I will definitely go with Assura for 2021 : PharMed or Family Doctor. I am with Supra for many years and I am really happy with them, never had a problem and their app is really good. But, they are too expensive now.

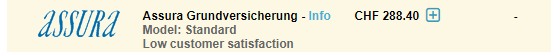

So, my current standard insurance would cost me 288.40

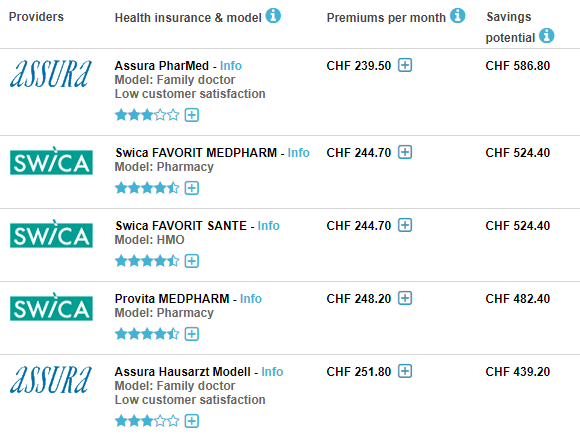

Cheaper alternatives:

Would you really recommend to switch to Assura PharMed? What if I have an emergency, like last time I had some allergy attack. I went to the 365 praxis in Zurich at 20:00, most places are closed by then. If this place was not in the network, I would need to go there outside of the health insurance, right? (no difference until you hit 2500 costs, but I don’t know if they will take you).

What about SWICA FAVORIT MEDPHARM/SANTE? Is it not worth to pay 5 CHF more for a Krankenkasse with much higher reviews?

For an emergency you can go wherever you want with the PharMed model.

On an unrelated note, the cheapest premium is 50.- more expensive here in VD

Honestly I don’t care about “customer satisfaction” ratings for the basic insurance. They provide exactly the same coverage but yeah 5.- is not so much more.

Lucky you, in my canton it’s 100 CHF more ![]()

Every insurance is fine as long as you are healthy. Swica year over year receives best customer satisfaction ratings. I have Telmed and can recommend it. You just call to tell them that you need to see the doctor and they say ok, and advice is not binding as in most other models.

For me it’s also important to have option to go directly to specialist. You also do not need to see and pay for GP visit who would have to do basic checkup refer you in GP/HMO model. Free choice of doctor can be also good if something serious happen.

Guys… again a mistake…

it’s not about Cantons!

I also live in Zurich but the cheapest in my gemeinde is 274, but it’s not Pharmed this year, it’s Qualimed. They might hope people did not see the difference and stay with the “wrong” plan (for an added 5chf).

Note that qualimed is fairly different. From what I understand, for some condition, it remove the referral decision from your doctor to the insurance. (personally I find it a bit fishy, I agree with the house doctor model as continuity of care is important, but then if that doctor can’t even refer you not sure what’s the point)

I’m really happy with Swica Favorit Medpharm. Premium is increasing from 333 CHF to 345 CHF for me and I’ll stay with them. I could save money with CSS Telmed (340 CHF) and Atupri Hausarzt (330 CHF), but it’s not worth it IMO.

Like others already said you can go anywhere when you are in an emergency situation.

Assura are really the worst as far as I know.

„Für (…) Schweizerbürgerinnen und -bürger mit Wohnsitz im Ausland, gibt es nach wie vor kaum gesetzliche Grundlagen, um von schweizerischen Krankenversicherern eine Deckung zu bekommen“ says the Organisation of Swiss abroad. And „Wer in einen Staat ausserhalb der EU/EFTA auswandert, kann (…) nicht mehr bei der obligatorischen Grundversicherung in der Schweiz versichert bleiben“ (here).

I have little reason to doubt them. And no insurance is going to insure you retroactively and cover your medical expenses. Unless they have to. Which, to my knowledge, they do - but it’s limited: they‘ll have to insure you from the date you’re taking up residency in Switzerland, and you pay premiums from that onward, even if retroactively.

However if you‘ve been living in Micronesia for 50 years (as you said) and didn’t have/keep residence in Switzerland (as I said), I can’t see how you‘d be covered by Swiss health insurance. Mandatory insurance, that is. There might be non-mandatory options, but I can’t imagine they wouldn‘t assess your individual risk carefully.

As far do you know then?

Regarding the costs of insurers I’ve found this:

https://www.priminfo.admin.ch/downloads/zahlen-und-fakten/Verwaltungskosten_D.pdf

Not exactly what I’ve seen several years ago…

Devils is in the details… If you get sent back here, as many international insurances do, then they must accept you. At the end of the day, the most important thing is that you get swiss-level care (no offense to micronesia. I have no idea). So if you might have to pay 10000chf instead of 800chf…well Ok.

