Hello everyone

I am sure, that some of you also have a headache rightnow because of the weak dollar. Yesterday I read this article (Absturz: Wie tief kann der Dollar gegen Franken und Euro noch fallen? | cash). In the article, three different predictions are made regarding where the value of the dollar will be in 2026 and 2029. One of the scenarios saw usd/chf at 0.52 CHF for 1 dollar.

Now I wonder, what one should think about such predictions?

Predictions are predictions. That’s about it

USD used to be 1.4 CHF. Not it’s 0.79. So if it goes to 0.50 at some point , it would not be a surprise

4 Likes

But you realize what this means for a swiss investor holding a world ETF with high % of assets exposed to USD? It basically means that the strategy does not work.

I think the dollar depreciation was predictable and overdue. The inflation has been much higher in the US than in Switzerland so USDCHF had to go down to compensate.

0.52 in 4 years sounds like a credible possibility to me given a current 4 to 5% of interest rate difference, the swap rate payed on hedging, and given that 0.79 could still be above purchase power parity. But that could be a pessimistic estimate since the inflation has now receded a bit and interest rate cuts are expected.

Over the long term USDCHF will continue to decrease as long as inflation remains lower in Switzerland, we just don’t know what the short term fluctuations will be. USD against CHF is not an apple to apple comparison. One has to compare USD and interests against CHF and interests to be fair.

A world ETF of stocks is exposed to USD not through the trading currency but through the currency in which companies do their business, which is basically the whole world. Unlike bonds, prices increase and follow the inflation so stocks offer some protection against inflation, and the decrease of USDCHF due to inflation, in the long term.

3 Likes

Yes. But it has always been the same

When a Swiss investor invests in US stocks, they take two types of risks „company risk“ + „currency risk“

The assumption that investor has to make is if currency devaluation would be compensated by the positive returns from the company.

Historically it has been true. But this does not mean it will be true in future too.

Investors are often prone to extrapolate but it’s a bit dangerous. We need to be comfortable in not knowing what will happen and remain diversified

- Few months back everyone was extrapolating that US is the best stock market and nothing else matters.

- Now we are extrapolating that CHF will remain strong forever

NET CHF returns = fx( US stock returns , FX )

You can try to hedge currency risk. But then you need to pay hedging costs too. Hence hedging only works in your favour if currency depreciation is more than hedging costs.

Having said that , I have been reading that many foreign investors have started hedging partially their currency exposure in US.

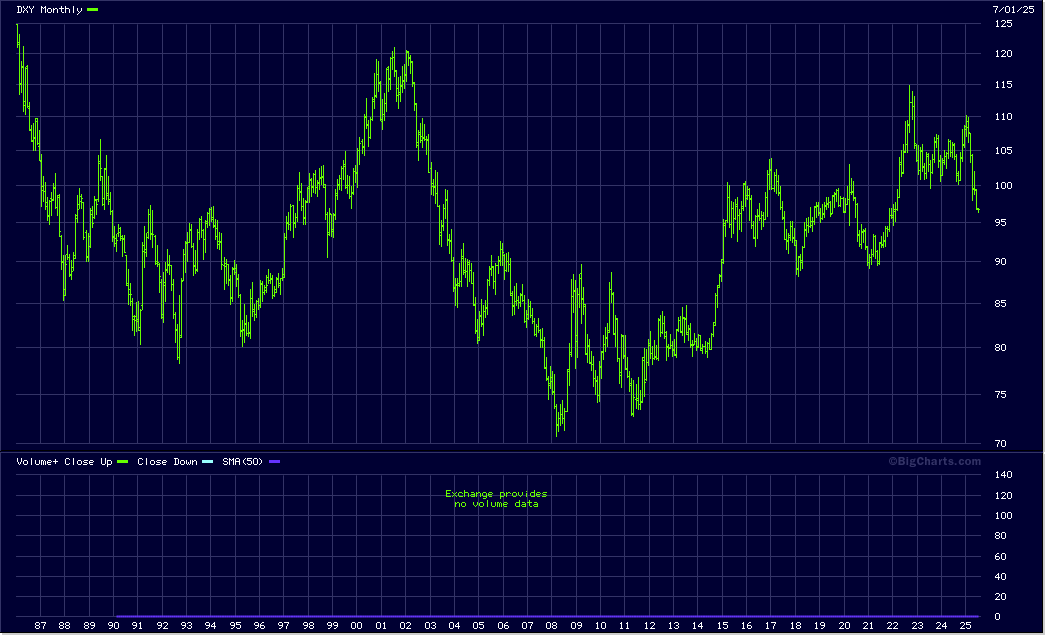

Much noise about nothing. Trump wants to copy Turkey, but he will not stay forever. The Dollar may fall and must rise. Check out the long term Dollar Index:

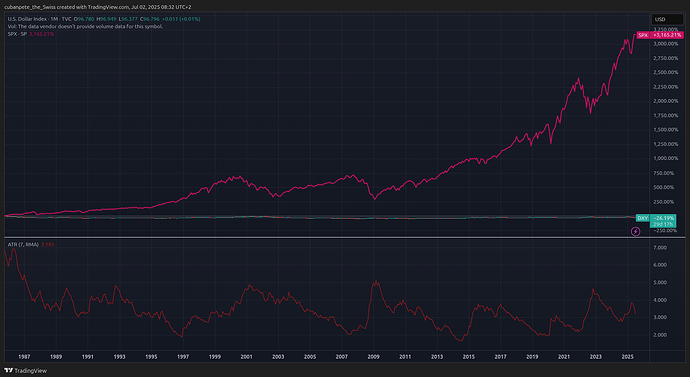

Now compare that to the performance of U.S. stocks, loss of 26% compared to gain of 3165%. It is peanuts…

6 Likes

Good overview but we need to remember long term charts don’t matter if an investor get stuck in a time period where net US stock returns are lower than currency devaluation.

