Hello everyone,

I am an accountant/fiscalist in Geneva and I I would like to provide you with a few advices on how to fill your taxes for those of you who live in Geneva. I advise you to use the supplied software and not the web version (GeTax). I won’t go into the exceptions and will remain focused on average taxpayers who work in Geneva.

Let’s get straight to the heart of the matter! We will procede by the section listed in GeTax.

0. Personnal data

Not much to say except if you have children:

0-18: every child earning less than CHF 15’557 per year is deductible (you can also add childcare costs, up until 14 years old, but be careful because it will lower the fixed fees that is already deducted; you have to try different combinations yourself to find the most efficient deductions)

18-25: all children in school who are in the care of their parents and who earn less than CHF 15’557 (a half-tax burden is accepted if they earn between CHF 15’557 and CHF 23’335 and their assets are less than CHF 88’776)

1. Income

This is the section where you record your salary certificate information. Simply report the numbers in the corresponding heading.

I’d like to draw your attention to a few points:

- Talk to your employer about maximizing your LPP (insure your whole salary up to CHF 88’200); the more you contribute, the less taxes you’ll pay (and the interest and conversion rates applied to compulsory LPP are higher than those applied to buybacks).

- I would advise you to buyback LPP whenever possible (unless you want to buy a property quickly by withdrawing it, in which case you should not make any purchases in the 3 years preceding the property purchase). Indeed, you’ll save tax, the LPP buyback will earn interest and the tax savings can be invested on your side (in addition to the buyback purchase).

- 3A pillar (in a bank, don’t put it in insurance): contribute the maximum amount each year (CHF 7’056 in 2023) and depending on the offered possibilities, you can invest it on the markets through various funds. I know some institution allows you to buy individual stocks but I would advise against that: this is part of your retirement: do not risk losing it by yoloing on Gamestop

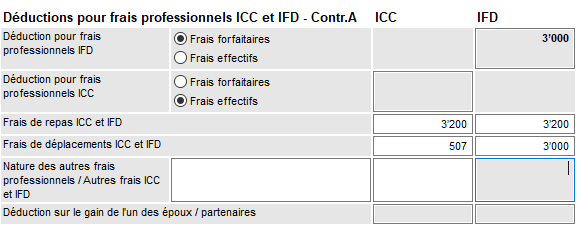

- Business expenses: depending on your home and workplace, the AFC will accept different expenses. The most efficient way to claim them is the following (again, for an average taxpayer; but it is not 100% sure that the AFC accept those numbers, based on the distance between your home and your work):

Regarding your situation you could also claim different expenses. For example, if you work and live in another town during the week, you could claim up to CHF 6’400 meal expenses ICC and IFD and also CHF 6’000 (ICC/IFD) if you rent a place for the week, in the city where you work.

2. Assets

Simply enter the various fortune elements in your possession as of 31.12.N.

Regarding banking fees, the AFC published a really interesting document.

I won’t go into detail about this section as I’m sure other users have posted very detailed instructions for each institution.

3. Real estate

I won’t go into detail about this section as I’m sure other users have posted very detailed instructions for each institution, but I will list below a few interesting points. You can deduct many fees such as (those are often forgotten):

- Water treatment tax;

- Waste tax;

- Property taxes;

- Building insurance.

4. Interests and debts

Simply enter every amount owned as of 31.12.N and every interests paid during the year. Don’t forget to include credit card debts (regarding those, I advise to always pay the debt in full each month to avoid negative interests) and taxes debt (you can also claim interests on taxes debt but only for the year the taxation was emitted; you can ask the AFC for the year-end statement.)

6. Other income and fortune

Simply enter in this section every other income/fortune you possess, such as health insurance subsidies, family allowances, income from solar panels, etc…)

7. Deductions

This section is interesting ans is composed by a few subsections:

- Life insurance: here, you can either enter the life insurance premium you pay or your pilar 3b contributions (the two are often link). Geneva is one of the only Canton where Pillar 3b is deductible (you can contribute up to CHF 2’232 yearly (different deductiosn are accepted regarding your professional and marital status, which results in about CHF 600 in tax savings).

My advice here would be to start a pillar 3b at Rentes Genevoises (no affiliation whatsoever, it’s just that it is the only institution where you keep 100% of your contribution) and you can even invest it (they launched this product a month ago and you can invest up to 60% of you contributions). You only pay about CHF 1’000 contract management fees the 1st year and nothing more (they will be reimbursed in less than two years since you save about CHF 600 per year in taxes) - Health insurance: here, you can register every health insurance premiums you pay (do not forget to include in this section, under the “accidents insurance” any IJM or LAAC premiums that were deducted from your salary by your employer.

- Medical expenses: you can enter here any medical expenses you encountered during the year (even those that were not reimbursed by your insurance, such as dentist, pharmacy receipts (dafalgan for example). My advice here would be to send any invoice to your health insurance and they will include all of them in the year-end fiscal statement they emit.

I hope that this little guide will help you navigates the tax meanderings of the administration! I like paying taxes, I really do, but always the smallest amount possible. ![]()

PS: A few last-minute tips:

-

Pay your taxes in their entirety before the 10th of February and you will receive a 0.25% discount (and maybe even more in 2024 because the rates have risen a lot;

-

Annualize your health insurance (and pay the whole amount in one go) and your health insurance will reward you with a discount.

-

Pay every invoices you can before the 31st of December (especially taxes or health insurance because of the amount if represents) because it will lower your fortune, thus reducing your wealth tax.

Do not do that if you estimate you can earn more than that while investing but they’re still useful little tips.