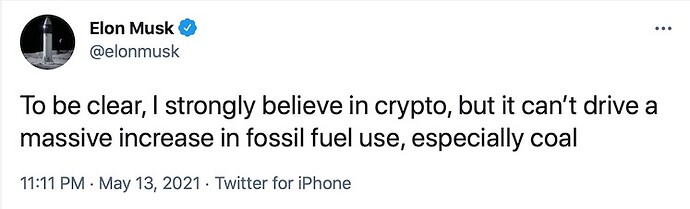

A few days later…

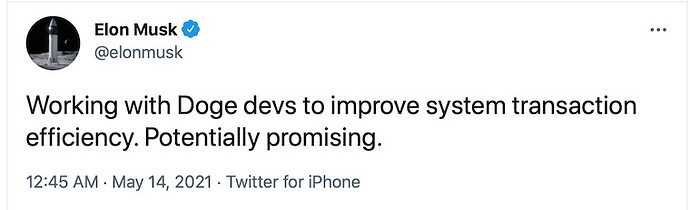

Also Elon:

And:

Yeah, as if he didn’t know that when his company pumped a billion into Bitcoin.

Then dumped (some of) only weeks later.

Guy’s a nutter.

Or a troll.

Possibly both.

I seriously hope all this shitshow is part of Musk’s hidden agenda. Because if not, damn…this is frightening.

How in the world a guy of this status could spend billions on BTC one day and then just a few weeks later turns his back on it because of its energy consumption issue. I mean come on… Anybody who has only read one article on crypto in the 20Min knows this is THE main issue of Bitcoin.

And I am not even talking about his tweets on Doge stating “Yeah let’s just increase its block size and speed up its block time!” while ignoring all the discussions and events that already happened in the crypto sphere between 2015-2017 during the block war.

This is simple market manipulation!

If you do it with securities you get in trouble with the SEC as it already happened with Elon Musk like in march this year:

or in 2018 with Tesla.

https://www.sec.gov/news/press-release/2018-226

Elon Musk has no respect for SEC so he is playing the influencer on the cryptos that are not securities.

And now he confirms that they did not sell bitcoin as speculated…

He lost a lot of credibility this week, it is really sad.

I think he’s exactly as credible as he was last week.

Musk seems to be this bull run’s McAfee.

At first everyone seems to love seeing a billionaire/extremely rich entrepreneur (not sure of McAfee’s net worth) backing crypto but eventually it goes bad

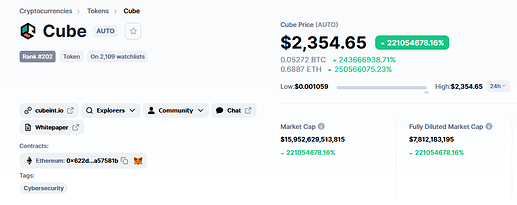

Try to find these numbers:

- how much gold is currently held as storage of value

- how much gold is needed annually for industrial use

Then divide 1/2 and you will get the number of years that we could satisfy annual demand with our current reserves. This would tell us the “real” value of gold.

Alternatively:

- check the annual production of gold (mining + recycling)

- check the annual consumption of gold for industrial uses

- check how much it would cost to mine enough gold to satisfy annual demand

Since mining gold is an activity with an increasing marginal cost, it makes sense to delve into mining to the point where the cost is as high as the current price of gold. If gold was only needed for industrial use, its price would purely come from production cost.

My point is, even if gold has practical purpose, it’s probably a fraction of the price. If suddenly everybody, who didn’t need gold, dropped it, the price would crash to a level that makes it almost irrelevant that it has a practical use case at all. Is it such a difference if your asset drops to 0% or 2%?

Wow, you guys sure have produced many posts last month, took me a while to get up to speed.

I might be totally wrong here, but I think BTC energy consumption is not a matter of efficiency. I see it like this:

- You get a reward for mining a block.

- The higher the price, the higher the reward.

- So the marginal cost of mining operations will follow the price of BTC.

- That means, regardless of the number of transactions, the cost of mining should always fall a bit under the total return from mining.

- And the total return from mining is: number of BTC mined as reward (constant) * BTC price.

- So if BTC price goes up 10x, the energy cost will also go up 10x.

- There is also the periodic halving of rewards to take into account.

Actually, I have “studied” the tulip mania a bit. First of all, it is possible that a lot of the data is fake, spread as ancient FUD scare stories. Second of all, the bubble has been largely caused by regulatory action. That is, at a certain point, all the tulip future contracts have been converted into options. This makes the price skyrocket, because if you have a contract that says “in 6 months you will purchase my bulb for $100’000” and then it changes to “you may purchase it for $100’000”, but you don’t know it (and the other guy does), you will be willing to make this deal.

I think the biggest feature of BTC is that you don’t need a central issuer that controls the supply (like gold or other physical valuables), and it’s possible to exchange it on the Internet (unlike gold).

When you exchange goods and services, you need currency to avoid barter. So you do some work, you get paid, then you buy some food. But if you’re paid in currency that belongs to a central issuer, he may increase the supply, causing inflation. With BTC the inflation level is known and there is a cap.

