Unfortunately no more money to buy more. If the correction lasts until the end of the month, I’ll buy something else. Are you others selling or hodling?

HODLing and DCA buying more monthly with the next salaries as long as it hasn’t reached any “excessive” prices.

Does BTC trading venues/exchanges have circuit brakers or any other mechanism to prevent crowd being irrational?

If not, I just can’t comprehend how any institutional investor would justify meaningful investment in BTC when the value of their investment overnight can be approaching 0 and there is no “incompetent” FED to step in to normalize market.

So does the curse work only on stock market? ![]()

Crypto kids have just recently invented accumulating funds and buybacks, you will have to wait until they will grow to this idea.

I’ve read that “crypto is a fast-forward of 400 years of banking history and how regulations came to be”. Eventually they’ll reinvent the wheel, for sure.

What’s interesting is how many crypto maxis have an extremely poor understanding of how finance, or TradFi as they’d probably call it, works. I was talking to a friend about options and he said “gosh that sounds like gambling”, this from a person who’s tied ~90% of their NW in crypto, hoping for a big win this year or the next.

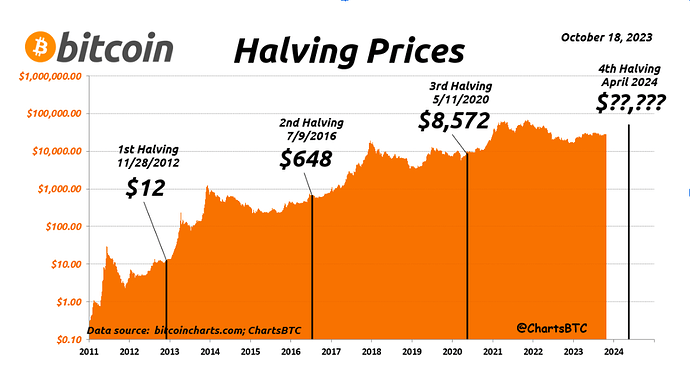

Hier ein übersichtliches Bild bezüglich der vergangenen Halvings und der Preisveränderung vor und nach einem Halving.

Can’t wait for my salary, very nice deep to buy!

That’s the whole point of being decentralised, we limit third party interventions as much as possible, if people value it at 0, then be it.

As for institutions, it s a $1T market cap so it starts to be “safe” from that perspective, but it is interesting because for some of them it is still not enough. So there is the possibility that bitcoin will become much more attractive to bigger institutions once we reach 2,3,4,5 trillion market cap.

Investment companies issue shares and use the proceeds to buy other assets. This is nothing new. UK investment trusts are an example.

What is different is the flow of equity and debt investors convinced that BTC is different to any other asset in history and is certain to go up over time, .

Saylor does a convincing pep talk but in the end his substance is “Bitcoin is the ultimate asset” and it seems like an act of faith whether or not you believe that.

Can you explain why it would it be a competitive advantage?

I am familiar with financing companies and it doesn’t make sense at all unless the objective of a company is to speculate in BTC

“Bitcoin has no top because fiat has no bottom”, if you price things in bitcoin, everything is getting cheaper. Saylor is just smart for trading one for the other.

Also, he announced it 30min ago, they now own 214’247 btc acquired at an average price of $35k. I am starting to doubt we will see below $40k price anymore, so I doubt they will get liquidated.

They will probably have financial products around bitcoin soon, and I won’t be surprised if microstrategy becomes a massive bank/insurance in 10 years from now. But hey, I am just a short term gambler so who knows.

Remembering tulips, those were also decentralized, I guess back then somebody made good money with them as well and even they are still in use today…sorry for the joke, compensating for the lost opportunity in BTC ![]()

So far all those institutional investor providing BTC ETFs act as agents and we yet to see anyone investing as principal, apart Microstrategy. Many others? Pension funds?

Btw, how do Blackrock and others mitigates password loss issue or that shady IT guy transfers BTC to some anonymous wallet issues?

If you price everything in BTC, especially once it’s fully mined, it’s a deflationary asset. What do we do then?

So at what price should we buy more ETH and BTC?

Are we sure he announced it to share information or he is trying to put a floor to the price ? Slayer has exposed his entire company to Bitcoin. Bitcoin is down 14% , MSTR is down 28%

It might sound like a very good strategy in bull run for BTC, but can cause disaster in the bear market.

As far as SEC or FED are concerned , they have said this already that people are on their own

At any ![]()

(20 chars)

Only the good high quality stuff.

Assuming it goes up forever you gain freedom to develop good stuff instead of chasing to invest the cash now just to avoid loosing its value resulting in crap products and failed projects.

Zero risk to Sayler personally. The more people invest in his company’s fund the wealthier he gets (commissions)

He has settled accounting fraud cases and is accused of tax fraud. Make of that what you will

Anyone know if you can buy bitcoin ETFs in Switzerland? Tried to buy IBIT through interactive brokers but it gives me a message saying “Clients from your country cannot open positions in crypto-related products”.