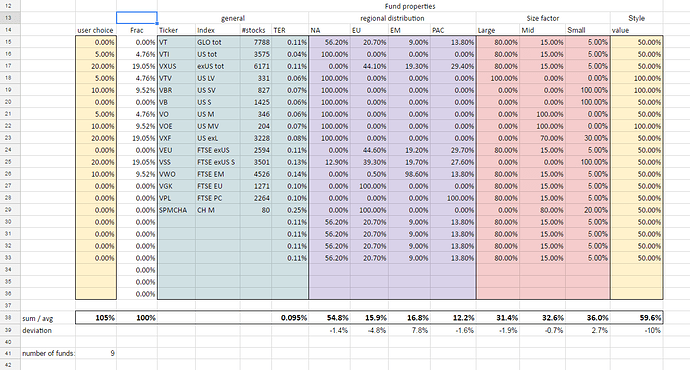

in case i move to IB soon, i made myself a stock portfolio selector to cope with the freedom of purchasing low cost vanguard funds.

Its main purpose is to find a portfolio that suits my idea of

- 100% stocks

- as many individual stocks as worldwide available (diversification)

- ideally equally distributed over any sufficiently liquid company stocks, but since this is utopic:

- market capitalization weighted, with small & value pronounced

- maybe small CHF home bias

go ahead an make yourself a copy of the sheet ![]()

the current numbers are only my first guess, i might refin it later. comments & ideas for extension welcome ![]()

flaws:

- the fund properties are very guess-ish, apart from the regional distribution

- could be extended for further properties

- leads to many-fund-portfolios

- not reflected: south america, africa, meddle east

- overlaps between funds exist

- …