Isn’t gold also used for small electronics components ?

Neither gold/silver or cash have expectations beyond wealth preservation (or for cash mostly being usable for commercial transaction).

Most of the current BTC holders (and esp. all those recently jumping on the bandwagon) are hoping for some gains. Ask most people currently invested in BTC if they’d continue putting their assets in BTC if it was just preserving wealth, nothing more, I bet most people wouldn’t be interested and would go back to more traditional (productive) assets (but who won’t go to the moon).

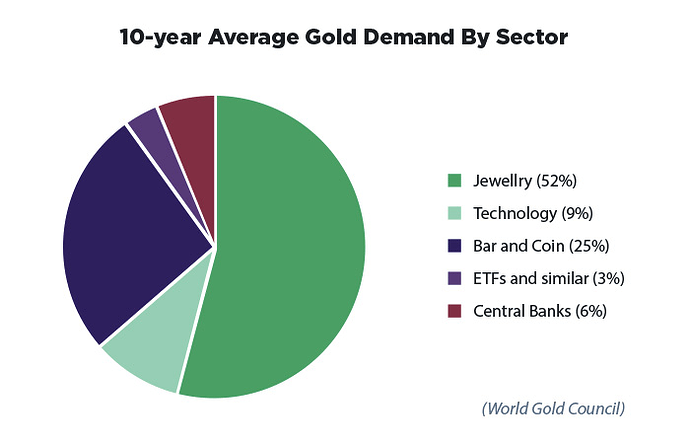

It’s a good conductor, with a low melting point, that can be worked into thin sheets and doesn’t tarnish. That last property probably played in it being used as a store of value since it made it resilient to the test of time. It’s main usage is jewelry.

Diamonds are in the same spot, being used in industry for cutting tools and not loosing their luster making them jewelry and symbolic material. (A third thing they have in common is the environmental and social cost of their mining, mainly due to their value outside of industry usage).

Here’s an insightful blogpost on it: Why Is Gold So Valuable? History's Timeless Metal [UPDATED FOR 2023]

And the graph in it:

I keep seeing posts / articles about mainstream financial institutions getting onboard. Why? Or is it just their trading divisions riding the wave(?)

When there’s a gold rush the best place to be in is to sell shovels

(yeah it’s the trading desks that usually make the news, there’s also a lot of arbitrage that can be done since if decades away from the complexity of the modern financial markets, but this part can likely only be done by small shops due to scale)

Aaaand, thinking more about it, Bitcoin could hold its value in the way bricks from the Berlin wall do: by being the first crypto, as a piece of history, for collectors. Rich people from the future may be willing to trade some good currency of the future for it, afterall.

Isn’t one satoshi enough for that?

The greater fool theory ![]() we almost have the bingo of all bitcoin FUD today, congrats!

we almost have the bingo of all bitcoin FUD today, congrats!

It’s not written by an academic, but by the Human Right Foundations: CHECK YOUR FINANCIAL PRIVILEGE

Some supporting data:

- P2p bitcoin trading in India +117% vs last year

- P2p bitcoin trading in Sri Lanka +800% vs last year

- Same for Morocco, Brazil, etc.

- P2p weekly volume in Africa has reached $20m

- all the above is available from public on chain data, because bitcoin is public.

It is easy to find additional explanations for the four use cases I quoted, I can find other articles if needed.

That doesn’t seem like a very good use case… it’s way more volatile than even VT. Are people really ok with having 5% or 10% change overnight in their assets’ value?

Given the choice, those people would likely prefer coin linked to a major currency, right? (as mentioned in the article linked, the main motivation is to bypass capital control and avoid potential hyperinflation, while high volatility and expectations of going up and to the right are a concern)

If you invest each month why not ?

Someone do that no cash in bank all in bitcoin and invest each month whatever the price of BTC.

Begin in 2016 without error so no issue at all if you not sell against fiat you just don’t care the price VS fiat. Only number of BTC is important so you win/lost nothing it’s just your new trusted currency.

Just to be clear, and yes, I’ve switched position a bit: I do recognize the use of a decentralized financial monetary system to be useful for protecting human rights in some economies/regimes.

To make sure I am understanding properly, by “Human Right Fundations”, you mean the fundations cited in the article you’ve linked to (and probably others) and not a specific ogranization that would be called that (and that I haven’t found)?

