In my case IBKR did it automatically due to the recurring investment, because the USD balance was too low.

In which country is your account open?

As far as I know, this feature is only available to one EU country (can’t remember which one… Bulgaria maybe?).

Switzerland so IBKR UK i guess…

Oh OK, thanks! That’s good to know, I’ll give it a try, then. ![]()

I guess you haven’t enabled margin on your account?

Interactive Brokers has now enabled purchase of fractional share/ETF from Swiss exchange

We could merge this conversation with the other one

I’d love the option to have our fractional shares converted to real shares once in a while and keep only the fractional of what you cannot convert.

I thought it would be like that, to only have 0.X % of fractional shares… Would the term not be wrong otherwise? That would be virtual shares, backed by IBKR…

So there is no commissions when you use recurring investments? or a better exchange FX comissions using this? It is not clear… In IBKR they say clearly that standard commissions apply or am I wrong?

In my case it was 0.9 chf, the order was small though (170 USD)

I’ve seen also some FX-commissions for later auto-exchanges, but they have been less than than the 2 USD/2 CHF. Still not sure how it is calculated, but I’m not complaining.

Alright, but this is very important… I don’t understand then why they don’t promote in the recurring investments page.

Can the recurring investments be cancelled anytime? If I set 12 investments, 1 per month and I want to stop after 3 months, is that possible?

You can stop immediately. Just try make one, you can then immediately cancel it again, no problem.

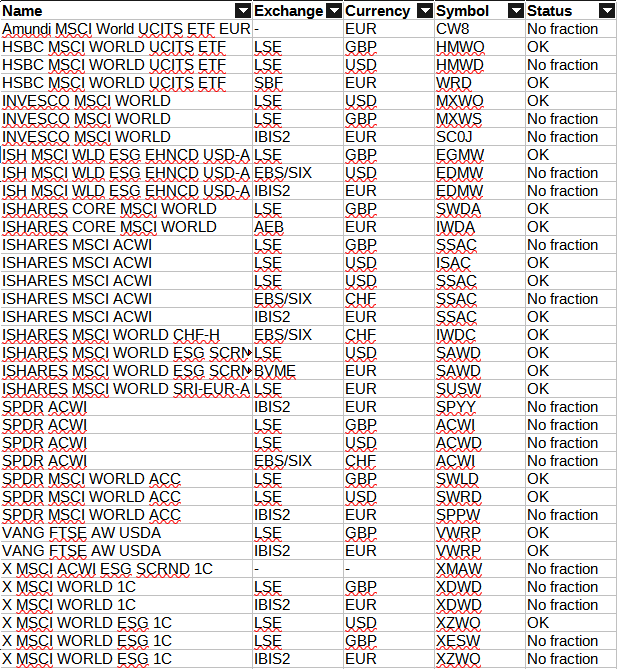

I’ve looked through the various accumulating World ETFs, and unfortunately couldn’t find anything tradeable as fractions on SIX in CHF. ![]()

IWDC is available, but it is hedged in CHF.

Here’s the list I’ve compiled if that can help anyone:

Do you have any specific reason to want to buy them from SIX? The currency conversion is automatic and free, so as long as the recurring investment is available for your ETF on one exchange, you should be fine.

I guess IB enables recurring investments for one exchange per ETF only, which makes sense, and they choose exchanges with the highest traded volume, which also makes sense. That excludes SIX unfortunately ![]() .

.

Are we sure it’s free (and will remain free)?

Also, one advantage of buying in CHF is that I can simply specify I want to buy 300 CHF worth of ETF.

If the ETF is listed in USD, I need to specify the price in USD, which means I will either buy less than my 300 CHF, or the purchase will fail if the exchange rate drops too much.

Not exactly. They do support multiple exchanges per ETF, but they have a minimum volume requirement, which apparently isn’t met by any unhedged CHF ETF. ![]()

By now we can’t schedule a recurring investment on a ETF listed in USD, while we have our cash in CHF, and we still need to exchange our CHF to USD manually. Right?

We must define the amount in USD. The conversion from CHF to USD will be done automatically.

The currency exchange cost in IB is 2 USD. Let’s say we schedule recurring investment of 500 USD on 3 different ETF listed in USD. Is the 3 currency exchange done at once? so the exchange is done by 1500 USD, or 3 times 500 USD with a monthly currency exchange cost of 6 USD?

The currency exchange bundled with recurring investments is free. And, if I understand/remember correctly, they pool all recurring investments into one order and there are no exchange fees, only IB fees.

I just tested it and can confirm. ![]()

1- You only pay the IB commission.

2- No currency conversion fee.

3- No exchange fee.

4- They will even convert multiple currencies if needed.