We have a contact who works cleaning. But we need to care about all the paperwork, so no company in between. Anyone knows how it works regarding contract, AHV, 2nd pillar or anything else we need to do?

A coworker once said he uses a service that does the contract and tax work for him. I don’t remember which company exactly, but I found this: Fairboss.ch

It’s quite easy. On my (employer) side, there was an initial effort of around 3-4 hours (contact, registration, set-up a calculation-sheet, …), a monthly effort of around 5 min. (payroll and tracking) and a year’s end effort of around 15 min.

Assuming, the salary per year is below ~21k CHF, you can register cleaning / household personal under “Vereinfachtes Abrechnungsverfahren im Rahmen des BGSA” (BGSA for “Bundesgesetzes über Massnahmen zur Bekämpfung der Schwarzarbeit”. Like so, everything comes together: AHV·IV·EO, ALV, … and taxes (at source).

Things you need to get started:

- hand in the BGSA registration form (provided from the “AHV Ausgleichskasse” of your canton, example of canton BE: Anmeldung für Arbeitgebende im vereinfachten Abrechnungsverfahren (BGSA))

- Compulsory accident insurance (UVG, around 100 CHF per year, provided by regular Swiss insurance companies)

- have a contract with your employee

Once the person starts working, you need to keep track of the hours / payroll and all the costs (employer and employee side), e.g. Hauspersonal - Ausgleichskasse des Kantons Bern (some may differ in other cantons).

At the years end, you’re getting a form where you have to provide the information regarding the salary paid during the year - based on that, you’re then getting a bill to pay the employer contributions and the employee contributions (that you were withholding during the year)

… that’s mostly it

BTW: Regarding the effort on your side, all the available services are WAY to expensive (e.g. taking a few % of every hour worked!)

… and to give you an impression regarding salary:

Just an example, salary per hour (as of 2020, canton BE):

- Net salary: 28 CHF

(+ employee contributions: 3.593 CHF) - Gross salary: 31.59 CHF

(+ employer contributions: 2.519 CHF)

(+ BGSA “management costs”: 0.167 CHF) - Total salary costs: 34.28 CHF

So, every hour worked costs you 34.28 CHF and your employee gets 28 CHF…

We use quitt.ch to handle that.

You just enter the hours that the person worked for you. You can download all the required documents when needed, such as the salary statement for the person’s taxes or proof of work if the person applies for unemployment benefits, etc

I used to use the services of Batmaid until they split. Now, Batsoft is a payroll company for cleaning services. So you’re the employer, but they cover all the administrative hurdles. You can set the salary yourself, I think for my cleaning lady the rate is about 33.60 CHF/h. Alternatively, you can use their “premium” service Batmaid, and I think it costs 40 CHF/h. I think they pick from the best rated workers and hire them directly, and you’re just a customer, not an employer anymore.

Don’t want to sound like an ad guy, but I think they have organized it pretty well. You have a schedule on the website, you can postpone or cancel your cleanings. If your cleaning help cannot come, they will call you to organize a substitute, and most of the time it will even be around the same time, which is convenient. The negative was that I couldn’t stick for years with the same person, there is some rotation there.

I am a bit lost. I have always thought that the cleaning person are here self-employees. Therefore you do not need to do the paper work.

Am I wrong?

No. They are either employed by a company (even if a company is just them), and then you pay to a company for the service; or they are your employees and you are an employer. In the latter case, you have to do all corresponding administrativa.

That depends. A cleaner can register as self-employed with social security if they have several different customers. In that case, they are responsible to handle their own social security admin, so no work for you and no employer-obligations (i.e. paid sick leave, pension contributions, etc) as you’re just a customer. But you would have to be absolutely sure that they have this status, or you could end up in trouble. Comparnies like Batmaid etc. are the easiest as you don’t have to worry about anything. But if you find a cleaner who is more affordable and is registered as self-employed, that’s all the better. I would shy away from actually employing someone myself, as there’s a fair bit of admin involved, and the whole point of hiring a cleaner is to save time. If you are toying with the idea of hiring directly, I suggest you play around with this calculator first just to get an idea of the real cost: Salary Cost Calculator for Employers - moneyland.ch

Thank you everyone for your responses, they are very helpful!