This is why we have to understand that a particular person‘s experience might not be the same as what the overall experience looks like using headline numbers

Just to give an example (not from FX perspective but from another big trend we have seen) . We all know BTC has gained significantly over the last 5 years

- a normal person doing DCA of 1K USD per month for last 5 years would have had absolute gains of 230%

- But MSTR guy who talks about BTC all the time, has an average cost of 70K USD which means absolute lifetime gains of about 50%.

- A normal person doing DCA of 1K USD per month for last 5 years in QQQ would have had gains of 80%

So a theoretical person would have outperformed QQQ but the messiah of BTC underperformed QQQ. I used 5 years because MSTR started buying 5 years ago

Poor short time investors, yes.

An investor needs to understand that time works the other way around when investing. In real life you may know what you will do the next moments, hours, days, but not where you will be in 20 years (OK, 6 feet under in my case…).

If you cannot ignore the short term noise probably that business is not for you!

Of course you can hedge your investments for currency. But this is a very bad idea. Either it will be very expensive or it is just another bet, added risk. Whenever you think you know something for sure (the Dollar will go down)… guess what happens.

7 Likes

Agree on the principle.

But even long term experience of a person depends on when their experience begins & ends

Obviously yes, every period is different. But just play around with the TradingView comparison. You will not find a long term period where you would have made less with stocks than lost with currency. That is a fact. And the shorter the period the more volatile is the outcome.

Of course when the Dollar or any other instrument goes down you will hear everybody whining about it. But it is just not that important…

1 Like

I don’t think comparing stocks with currency is the right comparison.

Shouldn’t the comparison be Foreign stocks vs Domestic stocks?

I think that would be another interessting comparison. It would show another view on this topic.

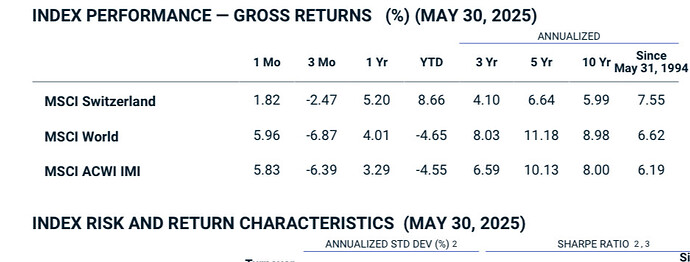

Since 1994 , Swiss stocks have outperformed Global stocks

Source

Now rolling 20 year returns comparison would be more interesting

1 Like

Hmmm, that is interessting. It speaks for some some bias  …

…

Predictions are useless. The same site also predicted that € would gain parity to CHF again last year.

The thing they do is take recent movements and draw a linear line, then call it prediction…

The only thing we have is the interest rate parity theory. That would predict a devaluation of the $ according to the interest rate difference between the currencies.

But then there is also carry favoring the higher yielding rate.

Also unless the devaluation is higher than interest rate parity predict, you will basically not make extra money if you take the other side.

Just be happy you buy more US stocks now and continue buying.

9 Likes

Any prediction is useless and every stock is its own currency. I did compare U.S. stocks to the USD index and the difference is that big that you just can ignore currency fluctuations. That was my point.

If the community starts whining when the USD loses a bit, what will happen when the bitcoin will start its decline, which it obviously will sooner or later?

2 Likes

Maybe part of the reason for the recent rally of US stocks is because the dollar is low. E. g. iPhones can be sold for less in ex-US and/or Apple earns more per iPhone if dollar is low.

1 Like

A brigader for diversification in the Bogleheads reddit used to keep posting a list of 40-50 items, among which was one saying “US companies did not inherently become better than ex-US companies, it’s a combination of rising valuations, dropping dollar, low/zero interest rates”. Of course all of this is beyond my brain’s capacity to understand

I am more aligned with @cubanpete_the_swiss: happy to lose 25% in exchange rate if it means I am making 15 times that in stock price appreciation. That was the thinking ~4 years ago to start off with a US tilt too.

1 Like

There is no denying of the fact that US has delivered some exceptional companies in the big tech space. All of the mag 7 are really very good companies.

In my view other than valuations , fx and interest rates, EU crisis etc , the main reason for US outperformance post 2011 is the emergence of these exceptional companies with global MOAT.

However, the overperformance for next 20 years would depend on following

- If more such companies will come from US & if they will be reasonably priced when they IPO

- If these Mag7 will dominate globe or they will become less dominant due to push for isolationist agenda (which inherently drives innovation in other regions). Let’s face it China has 1-1 competition for most of these firms except NVDA. So it really depends what would happen in Rest of world in terms of tech stack (American, Chinese or Sovereign)

If you think about it - what made US truly exceptional was the environment it created for innovation by embracing diverse talent from the world, creating an inclusive culture & provide stable governance to foster businesses. Time will tell how much of this will remain in place

3 Likes

There is no real rally

It’s just repricing & return to original value because now tariffs are deemed to be lower than liberation day announcement