Also, both effects can operate simultaneously: a societary revolution can start in countries that are needing it and western fools can pump money into an environmental disaster at the same time. I find it enlightening to find people starting to research other cryptos (example, Kevin from “Meet Kevin”) when they were talking enthusiastically about Bitcoin and Dogecoin earlier, admitting that it was done without much research - meaning that a lot of people, and I’m among them, are talking about the topic without knowing what they’re talking about. “Experts” abund on boards all over the web. Most of them were there in 2017, had vanished in 2019 and now are back, magically (I’m granting that some people are true believers and are unfortunately caught in the flock of new prophets, sorry for them).

The reaction to Elon’s tweet enlightens this aspect, with people discovering what was widely publicly known when Elon took Tesla into Bitcoin (that mining was in big parts powered by coal and fossil fuels) and moving away from it, toward DOGE of all things (because that crypto has good fundamentals, of course).

It’s the eternal situation of devoting resources where they’re needed. If we want to support the people who need it, that’s great! The energy consumption of the people living under tyranny who need a currency to which their government has no access is fully justified but let’s not burn fuel on things we don’t know, acting like they are coffee beans futures ripe for speculation.

I don’t think volatility matters in this case because if you send $50 to your family in El Salvador, it will probably be immediately used. And the reason you don’t want to send usd directly is because it might take days and cost a lot in fees, without mentioning safety if you need to go gather the cash in person at an agency.

I mention El Salvador in particular because the Strike application was just launched there as a test market and it seems to work as advertised: near instant and free transfer using the lightning network

Yes the author is working for this foundation, a great guy to follow if you want to learn more on this topic.

You are absolutely right, and that’s what I like about it, you can have your own “story” and use it the way you want, whether it is to day trade or get a loan.

The article mentions mostly inflation concerns (so where people would hold btc instead of local currencies, that’s where high volatility would be an issue).

You’re now talking about remittance, where you’d still get fees to on/off ramp the transactions (but have a small vol exposure).

FYI digital remittance is actually not that expensive, and prices have been continuously going down (esp. if you take into account it’s money transfer+fx transaction), when not using traditional channels (~3% avg).

The world bank tracks the evolution of prices: https://remittanceprices.worldbank.org/

(I had the chance of hearing from field experts, and it’s surprisingly a very low margin/competitive market, I’m sure if they could lower the cost with btc they’d do it, but traditional fx markets are probably way cheaper for them).

Found them, thanks: About - Human Rights Foundation

Looks interesting.

Also, thanks for your inputs, I don’t think either of us hold the truth but you’ve managed to bring to light some of my blindspots so that’s appreciated (I’d still not advise anybody to invest in cryptos by buying coins but I can see some use cases - which don’t depend on the value of the coins skyrocketing).

If you click through the links in the article the official Nigerian government exchange rate used for international bank remittances is 20% worse than the black market rate and this is the main reason why people changed to BTC.

I can see why people in Nigeria, Venezuela, Argentina ,.etc … prefer BTC to local currency. It seems people in Nigeria are collectively agreeing to use BTC as a unit of exchange. For a currency to work people need to trust it and it seems BTC has this inNigeria for now.

They could open a lightning channel between agencies, the gain in operational efficiency could be massive.

Also, I can imagine that final settlement in a few minutes without intermediaries could be a big plus, and the fees are not a % of the amount you send which is great for big amount. Not sure how it happens between countries, but I think it is not completely crazy to think about it.

I recently used transferwise to send money to the US, I would have much prefer bitcoin.

Doss the transfer have to be denominated in BTC for this to happen - couldn’t the transfer conceivably happen in fiat currency via a blockchain technology?

crypto tokens use blockchain, but you don’t have to use crypto to use blockchain, do you (?)

I guess it varies on a case-by-case basis. And what you are describing is a stablecoin denominated in USD, EUR, yuan, etc.

As we were discussing earlier, you probably don’t want to use tether because of their poor financial states, Eth could work but I don’t see an advantage over btc, it is actually more expensive, and you don’t want to use random coins with low usage rate.

I don’t have working knowledge of the question, but let say Iran wants to buy gas to Russia, or the red cross wants to send donation to Myanmar, I can imagine btc would make sense here. Just some thoughts.

Technically any CBDC could work (as long as it’s not strongly permissioned), and would provide more stability. That was also the approach taking by FB (the original libra plan was a basket of major currencies).

That said (as shown by libra), it might provoke a fairly strong pushback from developing countries, since it would facilitate dollarization (that’s what happened to libra, project was scraped).

Dollarization (usage of a foreign currency) has pros and cons, the hardest part is that once in it’s really hard to leave that state, and the country would be giving up it’s right to mint currency which can be a critical tool in case of crises.

https://www.imf.org/external/pubs/ft/issues/issues24/ has a pretty good summary of the implications.