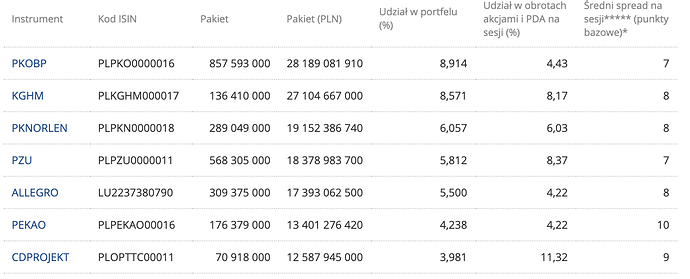

The MSCI Poland index only covers large and mid cap companies.

The MSCI Poland IMI index includes Small cap as well and has 35 companies in it.

There isn’t a MSCI Poland microcap index, but the Europe microcap index probably includes at least some of the remaining companies.

There are some liquidity and size requirements for inclusion in an IMI index.

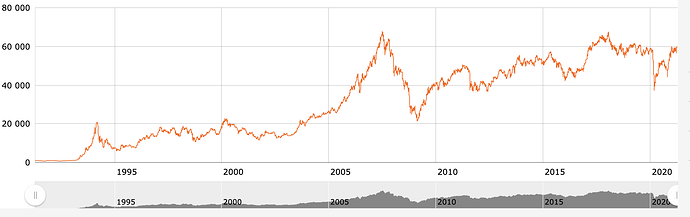

If you want a broad index covering the Polish stock exchange, why not take the oldest one, provided by the GPW exchange itself, the WIG? Don’t know if it has any ETFs, but your LIVECHAT is included, as well as over 300 other stocks:

It’s a total return type of index, so you can easily track your potential return, have you had invested. Starting at 1’000 in 1991, it reached 66’000 in 2007, offering some 30% CAGR! (there was high inflation in the 90s, though) Then it crashed, and 14 years later it still hasn’t recovered all losses. Polish stock exchange has generally bad reputation, people are afraid to invest into it and they rather pack all the money in real estate.

For the one interested in investing into Quality funds with their 3rd pillars at Viac, you could suggest it to the Support and bump the vote to enlist them.

More info from the founder in this thread:

Or they can come to finpension and it’s already there ![]()

Yeah I could move 2 of my 5 3rd pillars to FinPension to try out and diversify.

I also suggest to Viac to get rid of the 40% chf limitation…

thank you very much for your contribution. is there an etf that has the benchmark at all? two etfs were mentioned in the comments, but only for europe (LU1681041890) and the usa (IE00BX7RRJ27) is there no world quality at all?

Fund managers hate this trick.

Not anymore (that I know of). The index must have been too good - that’s why they changed their funds and you can only get MSCI World Sector Neutral Quality funds today.

But Europe & US is arguably all you need - you’re basically only missing out on a couple Japanese stocks.

thanks for your feedback. the chapters on value investing by mr. marc pittet were already inspiring. i will look into it a little more. but i see the big effort in the information about the respective stocks. therefore such factor etf’s would be very interesting.

Currently, there is only the “MSCI World Sector Neutral Quality Index” available as an ETF, which is similar but the “Sector Neutral” factor is not included in the MSCI World Quality Index.

In Pillar 3a there is a “Equity World ex CH Quality” in hedged and unhedged variants. Both are available through finpension and are optimised for pension funds (withholding taxes etc.).

so what would be the best way to replicate the MSCI World Quality index in the portfolio?

You can try to work with these 3 ETFs:

- IE00BL25JL35 Xtrackers MSCI World Quality Factor UCITS ETF 1C (sector-neutral „factor“ ETF)

- IE00BX7RRJ27 UBS ETF (IE) Factor MSCI USA Quality UCITS ETF (USD) (distributing only)

- LU1681041890 Amundi MSCI Europe Quality Factor UCITS ETF

The Xtrackers MSCI World Quality Factor UCITS ETF 1C being your main asset, and the UBS ETF (IE) Factor MSCI USA Quality UCITS ETF (USD) and Amundi MSCI Europe Quality Factor UCITS ETF being a bit oversized in order to “replicate” the MSCI World Quality Index.

