I would have to look up resources. Tried some forex trading myself (with help from a professionel Forex trader), but it wasn’t very successful. Plus, even though I spent hours and days reading about the topic, I still managed to lose money.

You say that you are ready to lose some money as a learner fee. Please note that you can not only lose the money you invested, but much much more in case of leverage.

Still, I will try to check if I can find some good resources. It’s just not my main topic, and what I said before was mainly from my own experiences trying to learn it. To give you a better idea: I wanted to book a Forex course from someone who’s been doing it for 10+ years, but this guy stopped his program and instead concentrates on Crypto. More money to be made in crypto.

Playing devils advocate now: why do you think you know more than those professional Forex traders out there? Don’t you think that some people would already have taken a position if your assumption was so obvious? Don’t take it personally - it’s just for you to understand that you are playing with the big fish when it comes to Forex markets.

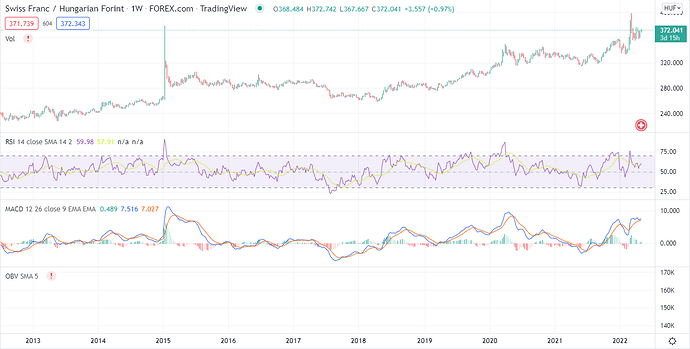

If you want to short CHF-HUF long-term, you will need to educate yourself about overnight rates first. For starters: here, here and here. Hint: it’s a little bit complicated.

Once you figured out the overnight rate topic, you need to check for lot sizes. Usually, for long-term trading, you go with really tiny lot sizes (unless you have a lot of capital). After deciding on the lot size, you need to set your SL (stop loss) and TP (take profit) targets. E.g. For long-term, you might want to use 200 pips for your SL. It can still backfire and your SL is triggered. That’s where risk management comes in. You don’t want to risk more than 2% for each trade. Which means that even if you are right about the long-term trend, you won’t make fortunes.

Forex is usually played in short-term durations, not so much long-term. Yes, you can make money with long-term stuff, but it’s more complicated.

It is pretty bad, because the broker might just do stop-loss hunting. You might get stopped out, even though your general idea was right. For the bucket shops, you are not only playing against the market, you are actually playing against the house. The broker sees your stop-loss in their system, and can use that information against you.

You really need to carefully select the right ECN broker to avoid that problem.

![]()