Additionally there is the matter of oppressive governments, tax evasion and convenience. In order to escape taxes, you need to use cash. Carrying and storing banknotes is impractical. With crypto the transactions are made digitally. Disclaimer: I’m not saying this is right or wrong, just stating the use case as a matter of fact.

Honestly I don’t care about speculators and day traders, who lose some money in the short term because of Elon’s tweets. I think it’s stupid that an organ like SEC is controlling what “responsible” people in high position are allowed to say. It’s just about keeping appearances. The same goes for insider trading.

I’m not happy about TSLA betting strong on BTC, only to withdraw a few weeks later. But I don’t feel sorry for anyone who acts upon these public announcements and then loses money.

Neither do I care about the day traders. But I care, like the SEC, about the advantage of Elon Musk, through his tweets, on the market. The SEC is not there for the appearance, anyone in the US is investing in stock for his retirement and stock is part of the democratic system. I am convinced that the tweets are anticipating movements in the market. Maybe not directly for Elon Musk but for some of his friends or related societies.

If you’re investing for your retirement, you don’t care about day-to-day swings. I’m not a big fan of the SEC. It was created after the 1929 crash, as if the crash was caused by market manipulation of some evil forces, and not by failed government regulation.

Seriously, anyone who acts on Musk’s cryptic troll tweets is responsible for his own actions. Anyone actively investing with TSLA should also be aware that the boss is prone to act this way. You don’t like it, don’t invest. I’d like for the people to stop looking for someone to protect them from their own stupidity.

What’s missing for me is why people will trust BTC. First we used commodity money which people trusted because it was backed by the value of what it was made out of (copper, silver, gold,…). Then came fiat money which is trusted to a greater or lesser extent because it is backed by government promises.

Now we have BTC which AFAIU is trusted by some people because of :

- a unique piece of code that can’t be counterfeited (that is pretty much valueless otherwise)

- a mutual trust between people to transact in it: especially in countries like Nigeria, Venezuela,… where there are restrictions on accessing USD and people trust BTC more than local fiat

- huge price increases pulling in more users

This trust seems fragile. What if a new technology comes along that people in these countries trust more – e.g. USA or China Central Bank announces its own crypto? Or we have a price decline triggered by E Musk Twitter account (?)

First we used commodity money which people trusted because it was backed by the value of what it was made out of (copper, silver, gold,…)

But where did the value of gold/silver/copper come from? It was a shiny metal that’s difficult to find, so a lot of the value came from scarcity.

Then came fiat money which is trusted to a greater or lesser extent because it is backed by government promises.

But what kind of promises? The promise to keep inflation at a steady low level, maybe. But can the central bank really control inflation? A fiat currency is not backed by anything, it’s just pegged to the real world by prices which normally do not change on a daily basis. So there is some inertia which keeps the value of fiat money stable. Then there are taxes. Taxes have to be paid in the local currency, which creates demand for it. Fiat money makes for good means of exchange, because you can quickly sell something and then buy something else. But as a storage of value it’s not so good, because it is prone to inflation.

This trust seems fragile. What if a new technology comes along that people in these countries trust more

This kind of risk also exists with fiat currencies. A poorly managed currency will lose its value over time. The advantage of BTC over fiat is not that it can be unconditionally trusted. The advantage is just that there is no central party who has control over money supply. BTC can be patched and improved. The direction of its development is set by a consensus reached by the whole community of miners and developers.

USA or China Central Bank announces its own crypto?

A cryptocurrency controlled by the government has no advantages to the people over fiat currency.

It was created after the 1929 crash, as if the crash was caused by market manipulation of some evil forces, and not by failed government regulation.

On the other hand, the crash of 2008 is totally due to the lack of control and the SEC turned a blind eye.

And I have to check my History Books, but I am not sure I can sign off on the fact that 1929 crash is due to failing government regulation.

the crash of 2008

I guess it depends on who you listen to. To my knowledge, the crash of 2008 was caused by lowering interest rates to unnatural level in order to stimulate inflation, and by quantitative easing, which spilled over to mortgage loans. So yes, also by manual override of the economy by the government.

Palantir is considering adding BTC to their balance sheet

And who is Palantir’s founder? Elon Musk’s friend Peter Thiel. The PayPal mafia is at it again ![]()

the crash of 2008 was caused by lowering interest rates to unnatural level in order to stimulate inflation, and by quantitative easing, which spilled over to mortgage loans

AFAIK the consensus is that it was due to money market funds and mortgage based security, in particular by financial entities outside the reach of the US regulation creating a shadow banking system (e.g. in Europe). It’s actually very interesting how tether mimics money market funds.

What’s missing for me is why people will trust BTC.

You are about to dive in the rabbit hole with questions like this ![]()

Bitcoin (and other blockchains) is a trustless system that minimize the need to have a central authority, it distributes trust instead with its proof of work protocol. There is a consensus mechanism that will confirm the transaction for you.

It can be quite technical because it touches public/private keys, but to simplify, if I send you 10’000 sats, the entire bitcoin blockchain protocol will confirm the authenticity of the transaction for you. And because it is decentralized and public, you can check it yourself, you will see that the transaction has been “confirmed” xxx numbers of time. You can even go further and use your own node to broadcast the transaction to the network.

You can search “trustless system” and “proof of work” if you want to learn more about it.