So what do you think is the likely outcome? priips style curtailing of option trading for retail in the US?

This is not specific to GME, Degiro does this to all stocks since for ever. You can not submit a buy/cell order with a limit that is more than 10% different from the latest price.

This is both smart and evil. Hedge funds launch ladder attacks to artificially lower the price of the stock by doing super low volume trades in order to trigger margin calls on retail investors.

Well, what are the chances of this happening to VWRL? Very close to zero, right?

I bought today 80 GME at 130 USD (on Swissquote), so not at the bottom but quite close :).

Well done, bravo!

Lets see what will happen tomorrow.

So the argument is that brokers and clearing houses started not trusting each other? (liquidity crisis)

Yes! He feels responsible for his customers - HA! That responsibility sharply comes to an end when the customer is on the loosing side… how two-faced is this?

To paraphrase the interview: „We are scr*wing our customers to protect ourselves, er, I mean, to protect our customers, of course. Phew, remembered just in time that customers are supposed to come first. Nobody noticed what our real priorities are, right?“

Oh my god this interview is a catastrophe! Not only did they change the rules in the middle of the game, but they took one whole team off the field! I am done with IB.

If clearing can’t be done, there’s probably many people impacted, right? Wouldn’t the brokers absorb the losses? (because they were the one supposed to maintain their clients’ margins and provide the funds for clearing the transaction)

I’m not sure how it’s a better outcome for market participants (esp. the bystanders who were not in game).

I’d be surprised if the courts blink an eye, they stopped trading a few shares to prevent a systemic crash, I assume their ToS allows it anyway if they have semi-competent lawyers.

If he‘s still in, I‘m still in

By the way, similar interview from a different broker Yahooist Teil der Yahoo Markenfamilie

key quotes:

But in reality, what’s going on is that there is a two-day settlement between if you buy the stock today, those brokerage firms that you bought that stock on have to fund that trade with the clearing central house called DTC for two whole days. And because of the volatility of stocks, DTC has made the cost of the collateral of the two-day holding period extremely expensive.

And we just can’t afford-- well, we’re not a clearing firm, but our clearing firm simply cannot afford the cost to settle those trades. We cannot use customer funds to front that cost due to regulation. So the brokerages or the clearing firms have to go into their own pockets to do it. And they simply can’t afford the cost of that trade clearance. That is the reason why these stocks are coming off. It has nothing to do with the decision or some sort of closed room cigar-- smoke-filled cigar room of Wall Street firms getting together to the dismay of the retail trader. This has to do with settlement mechanics of the market.

If the collateral increased by 3x overnight kinda makes sense… They let customer unwind their positions but not go into new ones.

crypto version of reddit’s GME push: DOGE.

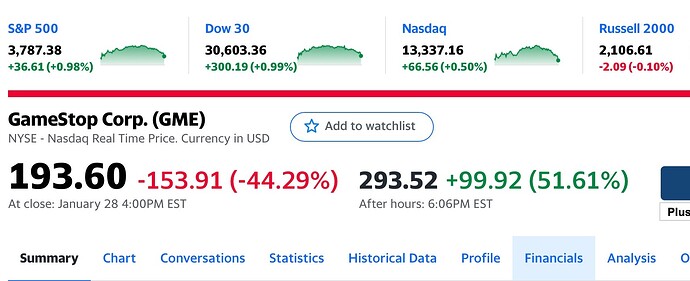

I sold 50% at 250% plus… now at 380%.

A good explanation on the clearing regulations that led RH/IB to restrict trading in GME/AMC/etc.

https://twitter.com/KralcTrebor/status/1354952686165225478

TLDR: On one hand, the netting of buyer/seller is so unbalanced, and on the other hand, the volatility on GME is so high, that brokers are on the hook to pay from their own pocket the collateral made from the difference between trade price and current price between T and T+2…

This is a correct decision. If the worst thing that happens is that people cannot trade stocks for a few days, that’s fine.

I think in that case it’s almost better to tell the truth. “We had to stop you from buying because of the strain that regulations put on us”.

No. They will prefer to look like the bad guys for a few days, rather than admit that they don’t have enough money to cover their collateral (even if the reason is regulatory). The latter is much worse because it leads to a bank run.