Should be a bit complexe. Otherwise, just play with UBS ETF (IE) Factor MSCI USA Quality UCITS ETF (USD) and Amundi MSCI Europe Quality Factor UCITS ETF and don’t care about Japan (I guess).

An other option: just take the Equity World ex CH Quality in Finpension and don’t care about this index for your main investment.

Or maybe wait the new investment solution from Finpension/VIAC, maybe it will be possible to invest in mutual fund with them?

My finpension account is set up to include World ex CH Quality.

What about this one IE00BP3QZ601 - iShares Edge MSCI World Quality Factor UCITS ETF (Acc)?

I don’t really understand the difference when it says sector neutral ![]()

Outside of pillar 3a:

a) Mix

- IE00BX7RRJ27 UBS ETF (IE) Factor MSCI USA Quality UCITS ETF (USD) and

- LU1681041890 Amundi MSCI Europe Quality Factor UCITS ETF

while neglecting the rest of the world - because given the country weights and correlations to other developed countries included in the indices, they arguably are negligible.

b) Buy one of the MSCI World Sector Neutral Quality ETFs

c) Opt for the Wisdomtree Developed Quality Dividend Growth ETFs instead (what I’ve been doing).

Sector neutral = economic sector weights are kept the same as in a vanilla MSCI World index. Only within those sectors are stocks chosen/preferred according to higher “quality” characteristics.

In other (simple) words: Assume all stocks within a given economic sector are really “low quality”.

![]() None of them would then be represented in a MSCI World Quality index - the whole sector would just happen to be left out.

None of them would then be represented in a MSCI World Quality index - the whole sector would just happen to be left out.

![]() In a sector-neutral index however, some, the “highest quality” among those stocks from that particular sector would still be included - since sector weights are the same as in the “vanilla” MSCI World index.

In a sector-neutral index however, some, the “highest quality” among those stocks from that particular sector would still be included - since sector weights are the same as in the “vanilla” MSCI World index.

Does that make sense?

Note that these two funds or indices - despite the “quality” moniker - are quite different in their index indexing method and weighting:

MSCI World has a much higher much more share of Big Tech/IT and Financials, whereas the WisdomTree funds/indices are leaning more towards Healthcare and Consumer Goods sectors.

You might as well mix the two.

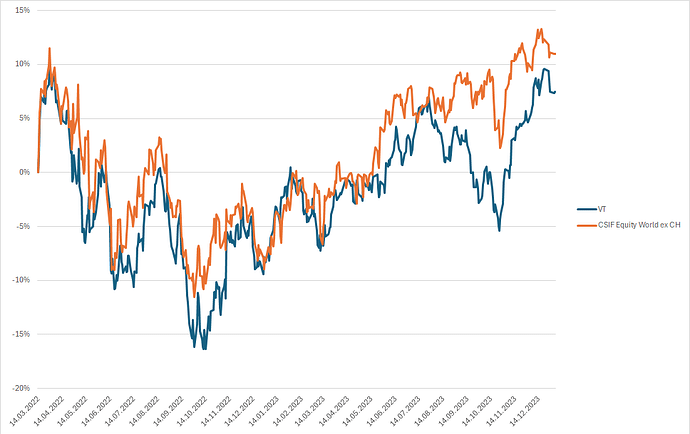

I have tried to compare the CSIF (CH) III Equity World ex CH Quality -

Pension Fund DB with the MSCI World Quality Index. I have no idea where to get the data for the MSCI. Therefore I took the VT as a reference, which I have in my portfolio and want to top with a Quality ETF. I downloaded the data from Yahoo and the data refers to the market value in March 2022 (there is no older data for the CSIF). So the value development on the first price entry is calculated and displayed in %. Conclusion without methodical means: the CSIF performs better. But close to the VT.

Can you analyze it like that?

edit: background to the comparison: i was thinking about including the CSIF in my 3a portfolio and wanted to look at the charts and compare them. I did not find the CSIF on portfoliovisualizer.com. I am aware that the time period is too short for a comparison.