Hi everyone,

It’s about time I introduce myself, since I’ve read pretty much every thread on the forum!

Before I moved to CH in 2010 I was living in one of the most expensive cities (London), in an underpaid job (the recession meant employers could pay far less than they should have) and with a costly way of life (aka breaking Rule 1 of Mr JL Collins). All this meant I was ecstatic to have £20 left at the end of the month. Literally, £20.

Since then I’ve been happy to even have money on the side and didn’t really think about doing anything more with it, other than keeping it and seeing it grow slowly each month. Now I’m at the point where I have my emergency fund, the debts are paid and I don’t live on credit, so according to the Bogleheads, I’m ready for more!

I just started learning about investing and, up until 1-2 months ago, didn’t know there was such a thing as an index fund. All the advice on this forum and MP’s blog have been so, so helpful.

Some stats:

Savings rate: 50%, which I can’t seem to get any lower as rent makes up 25% of that (my boyfriend and I live just outside Zurich)

Income: Was 180K (combined) but my income will drop dramatically as I will work only max 40% after our baby is born (which could happen any day/minute!)

Asset Allocation: 25% emergencies/liquid assets, 75% investments

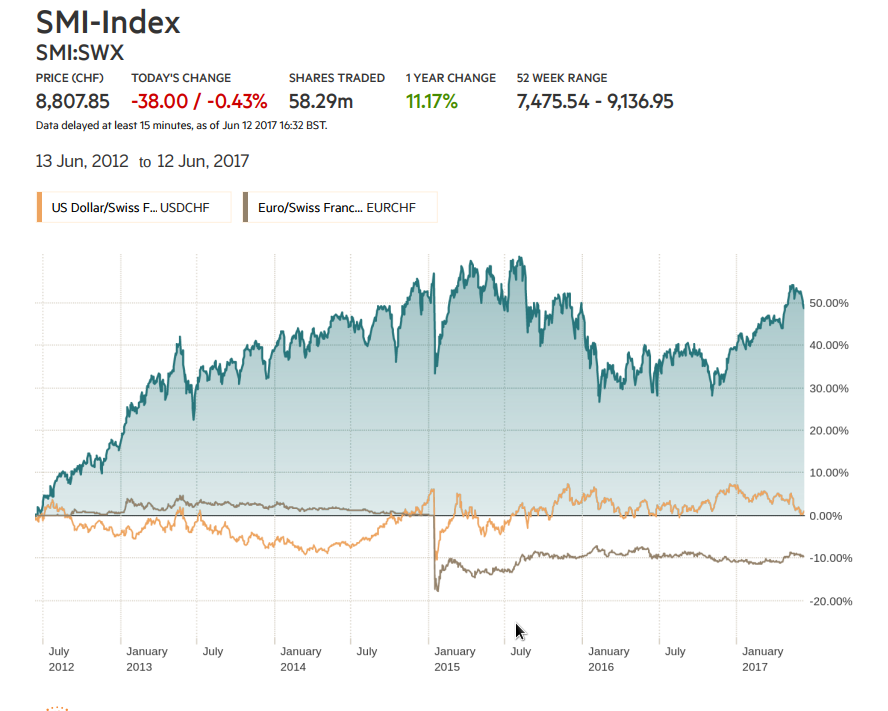

- 55% VWRL on SIX with CornerTrader*

- 20% local Swiss fund, probably iShares Core SPI but we’re not sure which is best - any advice there would be great

- Following Boglehead’s advice, I know we should invest in bonds, but from what I’ve read on this forum it doesn’t look like that’s the way to go…Further research required!

*Seems a lot of people on this forum are in favour of VT with IB, but is it so much cheaper after paying the monthly inactivity fees, cash transfer fees and currency conversions? This is definitely a question, not a challenge, as I’m still trying to make sense of all the things I’ve read - it seems so much overlaps or cancels each other out!

Anyway, thanks a lot for all the help and hopefully one day I’ll know enough to help out too. I’d be very, very happy to have your comments/advice!