Did you hear from @Cortana ? Still holding?

I agree that it is important to take into consideration potential conflicts of interest. Please keep in mind however at the same time that whoever is invested in Bitcoin also has a conflict of interest.

In other words statements of Michael Saylor and a likes should be taken accordingly.

Having said that it would be interesting to understand where you see the weaknesses of the article and the statements made.

True, Saylor talks a lot of hype as well. I dont really like listening to him as the statements are often so extreme and a bit weird.

The article for me however is just factually wrong and shows the author doesnt understand the matter or miuses it intentionally.

For example ponzi sheme, certainly he is aware of the definition but completely misses the point. As there is no central authority benefiting from btc, it cannot be a ponzi.

A crash of btc because of stablecoins. Absolute utter nonsense.

I dont really have the time now to disect everything. Basically i just wanted to point out to take these opinions with a grain of salt

all of what you said is applicable to gold as well for example. and with some differences (that probably make it worse) to most currencies as well. I mean you can even go further and expand that same argument to bonds and stocks. Yes the money has to come from somewhere and it’s either from another “fool” that bought your stuff directly (BTC) or indirectly (bought an iPhone and you own apple stock), or it’s because of money printer.

I also don’t understand your fixation with fees. Fees isn’t money/bitcoin that evaporates. It’s a price billed for a service. You either have fees to buy bitcoin (which goes to exchanges) or fees to move bitcoin (which go to miners).

I am starting to regret my answer in this poll ![]()

and I was too pessimistic ![]()

It’s getting interesting again… game theory.

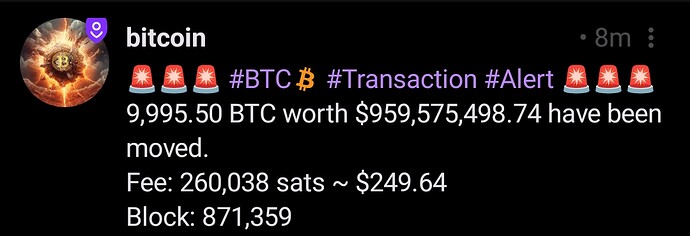

wow. 139mio in bitcoin moved for 13.14usd

this one also not bad

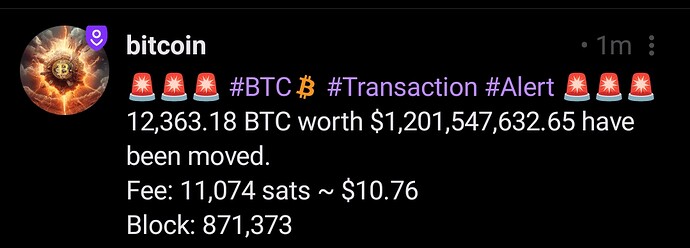

1 billion!

… and better 1.2bn for 10 bucks

Well, should have stayed diversified instead of putting everything on ETH lol. It‘s not a huge amount, but I left a couple of k on the table. Luckily it‘s not bothering me as I have other worries at the moment.

Potentially altcoins will catch up soon.

When ETH pops its probably a good time to get out and shift to BTC.

I would not hold anything else than btc to be honest. I think bitcoin is a very special and fantastic thing. But the “crypto” market is basically a giant rip off

Don’t worry, ETH is usually the first one to open the dance when the altcoin season starts ![]() It will come in it’s due time…

It will come in it’s due time…

I agree with @Joe_Coconut. if ETH pops, transfer some to BTC, or if you have additional savings and want more exposure, just buy BTC when you think it’s a good time to re-balance your port.

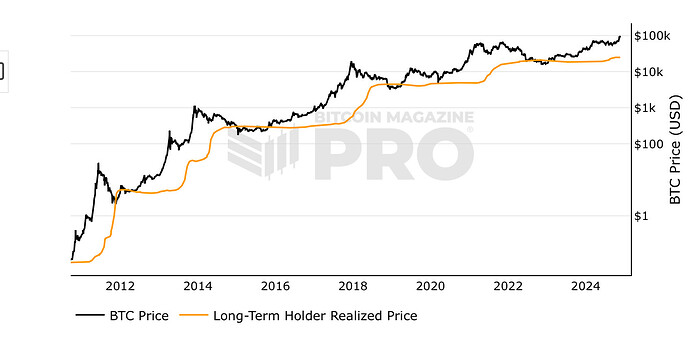

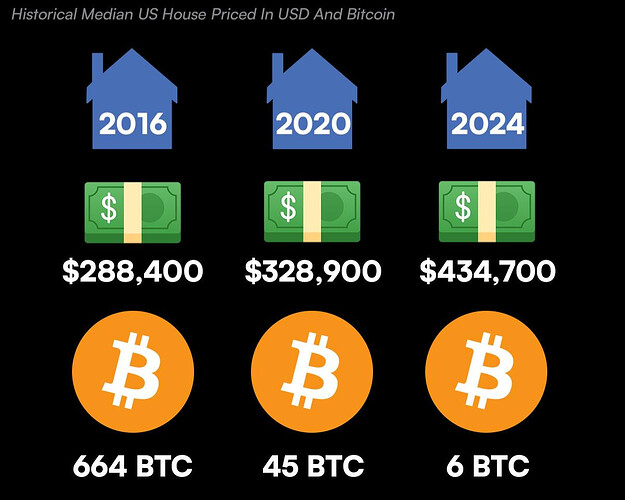

Does this chart really mean what I think it means?

My interpretation

Every now and then, the actual invested capital in BTC becomes equal to the actual market cap of BTC. Intuitively it makes sense because there is no returns generation and only cost generation (maybe not high costs) and hence the personal equity is the net asset value.

Does it mean the long term market cap should be expected to be at same value as the long term invested capital ?

P.S -: I know it’s a log chart

I actually plan on doing exactly that with my 5.5 ETH.

The only questin is at what ETH/BTC ratio? 0.40? 0.45? 0.50?

I’d buy BTC now. In the long run, everything goes to 0 against Bitcoin.

I have only btc.

Sold all else and not planning to buy again.

I like ETH as a technology . But i dont trust it as an investment. The governance sucks compared to stocks

including my apartment ?? ![]()

I agree with stojano. Just do it now.

As for ratio I’d do:

ETH = 0.25

BTC = 0.70

DOGE = 0.05