what an excellent opportunity it would have been, yes!

But how can this be justified mate - its a free market no? How can you prevent someone from spending their own money on something they want to, whilst putting no restrictions on the hedge funds?

You can only lose as much as you invest in a long position. The hedge funds are the ones who put themselves at risk of literally infinite potential loss - this has nothing to do with protecting the retail investor, they are doing this to protect the hedge funds and its a coordinated attack across nearly all the american brokers.

I feel like I am trading an altcoin at the moment - 483 - > 112 → 270.

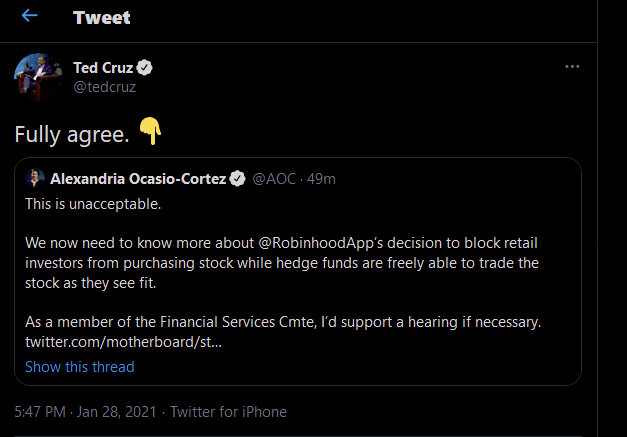

If both AOC and Ben Shapiro are tweeting about you, then you know you f’ed up. I am wondering what the consequences will be.

When the meme becomes the reality

Because the broker also need to protect itself? Given the volume, volatility, and having likely so many users on the same stocks, how much faith does RH put in their risk management systems?

And even the solid brokers (e.g. IB which doesn’t really target retail) increased margin requirements drastically.

Anyway, still fun to watch, esp. the various financial/conspirational takes.

In the meantime, most likely wallstreet folks are actually loving this and printing money, esp. the market makers, I don’t think hedge funds are trading heavily directly on shorts (instead they have more structured product, that might have some short components), and those who do I doubt their risk management would have let them kept the trade going when they started having large losses.

So all the people who hit their annual targets this week are thanking wsb ![]()

Edit: re free market, if people want an unregulated market isn’t it what crypto is for?

You cant buy GME on IB… only closing trades are allowed.

I found this interesting, and kind of scary:

The S&P 500 Index is an index of, roughly speaking, the 500 biggest U.S. public companies by market capitalization. GameStop is not in that index, because a month ago it was a small company, in the index of 2,000 small companies. Now it is—measured by market capitalization, though nothing else—a big company. If the redditors can hold on long enough, can they get GameStop added to the S&P? Can they turn it into a big company just by bidding the stock up? If they can, then S&P 500 index funds will be forced to buy it, no matter the price, and all the redditors who brought it here can get out at a profit. And they will have a big and permanent win, and also the current version of financial capitalism—the index-fund version—will collapse in absurdity.

So this craziness could spill over to us boring ETF investors (assuming there are any left in this forum…) after all! Fortunately, it seems like it can’t really happen:

This is not likely just because the S&P is not purely based on market capitalization; for one thing, a company needs to have positive net income to be added to the index. GameStop doesn’t. GameStop would have to go at least a little way down the path of its fundamental turnaround—it would have to start making money instead of losing it—to get into the index. You need a little bit of corporate reality for this one to work out.

(source)

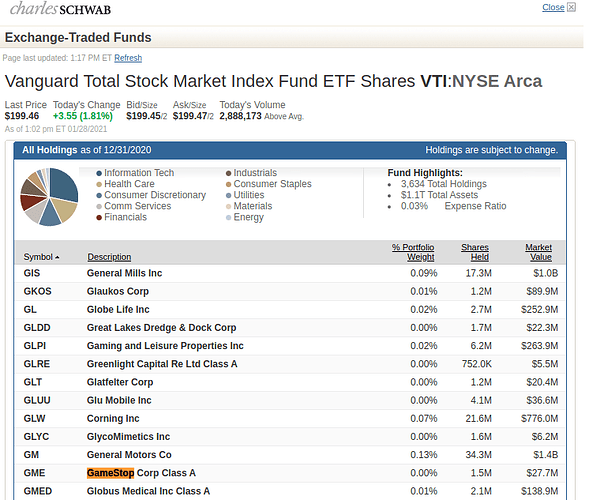

VT or VTI are probably already holding GME.

It’s not in VT

I just checked, VT doesn’t hold any Gamestop shares. VTI holds 1,468,071 shares. This fund has 1.1T in assets, so with the current price of 229$/share, VTI holds 336 million $ in GME, so 0.03% of VTI.

Hi all. So considering that IBKR has suspended buying of basically any stock mentioned on Wallstreetbets, I’m no longer comfortable with them having my business. Not allowing option trading or stock trading on margin I can understand but not allowing me to purchase stocks with my own cash is unacceptable and flat out market manipulation.

So my question is, is Charles Schwab a good alternative? I heard they are still allowing trading of these stocks and in addition still provide us access to US ETFs (which I think is still a bit of an unknown regarding whether or not we will continue to have access to these)?

Cheers.

EDIT: Apparently Charles Schwab has also blocked buying of these stocks. This is absolutely disgusting. Still interested if CS is better though. IBKR has been a pretty crap experience even on good days.

Rh and ib could have donne what they did (canceling every buy order from retail) because their cgu mention that they have the right to cancel any order whithout explanation…

So bettzr start reading the schwab cgu !

It’s immoral, not illegal…

Yes. I cannot purchase BB (which isn’t even sold short). Its just mentioned on WSB and has been mentioned there for a while to be a good purchase due to them turning around their business model and focusing on AI and machine learning for vehicles.

I wanted to buy in on the dip (and I already hold BB).

Yeah, it’s certainly not a good look for IB…

I will also look into Schwaab. What IB is doing is beyond okay in any way.

I don’t know if its because they stopped BB trading but now it lists BB short stock availability at 0. Not even a week ago there were millions available.