I don’t know about the service, just the numbers:

- On your own: 100 CHF + all the paperwork

- quitt.ch: NET salary 22 CHF → Total: 27.07 CHF (4 hours per week, more hours, less fees)

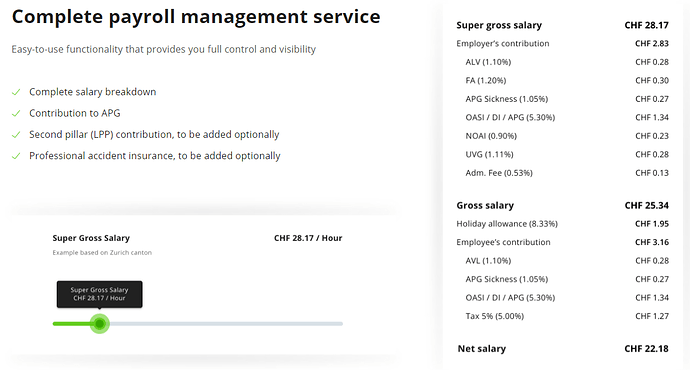

- badsoft.ch: NET 22.18 CHF → 28.17 CHF

I have used quitt.ch for many years now and am very happy with the service. Easy to handle and avoids you all the headaches and administrative work. I can highly recommend it (DM me for a friend referral code to get CHF 50 bonus)

Even if it sounds like a lot of paper- / administrative work: It’s not (assuming one can use the "Vereinfachtes Abrechnungsverfahren im Rahmen des BGSA”) - and I guess, it’s kind of the marketing-strategy of this services, to let you believe that there is a lot of work involved ![]()

No doubt: it’s easier! But you pay a lot for what it actually requires… IMHO

Partially agreed, as you have to take care of insurance as well, and putting together the yearly “Lohnausweis” etc…it’s not too much work, agreed. But quitt.ch does it all for you. The yearly fee you pay is quite fair in my opinion.

Indeed: Insurance is signing one (standard) policy … and there is no need of a “Lohnausweis”.

" Vorteil für den Arbeitgeber: Kein Lohnausweis

Für den Arbeitgeber hat dies den Vorteil, dass er dem Arbeitnehmer keinen Lohnausweis ausstellen muss."

Thank you everyone for the info!

We live in Aargau, so it’s a different form. I’ll try to see if it’s not too much.

Actually an accountant we know told us that he does the registration for 100 CHF per year (SVA form + contract + insurance) because he has a deal with an insurance.

Then we need to do the monthly payroll and fill the form at the end of the year?

My question now is: is the insurance 100 CHF or it could be less?

So after the registration, we do a monthly payment directly to the person (Net salary) with a payroll. And then wait until the end of the year to pay everything else?

It sounds quite easy, I just need to find the right form for Aargau

If I remember correctly, the premium of UVG for household personal is around 100 CHF (was as of 2020) - the premium is not fixed per law, but was +/- “standard”… I signed up for this one Unfallversicherung für Hausangestellte | die Mobiliar

So, your accountant is actually filling out the forms “for free” - resp. just taking the insurance provision (and that shows of how much effort one needs ![]() ).

).

Once everything is registered, you just need to do the monthly payroll (maybe with a salary statement for your employee) and to fill out the forms your will getting at years end (like provide the annual gross salary).

Canton AG has a nice overview as well: AHV-Beiträge bei Haushaltshilfen | SVA Aargau and a link to net- and gross salary table: Dokumente | BSV Vollzug and here is the link to the registration form: https://www.sva-ag.ch/private/ihre-private-situation/haushalte-mit-angestellten/anmeldung

That’s very helpful, thank you clon! I don’t know German and takes me a lot to find that info. I checked their website and I didn’t find them

Just for future reference, here’s one more option: Chèques emploi