What the text says is that they don’t cover you abroad. So, to make a better example, say you live near some decent hospital (say Bangkok), you get your treatment there because you have an international insurance. At some point they might say that you need an heart transplant and the costs are outside their prices, they put you in a flight to ch and drop you here. At that point you look for the best basic health insurance and take care of your health (forget supplemental insurance).

I don’t have links again, sorry. It might take you 20-30minutes if you check what health insurances for traveler have in their contract. The one I saw said that they transport back to your home country. You are not swiss, so maybe this topic is pointless for you.

I hear this quite often but I still don’t know the reasons why people mention that they are the worst.

So if I may ask, why are they the worst? Don’t they pay back? Are they maybe even cheating? or what’s the problem really?

One reason is that Assura is usually using the Tiers garant which means you get the invoice and pay it before you hand it to the insurance and get anything back and a lot of people don’t know that (I work in the medical field and send the invoices to the patients). So they think they are bad for not directly paying them. There maybe also other reasons, but I don’t know those.

I absolutely second this.

For emergency care, choice of insurance is pretty much a non-issue: the coverage is the same. Some companies might make it harder for you to handle the paperwork or question payout, but in the end that’s just administrative paperwork.

I dread the idea of “feeling something’s wrong” but being unable to visit a specialist for diagnosis or receiving inappropriate care though.

No, afaik they don’t. They have to accept you if and once you take up residency in Switzerland again - though that doesn’t mean registering with the sole intent to slip under the health insurance coverage, which would be an abuse of the system.

To quote the federal council itself…

“Sollten die Auslandschweizerinnen und Auslandschweizer nur zum Zwecke der medizinischen Behandlung in die Schweiz kommen, dann werden sie nicht versicherungspflichtig und können die obligatorische Krankenpflegeversicherung nicht abschliessen. Die Krankenversicherer haben das Recht, eine Krankenversicherung rückwirkend aufzulösen, wenn sie nachträglich feststellen, dass eine Person nur zum Zwecke der medizinischen Behandlung in die Schweiz gekommen ist und sie nach Abschluss der Behandlung unser Land wieder verlässt. Damit werden Missbräuche verhindert.”

…insurance companies are even allowed to cancel the contract retroactively in such cases of abuse of the system.

I’m not saying there’s absolutely they’ve closed every loophole to make it possible to “game the system” (and abuse it) in practice. But neither do I believe it works out as smoothly as you imagine it above.

The link to the federal council also provides examples of people living abroad, from whom the Swiss insurers had no qualms to cash in insurance premiums for 10+ years and for whom they paid smaller bills. Only to cancel the insurance with immediate effect once a serious health condition and bill came up.

If that’s the main reason then it just proves the stupidity of humans. Ok, the convenience is a little lower, but at least you can see the bill first and check what they charged you for.

You mean, you would not like to have to go to a GP beforehand? Or that your choice of specialists would be limited? Because if it is the second option, then in my case I don’t know any doctors and wouldn’t know a top doc from a poor doc.

Thanks @Erma for your answer. Well if it is “just” that I think there is no reason the label them as the worst. For good fellow mustachians in the worst case of big unplanned medical bills I guess the emergency stash/fund could be used temporarily. So not so much of a problem either.

I’ve now actually insured with a GP model for a while. Though I’m on a first-name basis with my GP and trust him to refer me to appropriate specialists if needed - or with some convincing on my part.

I have received less-than-optimal health care for a serious condition and suffered loss of health that would most certainly have been (partly) preventable.

Not by by the luck of the draw of one single practitioner - but by seeking out a better, bigger, more experienced and (technologically) better-equipped entire health organisation, i.e. hospital.

At least in hindsight it has been very obvious - though also eye-opening for me, in case it should happen again.

I am seeing “Mix model” on offer. A very shallow looking into it indicates that it lets you either call your telmed hotline or family doctor. Anyone know of any downsides compared to the telmed plans (which surprisingly are more expensive)?

The way I undestand it, is that you always have access to the phone assistance, the family doctor / hmo models just have a limited list of partners you can go to. That’s the only way it makes sense to me.

To me it’s a bit of a feature (but I have enough cash so that I’m not worried), I like knowing what I’m being billed (before I switched to assura I was always wondering why things would cost so much, since my insurance would ask me to pay, but I wouldn’t be able to see the bill).

I currently have one minor issue with them. Corona tests are fully covered (with no franchise).

But Assura wants eligible corona test to be done as Tiers-Payant (not tiers garant as they normally do) and I feel like it’s going to be a mess since I already payed the lab when I got the bill… (I’ll have to call and somehow try to get paid back and have it re-billed as tiers-payant, I really doubt it’s going to work).

It’s only because of that ? I am with this system with SUPRA since 2016 and never know another system. I have friends who move to Fribourg and took this insurance last year and they are happy with it. I will give it a try this year.