Phew this is some hardcore volatility here, I am already looking forward to it shooting back up. I am not selling.

Lol all this halting and vertical moves look very “natural”.

Well, they aren’t even hiding it anymore - this is going to backfire on them.

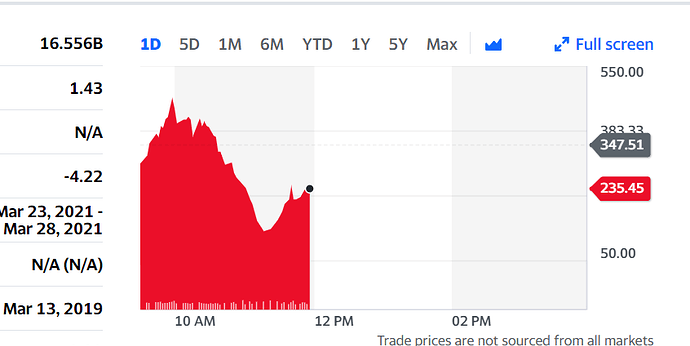

I have never seen anything like this in my life - I was at 45k an hour ago and now 16k lol

I saw some people reporting they‘d been able to buy at IB.

Can understand they restrict transactions on margin and/or leveraged trading.

Restriction fully paid non-margin transactions seems fishy though.

… yeah, what a shame! At least, now we know who is making the rules

edit:

It’s quite the show isn’t it? I’m holding my last shares at least until tomorrow: the options expiration Friday that might be cataclysmic. I also have a sell limit order in place for $1000…

This has been a great learning opportunity. I’m really happy that I made my exit strategy and unwound most of my position on the upswing. I’m already in profit no matter what so now I’m in for the show.

I bet after these dopamine rushes ETFs don’t feel like anything anymore. ![]()

I am glad I pulled out my initial investment yesterday and I was playing with house money.

I will also hold until tomorrow to see what happens, I can’t lose any money but I am bummed that I might not make any money at all - but I am glad I participated.

From next week back to my boring automated quarterly investing into my index fund haha

the constant halting makes this super stressful, the european premarket is much nicer in that regard – a lovely flow to stress out to. But this here is like cable TV: 3min of content, 5min commercial break.

Imagine all Robinhooder would sell all positions they have to protest against RH (the app store rating is already down to 1 star), could this mean a collapse of the stock market?

RH is exactly trying to force their users to sell their positions…

I dont think the establishment quite realise what they are doing here - they might crush the little guy using all their dirty tricks - but physically preventing people from buying stocks? taking out the discord server - apparently there was a DDOS attack on reddit earlier. Getting all their hedge fund buddies on CNBC to cry like little babies and then all the hit pieces (one recently comparing people on WSB as “Alt right” and same as the Capitol rioters!)

I think this really emphasizes why we need decentralised finance and the importance of Bitcoin to be honest.

If they lose - they change the rules. We need to stop playing by their rules. I am going to go and buy some more BTC in protest now

I mean ALL positions, every RH sells ALL positions of EVERY stock. Imaginable?

It’s bouncing back up, I’m only down 36%

okay now let’s get this baby to $1000 pls

Remember who pays Robinhood’s bills. It’s not retail because there are no commissions on trading. The main income sources for them are securities lending and payment for order flow. Big hedge funds like Citadel are sifting the orders in real time and front running the trades. Sometimes a 3rd party will route the order to an exchange or price point which may not be in the consumer’s best interest. Now it turned against them and it’s not difficult to fathom who could have pressured them to halt trading.

I’m really not sure what people expected, those things always happen when it gets too volatile, no need to resort to conspiracy theories.

That’s a drop in the sea I guess, apparently from a quick googling there’s like 20B AUM at RH (compared to trillions at most major brokers).

The thing with RH is that people play a lot on options which tends to move the market more.

There’s so many financial bad takes, it’s cringy. RH makes money on selling access retail flows, but the users also benefits from it (smaller spread), the debate is whether the profits are split fairly between RH and users (it probably isn’t, other brokers give back more to users than RH, but it still benefits both compared to going through public exchanges).

(And I hate that quote btw but that was already discussed in another thread)

Trading is halted in a lot of platforms, perhaps other hedge funds ? xD