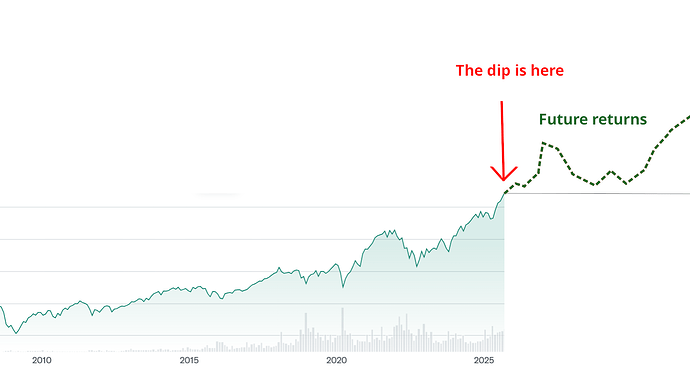

Whenever I got a large sum of cash (i.e., yearly bonus or RSU vesting event) I’d keep the cash and slowly invest it, trying to “buy the dip”, until the next big chunk would come. This has worked well sometimes (think 2020) but likely does not make much of a difference long term or actually probably made me lose some good days of growth (too lazy/incompetent to measure). Moreover, nowadays, even if the absolute amounts are quite a bit greater than when I started due to career progression, in terms of NW % we are talking about low single digits, so it really does not matter in the great scheme of things and I should just directly reinvest the cash into my AA (currently made of 4 ETFs). So I want to give up this “addiction”. Any tips for me?

Can you use the Bonus / vested RSU to pay down a big chunk or all of income tax and pillar 3a? that may help smooth your investing cash over the year.

The other way would be using trend following funds. Then you would outsource the dip-buying/shorting.

Advantage: still making about 7-8% profit p.a., and non correlated to normal ETFs, so a good tool to flatten the portfolio volatility and rebalancing tool, much better than bonds.

Problem : mostly they are lagging behind. But when the big crash/dip comes, they make huge profits at once. I am still on it. So psychologically, not as easy than an ETF. Not as easy to choose the right fund.

Certainly your NW is a lot bigger than mine, but it’s an interesting exercise (or mental accounting!) so here’re a few thoughts, or rappen:

- you quickly accumulate diminishing returns the larger your NW is, in combination with

- you also quickly accumulate opportunity cost in terms of dividends the larger your dry powder pile becomes, and the length of holding it

- it’s still feelgood to buy at a discount!

- it’s a good opportunity to lever up, if leverage is not your baseline, as @Tony1337 had pointed out here

But you know all this already!

Any suggestions for consideration?

You could buy dips on margin in advance, then when the money comes in you pay off the margin.

Or just keep doing what you’ve been doing. Trickling in the funds isn’t so bad.

I checked it out, but kind of gave up.It is really not as simple as the bread and butter ETFs.

A project once I am at 1 MCHF - in about 2 years after my sabbatical (plan to reduce my workload substantially afterwards).

I came into contact into this through this blog (German speaking, but deepl helps):

Alpha-Strategie und Alpha-Fonds | Finanzwesir

Den richtigen Alpha-Fonds finden | Finanzwesir

Disclaimer: the guy has now an investment firm which offer a mix of ETF and trend following funds, but with own skin in the game. (before he was just a guy saying buy ETFs and mix with saving account/Bonds and live happy).

Yeah, just live !

All of us here are doing much better than the average. Allow yourself some leeway and get out living your life. That is why we save and invest.

Yeah, there are the many trend following managed futures but I don’t understand them and backtests could be overfitting, there’s also the deep flash crash insurance like CAOS but it’s pretty hard to find a one stop shop.

Depending on your asset allocation and amounts, what works for me at the moment is: I estimate the total of what I’ll probably have to invest over the coming year, regardless of when I receive it, then divide by 12 to DCA monthly.

(I receive a 13th salary at the end of the year so basically I already invest it in the month that I become eligible to receive it in December.)

It hurts me that there are still such a lot of questions which can be answered with a single concept: mechanical investment.

Whatever the answer for one instance will be it may be completely wrong for the next time. Step back and define an objective strategy, then follow it.

Which is, correct me if I am wrong, not so different from the trend-following funds ?

I totally respect what you are doing, just right now I have not the ability to define such a strategy for myself, but would rather just pay someone to do it for me (in the hope he will do it better than I with my current limited ressources).

