3rd party car deductible is fixed at 500.- I was referring to the regular personal liability deductible, this one is adjustable

sorry I wasn’t answering your question. just ranting

I’m not sure if it makes sense to save 20chf there.

If you have this in the contract, (which you will if it is stated this way in the website) then it’s not problematic.

Thats true, I never thought about that in such a way. You are completely right.

I am currently at AXA and tried asking for a 2000.- selbstbehalt. It worked but it was only 15CHF cheaper than a 200.- selbstbehalt (insured sum: 40’000). The problem was that the selbstbehalt for “einfacher Diebstahl” also would have been 2000.- with an insured sum of 2000.- eg. no point!

this diebstahl insurance could not have a different selbstbehalt according to my guy.

Annyoing. I should just switch to baloise ![]()

I’m moving back in to my parents in January 2019, so I have to change the policy again then. Is this problematic? I’ll call our insurance guy to ask him this as well.

As a tip, make sure to always get a written confirmation from the guy who promises stuff to you ![]() Should he tell you that everything is fine for XYZ reason, just ask him to send you an email with the needed confirmations.

Should he tell you that everything is fine for XYZ reason, just ask him to send you an email with the needed confirmations.

Trust is overrated with sales people ![]()

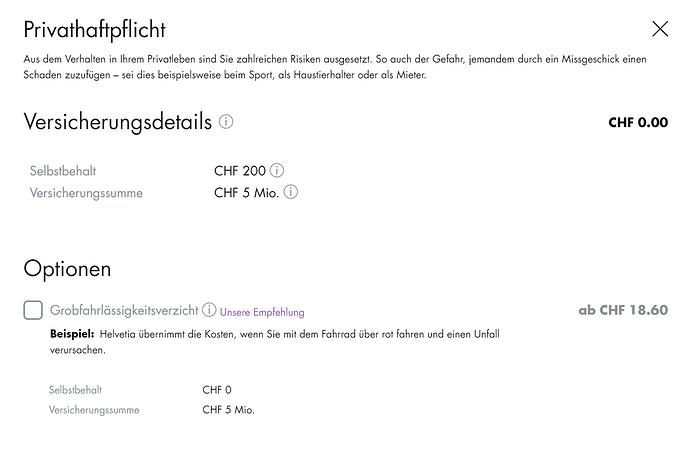

Thanks everyone for your feedback ![]() On Comparis, I found an offer by Helvetia for people under 25. They offer private liability for CHF 20.- a year. Included is also a basic “Driving other people’s car” insurance (but not worlwide it seems.) Excluded is “Grobfahrlässigkeit.” With “Grobfahrlässigkeit” insured, it would amount to CHF 36.-. What do you think?

On Comparis, I found an offer by Helvetia for people under 25. They offer private liability for CHF 20.- a year. Included is also a basic “Driving other people’s car” insurance (but not worlwide it seems.) Excluded is “Grobfahrlässigkeit.” With “Grobfahrlässigkeit” insured, it would amount to CHF 36.-. What do you think?

Is that regular Privathaftplicht insurance, for only 20.-? am I missing something here?

I am paying 100+ for that…

I just finished talking to a nice lady about my two insurances and she said something weird to me.

She said that if I broke the ceramic stove (kochfelder), my RC would pay and not the Furniture insurance.

It’s weird since also Comparis.ch put it under Furniture insurance. Was she lying or it depends from insurance to insurance?

On Comparis I see something weird: Glass breakage coverage, if I say yes, the Furniture glass option appears. With different explanation.

Glass breakage coverage

Glass breakage coverage is part of contents insurance and includes breakage of furniture glass and/or building glass. Building glass includes, for example:

- Washbasins

- Ceramic hobs

- Water closets

Furniture glass

Furniture glass includes all glass surfaces on furniture and wall mirrors. You therefore only have to insure furniture glass if you own glass cabinets, glass tables or an aquarium, etc.

Edit: I did miss the “and/or”. It’s basically depends on insurance. Comparis put them together.

I have no Hausrat. If something happens I`ll just go to IKEA to spend the money I saved on Prämien.

If you want to get money from your insurance, you may need a lawyer because whatever damage you have is excluded in the fine print lol

…to Ikea, H&M, Digitec etc… It’s not only about furniture.

