instead we will get a CBDC ![]()

How does being used as currency for thousands of years in all continents (bar Australia and North America) count as failed?

Gold didn’t fail in anything. At some point there was need for more liquid and easy to transfer currency. In addition there was a need to have more currency and gold was not enough. It’s not easy to make very small coins.

Hence FiAT came into play.

Nothing is wrong with Fiat either. Currency is not there to store value. It is there to transact value. This is why people always say “cash is trash” except in short term. Future of money will be digital cash. Let’s be honest we already use it all the time. There is no problem there to be fixed for currency.

So the new narrative is about the value of currency or assets. And because fiat currency can lose value due to government actions, BTC proposes to become that new asset class where people can store that value.

As usual in order for something to be valuable, one of the following needs to be true

- that something is actually valuable (real estate, agricultural land, goods, cash flow producing assets, technology, etc) for people at large

- That something is perceived to be valuable (gold, luxury, art) by enough people

I think BTC believers would say BTC belongs to first segment, and BTC naysayers would say it belongs to second segment.

In the end it’s all about what one believes in. Everything else is a story.

It’s a pity that this is now being used as election agenda in US. Politicians need to go beyond these cheap tactics

The simple truth why Gold backed Currencies was no good idea is that it is easier to weaken a Currency in which nominal sales are fixed, than it was to reduce nominal salaries - as they are both sentimental and protected.

If we don’t want to end up in a series of Great Recessions tracing Hyper-Booms, there will always be a need to adjust salaries with the overall economic development. Unless we somewhen end up in a “gig economy future” where salaries were bidden out on a monthly basis… there will always be a need for a lever that allows to either strengthen or weaken the currency.

Clearly, this leaver (which was required) can as well be abused by politics and/or central banks with weak governance. So there is a certain price to be paid. But to overcome this situation, we best focus on strengthening independence, incentives and governance of central banks… but not that we put our economy into a corset of a Gold Standard 2.0.

BTC heroes will however never ever get this point. They put their fingers in the right wound, but came down with the completely wrong remedy. There is a need for an option how we can adjust real Salaries up and Down. We can’t do it directly, so we just weaken the Currency accordingly.

I don’t want central banks. I don’t want any banks. So I’m for Bitcoin.

Like many bitcoiners, you are libertarian and would rather have economic doomsday than control amidst the Chaos.

That’s too superficial.

I may say, you as Keynesian avoid doomsday only by supporting neverending wars (btw that’s the reason why Bretton Woods died in the 70s, Vietnam war and financing it by fiat)… too flat.

(Edit: check out the Austrians, starting at https://mises.org)

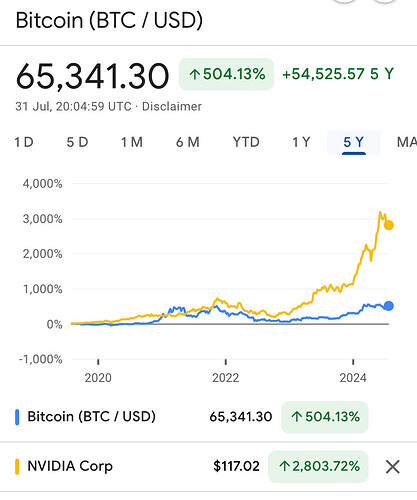

By the way, in the video of key note speech, there was a chart of returns of bitcoin vs NVDA.

I find it interesting that chart was shown for 4 years. It was kind of weird number of years . Normally people talk about 5yr , 10 yr etc

I could think of two reasons

- the idea was to compare the performance during the two halving periods for BTC

- the 5 year chart could have shown NVDA massively outperforming BTC. Same for 10 year chart

Edit -: there was a footnote that Microstrategy adopted BTC 4 years back. But I think the chart was misleading.

Agreeing with you, as usual.

Cool

By the way, I would recommend a podcast about Bitcoin on a show called “Acquired”

It’s very good podcast and for first time someone actually could explain in normal words what exactly people buy when they buy BTC.

I may indeed watch it as over many years i never heard an explanation that made any sense. Maybe that one’ll do. Doubt it’ll make me positive but I keep an open mind.

It seems the discussion got to a point where its about fundamental believe. Probably we wont get anywhere with this.

Essentially, the question is not if you believe in btc. The question is how many others believe in btc and are willing to allocate money accordingly… and how confident are you that your judgement about this question is correct?

I suggest to focus on the role of bitcoin as a potential addition to the portfolio and its impact on the risk/return measures.

Backtesting looks obviously very favorable. Future return assumptions are difficult, so i guess every PF will be different. But you can run simulations with different return assumptions for btc and see if it fits in or not

You are absolutely right. The discussion should be focused on the fact that even if we don’t really believe in BTCs 25% CAGR projection, should we invest in it.

The answer to this question is not easy. Because if investors start investing without having conviction in asset class , then they would not be resilient and would suffer losses during drawdowns.

This is why the conviction argument keeps coming back. In all honesty out of 100 people you ask, only 2-3 would be really convinced and rest are calling it a asymmetrical bet.

Anyhow. I won’t be able to contribute more on this discussion due to lack of knowledge on this topic. I just hope if the asset class grows then it doesn’t crash market for other asset classes and if it fails, then also it happens slowly or else we would trigger a big global meltdown.

Actually I like it mainly for its simplicity of explanation.

I agree. Few people invest in btc as of today.

Fyi: in the US some pension funds started allocating to btc. Some employees may have exposure but not even know it ![]()

Dont worry. With 1 trillion btc is tiny.

If something crashes the market, it will be the outstanding debt, as always in every financial crisis of the last decades.

March 2020 vibes ![]()

![]()

People bored at home with free money while the FED gets ready to cut rates by 1% in a single session ? ![]()

Rather end of the world