Absolutely not. But I’m not gonna repeat myself over and over, got a bit tired. Who wants to learn has enough material in this forum from me about that topic.

I’m not selling anything, just this: the first thing you should automate are money and position management. That includes how much to buy and when and how much to sell.

I’m in a similar boat like you. I always made big decisions regarding my asset allocation, followed by periods of inaction, where savings keep piling up on my bank account. I do not have a monthly investment schedule, I do not “set money aside for taxes”. I only feel obliged to do something with my money once my cash exceeds 100k. I am also a sucker for round numbers, like a round number of shares.

I guess the fix would be to work out a step-by-step plan and then make a habit out of it. Like ok, on the 1st i send money to the broker, on the 5th i just buy as many units of ETF X as I can with that money. Sth like that…

Like I said, what prevents me from acting this way is this inertia, you can’t just do it all in once go. You need to first send the money, then it needs to settle, then you can place the order. And you also need to keep some reserve for taxes and other unplanned expenses.

The topic title feels misleading to me: you seem to lack an investment objective and approach(es) you are comfortable with in order to get there. Your dip buying addiction is just a symptom of that.

Maybe shovel the cash into pillar 2 and 3a until you’ve figured your investment objective and corresponding investment approach(es) you feel comfortable with.

If you want to figure out your investment objective and approach … well, invest either some time (study, try, refine) or money (see an independent advisor) into it.

I personally prefer the first approach as it helps you build your own conviction.

A good in between is doing at the end of each quarter. After dividend dates + 3 months of saving to put to work. I personally find it more convenient than monthly investing

I don’t know how you handle your ‘regular’ investments. So I’ll just assume that you invest a fixed amount every month. I’ll also assume that you have a monthly standing order from your bank account to your broker and then invest your entire cash balance with your broker.

Let’s say, up to this point it’s all a boring routine.

So the question now is, how do we integrate your problem into your boring routine?

A few ideas:

- You can’t time the market if you don’t look at the market. Maybe you could check the prices less often or automate your investments so that all you have to do is transfer the money?

- Perhaps you do market timing because you are convinced that it will bring you more profit? Calculate whether you have been successful so far. If so, keep doing it. If not, it may be easier to refrain from doing so, because you now know that you are not successful.

- Set a max limit for your bank at the end of the month. If you exceed this limit (spent less than planned), transfer the excess money and invest it immediately. Every month. Perhaps this will help you do the same with larger sums, because it is now also a boring routine.

Every investor is sensitive to this psychological bias.

I have setup some rules to help control and minimise it.

- You must hide your average purchasing price on your reporting tool to avoid buying on a discount

- Fix a maximum amount/weight by stock investment. e.g. Your target will be 30k by line.

- Invest with number of purchase in a stock. e.g. You enter in a stock in 3 times with a 10k purchase. To avoid buying at the top without capacity to buy later without inflating the position.

- Display the total amount alreay invested (including the losses) for a stock.

e.g. formula = abs(pnl)+actual value) - Finally, you should alternate buying the deep + buying a growth stock. If you invest in a discounted stock, your next purchase must be a stock with a equivalent profit.

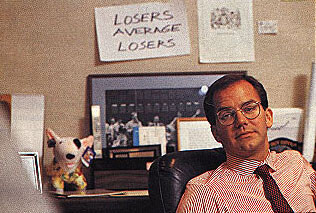

e.g. buying a stock at a loss of -30%, next purchase must be a stock with a profit of > 30%. - You can also print this famous quote

You can just have a standing order from your bank account to IBKR on any chosen day and then have auto investing set up on IBKR - you can do it on a monthly / quarterly basis and you won’t need no manual work

Set up your AA in a robo, sell everything, drop the cash into it, then a standing order, and rebalancing should sell what’s high and buy what’s low, without any other bias.

If you can’t diy, which is very ok, delegate, and robo advisors are a cheap wealth management delegation tool that fits simple AA made of ETFs and people struggling with their own bias, who can’t comply with their own rules. Which is very normal too. Even if this SHOULD be super simple and is. On paper.

You’ve done a big step recognizing you cannot control everything about your investment behavior. Think of some management fee as an investment to handle your own psychology, it’s cheaper than a psychologist or a mental coach. Wise and certainly not weak.

@finpension @VIAC_Daniel I’ll DM a btc address asap. Thanks.