Also you can get a lawyer insurance if you are afraid they don’t pay you

Just don’t get it from the same company eheheh

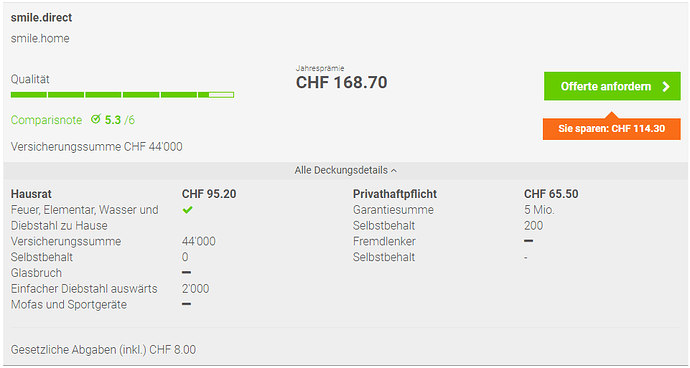

So Hausrat costs 100 CHF more per year. And it covers flat damages up to 44’000 and theft outside of home up to 2’000 (think stolen phone, laptop, bike, keys).

Let’s say you were not insured for 20 years and then something happened. Good luck replacing your stuff in Ikea for 2’000 CHF ![]()

Side note, but important for the thread:

If you want to cancel your insurance, you need to do it 3 months in advance.

Thanks guys for all of your help! Sorry for asking so many questions, it’s new to me ![]() I also wondered whether I’m missing something with this offer. It’s 36.- with “Grobfahrlässigkeit” (Gross neglicence) insured. Are Joey and I missing something or is this one a good deal?

I also wondered whether I’m missing something with this offer. It’s 36.- with “Grobfahrlässigkeit” (Gross neglicence) insured. Are Joey and I missing something or is this one a good deal?

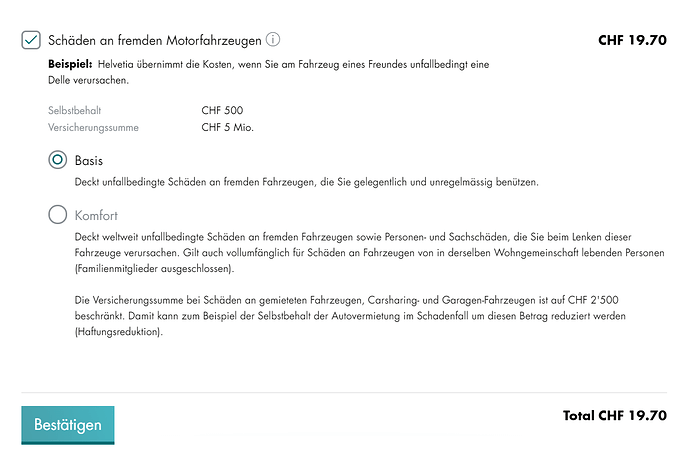

I’d take Grobfahrlässigkeit instead of fremden Motorfahrzeugen.

The former means the insurer won’t try to wiggle their way out of paying a claim by saying you did something stupid and is a useful option.

The latter basically is about insuring some dents if you put them on your parent’s car… Liability to third parties is always insured (by owner/canton). If they have a Bently, maybe you’ll get your money’s worth, otherwise think twice.

Also you have to pay 500chf first. So either your parents have one of those color-changing cars or that small dent is huge.

I won’t take Grobfahrlassigkeit though. I am maybe naive here, but I tend not to do dumb things and I believe they won’t nitpick in case something happens.

Do you get enough sleep? Because being tired is considered as Grobfahrlassigkeit… Grobfahrlassigkeit is huge and includes a lot of situation we don’t even think about.

I would strongly recommend you to choose this clause since having an accident almost always requires someone doing something stupid ![]() Alternatively said: errare humanum est

Alternatively said: errare humanum est

It makes almost no sense to contract an insurance not covering the most likely situations, i.e. that the cause of your accident is an human error IMHO.

That’s probably true for a car insurance.

For Privath… maybe a bit less. Does someone have examples? I always thought about things like candles left burning or stuff like that.

didnt the form give you an example already? you oversaw a red light while biking (or decided it doesn’t apply to you like to so many other bikers) and caused an accident - insurance will call you stupido and make you pay for everything. Biking is covered by private liability insurance, not car. If a person gets injured we could be talking tens of thousands to hundreds or even millions of franks damages (e.g. loss of income in case of invalidity)

better to think of it as a discount, not an option. Would you take a discount of 18 Fr for the off chance that insurance will refuse to pay out a valid claim in certain possibly subjective situations?

Yeah got it. For what I usually do I’m not really worried, but who knows, maybe in the future…

The only examples I remember reading when I signed my insurance were dumb things and related to what I could do at home. Biking might be a good reason to change my insurance.

Thanks