Actually i get what BlackRock is saying. They say that even though around major events , there is high correlation, over longer period correlation drops. So that is why intuitively the feeling is different versus 6 month averages

Data to support this statement please?

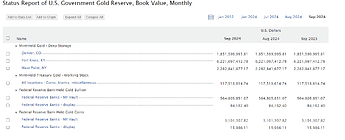

That says 10 billion USD, and is the historic book value, not market value. The US has 8’133 metric tons of gold in reserve, worth currently about 600 billion USD.

Oops. ![]()

I’ll see myself out. ![]()

Edit: Let me be helpful in other ways: the 8133 metric tons of the US gold reserves can be packed into a cube with edge length 7.5 meters.

And as Warren Buffett said about gold - all the gold in the world, a 67 foot cube (whatever this means in metric): “it’ll be the same in 10 or 1000 years, it won’t have grown, or produced any dividends, you can fondle it but it won’t care” ![]()

To continue off topic (which is anyhow more interesting than on-topic): a 67 foot cube is about a 20.4 meter cube.

Probably double the cubature of the house we rent, but I’ll still generously offer here, on the spot, to take care of storing half of the world’s gold reserves at my home.*

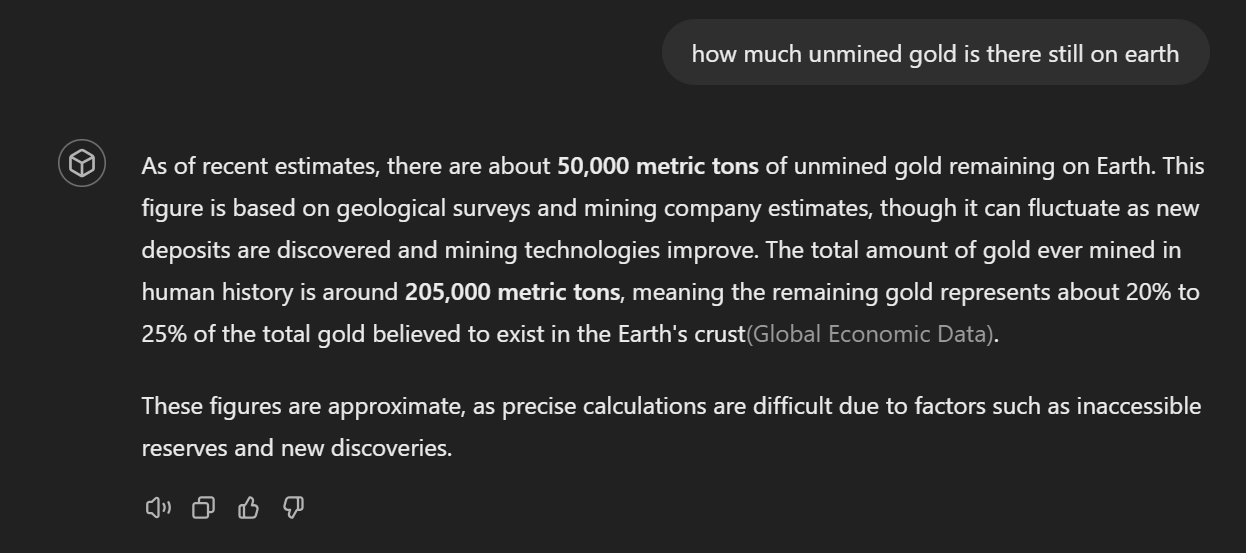

There actually still is unmined gold in human accessible layers on earth and very sophisticated estimates** say it’s about a fourth of what’s been mined already.

Kinda similar to Bitcoin – how about that!

Although, to be fair, gold is still being produced out there … like in supernovae explosions and neutron star collisions basically everywhere across the entire universe …

But then again, that gold is not human accessible and producing gold on earth is out of question given the energy that is required. Going out on a limb here, but I would guess that all the energy wasted already put into calculating the blockchain that is Bitcoin wouldn’t produce a single gram of gold. YMMV, of course.

Image: Early alchemists mining gold.

Then, there’s also quantum computing. Any amount of quantum computing – unless they reach supernova level energy consumption or so – won’t create gold. But they will eventually break Bitcoin’s cryptographic protections. Not today, not tomorrow, but some day (not measured in centuries).

Have fun enjoying the greater fool’s game until then.

I’ll … er, show myself out again.

* Ok, off-off-topic: I wouldn't exactly store it at our house, but at a place that I did tour a few years ago where national reserve banks (and very very very rich individuals) store their gold reserves. Spoiler: it's in a former military Swiss army bunker under a mountain with its own under-mountain lake, an internationally accessible airport, and basically defendable with a guy with a gun (unless you have already successfully invaded Switzerland) ...

