Meanwhile I have happily bought my 1 share on SQ without restrictions or problems.

I am wondering how many US traders manage to switch to WeBull and the likes to resume trading today… Hopefully yesterday was the only low volume day and we can get back to a free market.

I guess the real problems are caused by options, right? For normal shares they could have reduced their risk by holding the cash/shares until T+2? I don’t know, I don’t understand all this risk stuff anyway.

How much does it cost to get sued: 1 slave in jail or 10-100m

How much does it cost to let this stuff unwind: 1-2 companies will fail.

Ofc they prefer to get sued.

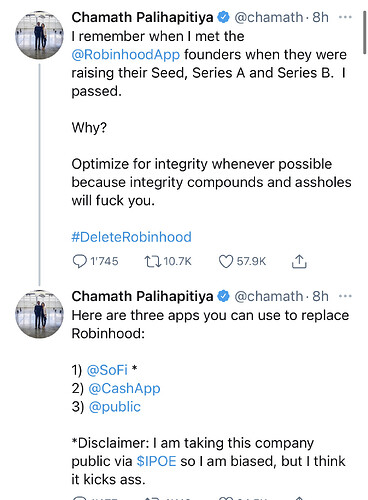

RH and IB are hiding behind a lot of technocratic chatter. Essentially it is the hedge funds who fucked up and don’t want to (or can’t) cough up the money they gambled away and at this point the sums are massive and are dragging the brokers into as well. The situation was created by the short sellers not being able to cover for the pickle they got themselves into. Why us regular investors have to now share the cost of this is what puzzles me.

This is it lads - today is the day.

2008 hurt me and a lot of good people, through no fault of our own the many had to suffer because of the actions of a few that gambled away billions. The entire establishment failed - the ratings agencies that rated these CDOs AAA, the lenders that lent money to people who clearly couldn’t afford it, the hedge funds and banks that made billions selling products no one really understood.

People lost their homes, their dreams, their hopes and many even took their own lives. Many parts of the world have never recovered, the inequality gap has only further increased. Today while much of the world is forced to stay at home because of a global pandemic, these inequalities have only gotten larger - we have seen the worlds richest increase their net worth by billions whilst the rest struggle to scrape by and count themselves lucky to get $600 stimulus checks. While some have been able to enjoy being at home in their second homes in the Hamptons, others have been stuck in tiny flats trying to look after their children or even risk getting Covid by going to work because they simply cannot survive.

This image from the Occupy Wallstreet protest in 2011 always stuck with me. The sheer arrogance and disdain that some of these people have for the ordinary public.

Whatever your views on this GME saga, this is more than just a pump and dump - its a leaderless movement that has caught the imagination of people the world over. A chance to democratically congregate and play these Hedge Funds at their own game - a chance to stick it to the man, an opportunity to inflict the same pain that these predators unleashed on so many companies. Their “Idea Dinners” their negative reports, their duplicitous statements (Bill Ackman coming on TV and crying last March about the pandemic and then pocketing 2bn by doing exactly the opposite) - we see through all their lies and their apologists don’t worry us.

Whatever happens - you can look back on this day and be proud that you took part in something that might change the way the markets work forever.

Disclaimer- this is not financial advice, only invest what you can afford to lose. I am not intelligent enough to understand how the market works like some other poster’s in this thread. I am prepared to lose my entire investment as this is personal to me - do not FOMO into this because of what I have written here.

God Bless you all

Cuomo grilling RH ceo Vlad Tenev:

https://twitter.com/CuomoPrimeTime/status/1354989746158784514?s=20

Thank you for putting time and effort in your post. The image is very striking indeed.

Guys, you are funny.

Let me see if I can get this straight:

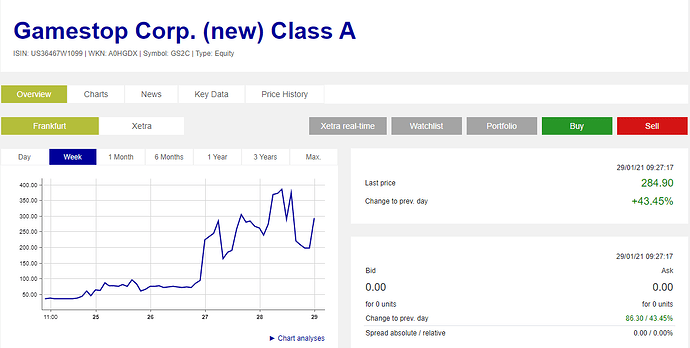

- A number of hedge funds got the GME trade very wrong on a risk/reward basis, and attracted the interest of smart retail investors. They spread the word via social media, and the stock skyrocketed.

- The affected hedge funds were run over, starting with a short squeeze, and then a gamma squeeze. So far, so good. But then things got weird.

- As the stock went higher and higher, retail investors began to believe that the hedge funds that were short could never cover because the short interest was 140% of the shares outstanding. Yet the stock was trading more than 100% of its shares outstanding EVERY SINGLE DAY. GME has 69 million shares outstanding, every day until Thursday the daily volume was 180 million shares. Hard to see how shorts could not cover. The shorts who had too much exposure to GME covered, and the shorts that did not are probably strong enough to not need to cover at $400.

- So from this point on, millions of retail investors jumped on the bandwagon, without checking facts, hoping to make a quick buck and to sell to a greater fool. They did not buy GME for the business, they wanted to speculate on the way up based on a false narrative.

- The collective behavior of retail investors led to liquidity issues where brokers could not face their collateral calls and had to restrict dealings in GME.

Please explain to me where Wall Street is screwing you? You were speculating, did not check the narrative that shorts would never cover, and things did not go as you expected.

You are free to speculate as long as you don’t threaten the solvency of your broker. But at least own when you are wrong.

On a side note, i am curious to see what will happen when everybody realize he is on the same trade and there is nobody to sell to anymore (hint: imagine a crowd in a movie theater with a very small exit door and someone shouting “FIRE!”).

I totally follow you on this !

It is the perfect example of the free (and “efficient”) market being exposed as an ideology/narrative (in the sense of a political choice based on principles) when it was presented for so long as the only logical and possible paradigm.

I am kind of a fanboy, but if you have the time, I strongly recommend you to read Piketty’s latest book “Capital and Ideology”

Your condescending first sentence is absolutely unnecessary in this conversation, thank you.

I am definitely not an expert (my strategy is to figure out who the experts are that I can trust instead  ), but I have the same feeling.

), but I have the same feeling.

There’s a lot of rumors, bad takes, and conspiracies going around. I guess that’s just how the world now is, just instead of politics or pandemics, the new things is finance.

When you see people claiming that it’s all due to hedge funds and wall street colluding, etc. I kinda understand how things like Qanon can become so popular, it’s easier to believe that than figuring out how the markets actually work (with settlements, collateral, credit risk, market makers, …).

…submitting buy orders at IBKR seems yet to be enabled again - so, the reasons and arguments from yesterday just magically dispersal over night? Strange

Maybe it is a different story outside of the regular trading hours? So far I have not yet read any news of IB changing anything to the better. Trading212 seems to allow trades again, but they announced it officially on Twitter.

Keep us posted on your transfer and how your adventure develops.

I have a stupid question: if a short seller defaults, who pays the lender back? Is it the exchange, and hence why they’re panicking?

What if the short seller literally can’t buy the share back because nobody will sell it? Do they just return cash instead?

I am no expert on this, but can they not roll it into a new contract, getting them further and further into the shits?

By the way did IB ever stop buy orders? (at least they never announced it, they only announced new margin requirements and restrictions on options)