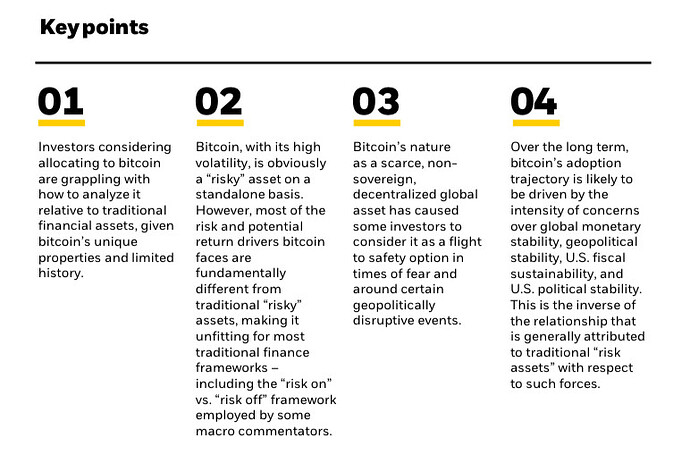

Interesting paper by blackrock on BTC…

I found #4 interesting. Does it mean people who invest in bitcoin ( referring to folks who are seriously invested in BTC , not just like lottery ticket) are going to benefit if US and global economy becomes unstable.

Doesn’t sound like a good thing to hope for ![]()

Not necessarily, but they sure prepare for it. As in, prep…are. Plus tinfoil. Guns. Nylon stockings. Shoot, a fella could have a pretty good weekend in Vegas with all that stuff! Purity of precious bodily fluids. You catch my drift? ![]()

The short answer is: yes.

In my opinion bitcoin will be strong in any scenario where money supply expands.

However, if there is a recession, equities will likely not perform great. Bitcoin (and gold) on the other hand will be relatively strong in a stagflation.

So it is rational to allocate a fraction of the portfolio to btc if you look for the optimal risk/return.

I do NOT think its bad to benefit from a shrinking economy as a small investor. Rich people benefit massively when they purchase bankrupt firms at dollars on the penny during recessions. Why should we restrict ourselves?

Sure. I am not saying it’s bad to benefit.

But if most people have have 0-5% of their portfolio in BTC, they would always have a problem if economy goes down.

If BTC goes up and everything else goes down, people would only benefit if they have decent/high allocation to BTC. And that would need real conviction which exists amongst few people only. As per data I saw less than 10% BTC wallets have higher than 10000 USD balance. More than 75% have less than 1000 USD. Unless everyone who holds BTC owns hundreds of wallets, it kind of shows the level of asset allocation.

Most people I know use BTC as „lottery ticket“ just in case it goes to million Dollars. Very few fundamentally believe in use case or asset class narrative.

this banana seems a little delayed compared to the previous bananas, no?

Yes the banana is ripening and will be ready to eat soon.

why do you think it’s delayed this time compared to previous halvings?

Probably due to the boring and long (longest?) sideway phase which will melt faces even more ![]()

Not enough momentum, and plenty of uncertainty, whales need the minnows to fatten up a bit before eating them.

I’m waiting for the Omega/God candle (20-100k on a daily). But I like banana though… ![]()

With stagflation you will be better off with 5% of btc in your portfolio, than without.

If btc goes up and equities tank, btc may be 10% or 20% of your PF.

Then you rebalance, sell btc, buy equities back to 5%

Standard portfolio theory.

The more uncorrelated assets exist, the more stable you can build the portfolio with same or higher returns…

Of course i do not hope for such a scenario, but i try to be prepared

Thanks for your feedback

But I have to say , even though blackrock says otherwise, I think BTC and High growth Equities are generally moving in same directions

Specially when bad time comes. Examples are Covid, 2022 bear market, Japan carry trade crash etc.

So I fail to see it as a protection when it’s mainly in demand during „good times“ and when bad time comes, it sells off. All behaviour so far has been very similar to high PE stocks

Agreed, short term correlation happens…thats also stated in the data and the paper. Same is true for gold. Mid term and long term is very different.

There is no perfect diversifier…

But you see gold with 0.1 correlation coefficient and btc with 0.2.

So I do not agree with a significant general correlation to equities.

If you look at risk factors, there is no reason btc should move like equities, except money supply.

So there is theoretical foundation why correlation should be extremely low. I am convinced, as more professionals understand this, correlation will drop even more.

Interesting

Even today QQQ and BTC both up about 3%. Bonds are mostly flat the day after FED cut rates

I understand the theoretical argument but we also need to look at reality. On one hand blackrock says it’s a risky asset and then they say it’s diversifier to equities which is also risky asset.

Anyhow, maybe time will tell what is the long term situation.

Well the reality is in the data, which says 0.2 correlation coefficient…

If we question the figure is correct, then we would need to calculate ourselves.

That is correct. I do not think we need to recalculate . Blackrock folks can be trusted.

Headlines in 3 years:

“Bitcoin crashes from $300K to $200K. Is crypto finally dead?”

Triggered! ![]()

90 day rolling pearson correlation coefficient of btc with sp500 currently at 0.13