** Chat-GPT:

If this becomes reality, there will be a strong incentive for users to agree on a quantum resistent algorithm.

Edit: If I read you correctly, you’re saying that when quantum computing breaks Bitcoin’s cryptographic protections, then Bitcoin’s value drops to … approximately zero?

Oh, sure.

Now, if when that becomes reality, everyone please orderly migrate over from Bitcoin to new QR*-Bitcoin … pick the one you like, because there’s many to choose from (in fact, I’d bet some already exist).

And please, no pushing or shoving, everyone please just orderly convert from current <insert your favorite flavor> coin to new QR-Coin(s).

Best to migrate to the one that will best transport the existing message and where owners continue to believe that there are always greater fools that will buy the new QR-Bitcoin at higher prices.

The latter – the greater fool theory – has been a belief for centuries already, if not milleniums. So, not arguing with that. Just suggesting you don’t make yourself believe that there is any value to be attributed to an “asset” that does not produce any cash flow.**

Please don’t get me wrong: in a computer science myopic sense, the blockchain is somewhat of an invention*** … and if you believe in the Bitcoin implementation of it, go have fun with it, by all means.

* QR: Quantum Resistant.

** Which brings me back to @Mirager’s point: gold is just as useless for producing cash flow, but at least it is actually scarce and not reproducible. I don’t own any of it.

*** Though actually rather simple and decades old, certainly not in the league of other more recent computer science advances.

You wont need to migrate. Bitcoin is not a fixed software but is continously developed.

If there is a change in the consens algorithm, there will be a hard fork. Similar to what happend during the blocksize wars when btc cash cane into existance.

The network with the most participants obviously will prevail.

Btw. I dont think blockchain is a good tool for anything else than bitcoin. From an IT standpoint its just a very inefficient database.

I hope you don’t really believe that yourself.

“You wont need to migrate” – Seriously. Do you actually believe this is true?

But at any rate, good luck to you, as well.

There have been numerous hard forks in the past.

I dont see this as a thread to bitcoin whatsoever.

I am not sure bitcoin survives. But if it dies, i think its rather because of a lack of adoption than it is because of technical failure

I’ll take the other side of that, but that’s what makes a market.

Good luck to you.

Warren Buffett’s* I do have a galaxy-sized ego indeed, but not that big ![]()

Why would anyone need to hack Bitcoin? Most people don’t use it for anything accept keeping it in the wallet. And yes some shops in Lugano would accept it but that’s long drive for most hackers to go and use their stolen BTC.

It was going to be the next currency

Then it was going to be store of value

Now it’s just an non-correlated asset class

I believe people would use such technology (quantum) to hack something which is actually used. Which most likely would be banks etc. So I hope we would figure out a solution by then.

On side note -: These days the valuation of things makes no sense. But the story is what matters

- Tesla makes cars but it’s not a car company

- Now it’s a company which will be the taxi for the world. And just because taxi would be cheaper everyone in world will use more taxis. As if people have nothing else to do

- But whatever the story, it’s always worth more than anything it is actually does.

Me and ChatGPT have estimated that it takes in order 10 MeV or 1.6E-12 J to produce one gold atom via nuclear transmutation, 1E12 J for 1 mole, 5E12 J per kilogram of gold.

The energy consumption of Bitcoin blockchain in 2023 was 120 to 140 terawatt-hour, or around 5E17 J.

From purely nuclear reaction point of view, without the cost of infrastructure and raw materials (mercury), it would be enough to produce 100 tons of gold, worth 9E9 USD.

The value of all Bitcoin in circulation is 1.2E12 USD.

Still not sure that nothing is wrong here ![]() .

.

Gold is undervalued as a store of energy, I think is what you mean. With all the renewable energies requiring storage growing out there, maybe gold is the next Bitcoin?

P.S. well, these estimations are bullshit, of course. Sources on practical realization say “Such transmutation is possible in particle accelerators or nuclear reactors, although the production cost is estimated to be a trillion times the market price of gold.”

The monetary value of 5E17 J is around 1.4E9 USD. The value of gold produced in a nuclear reactor would be 0.0014 USD, or 16 microgram per year. Yeah, that sounds more reasonable.

There’s tons of gold in seawater and on the seabed. Seawater is too dilute I think ever to extract profitably. The seabed possibly with improved technology.

Then again, we can just grab gold from rich asteroids which if we could get it would totally destroy gold as a store of value:

lol. it’s getting spicy… wen moon? wen omega? ![]()