Hi guys,

I discovered this forum with the blog of Mr MP like many of you.

I have been a long time reader of Mr Money Moustache but couldn’t really find an European community that support this mindset and I was glad to find this forum.

I am biking to work (before Covid) since 2015. I was a nice move from public transportation to some sport.

I also like minimalism, enjoying this world through good food, nice travels and less consumerism.

I am a French IT developer 35 y.o. married man to an amazing American wife since 3 years. We have lots of in common but different mindsets especially around money. She will more artsy, foodie, sensible, loving travels and I will be more analytic, geeky and Mr numbers of the family.

We had quite few clashes and arguments on saving/spending money and we had to compromise saving and spending to enjoy our journey on Earth.

I always had some security issues that translated into accumulating cash and saving for troubles. I’d love the idea to FIRE but not sure I will do the big jump. I will be more happy to have more freedom than my classic 8 to 6 job.

I really enjoyed MMM article about Money and Confidence being Interchangeable. The idea being, with a Stash big enough, I could take more risk for a more enjoyable job with less hour constraint.

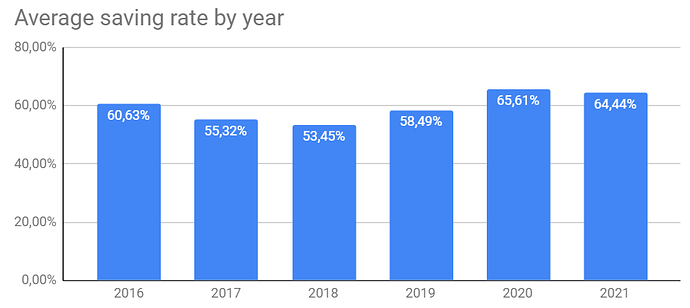

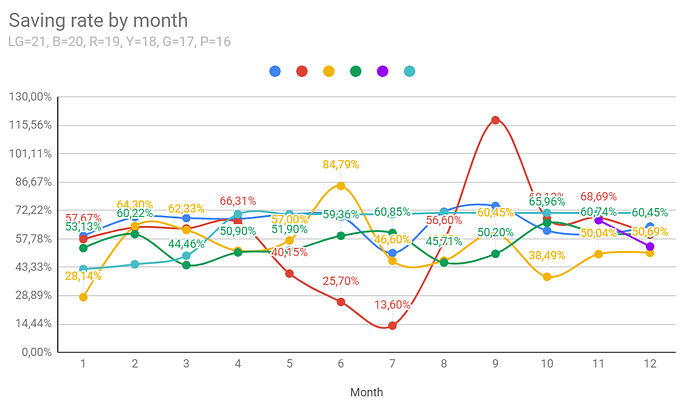

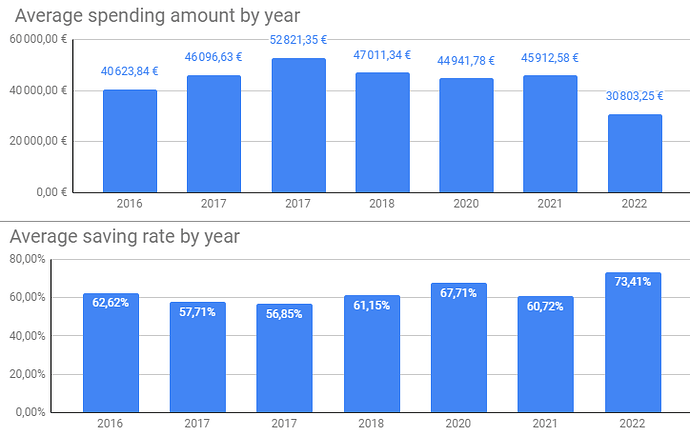

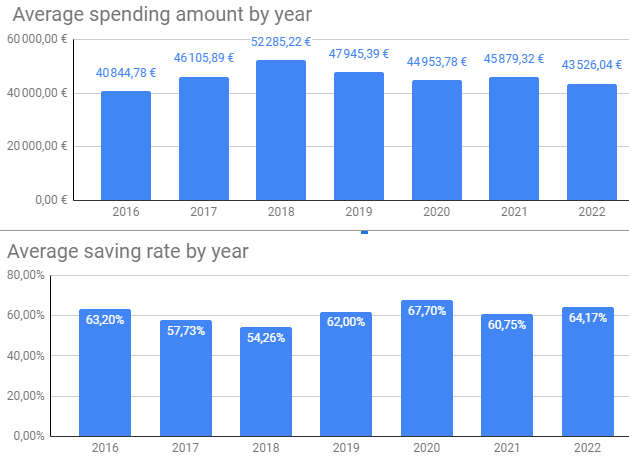

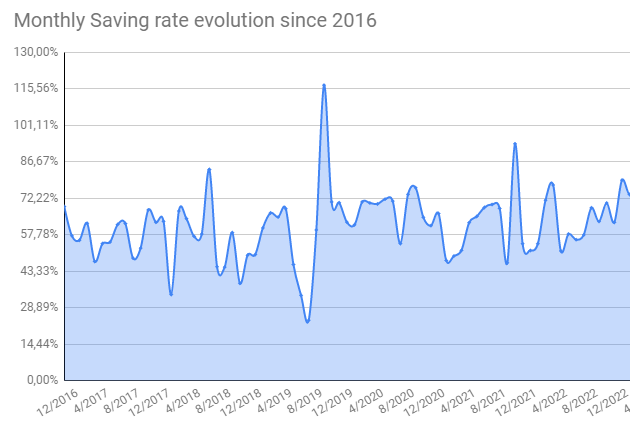

We still have separate accounts for now and I track my saving rate only:

I am targeting 45% leaving in Geneva as we were saving more 65% leaving on French side.

With a big hit usually on January

We have no car, no kid (for now) and leave below our means. We live in a small flat in the city center and spend mostly on food and travels.

I am able to save 45-65% thanks to my education (master) and field (IT).

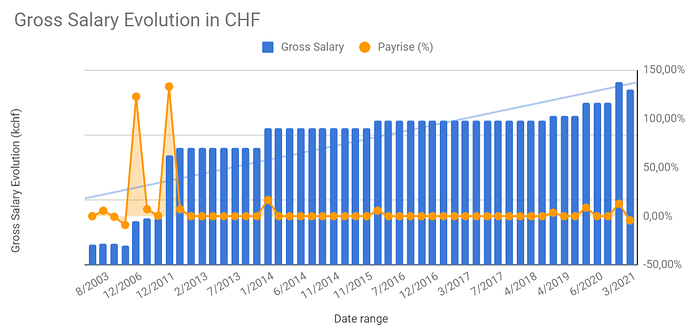

My gross salary progression could summarized it as follow.

- 2003-2006: I started with French minimum wages

- 2006-2011: I started to work with my bachelor. x2 French minimum wages. My parents push me to continue for a Master in IT and practice English with studies abroad.

- 2012: Graduated to my Master and started to work in Switzerland. x2 previous French IT dev salary

- 2013: Moved from Junior, confirmed then Senior IT developer in Switzerland

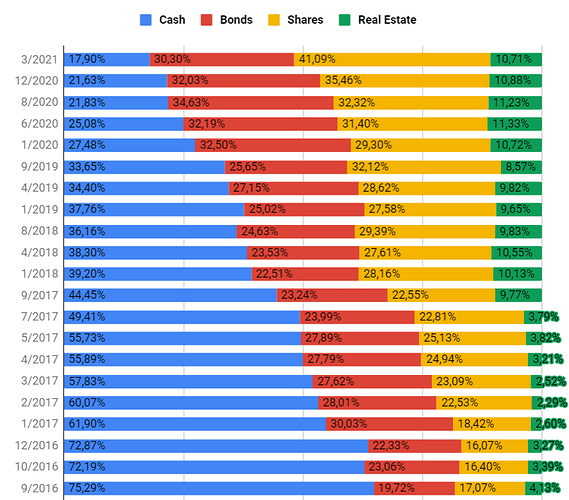

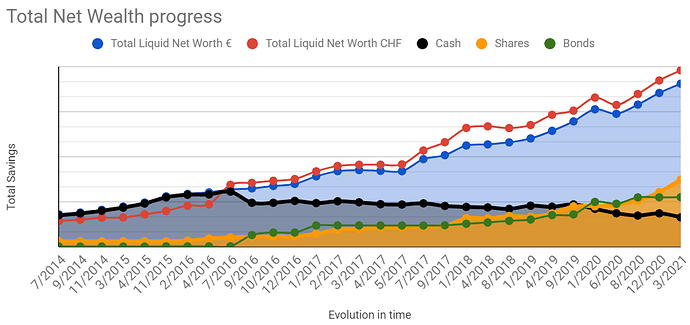

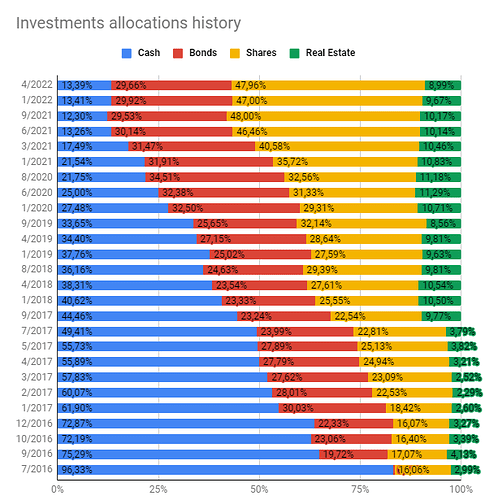

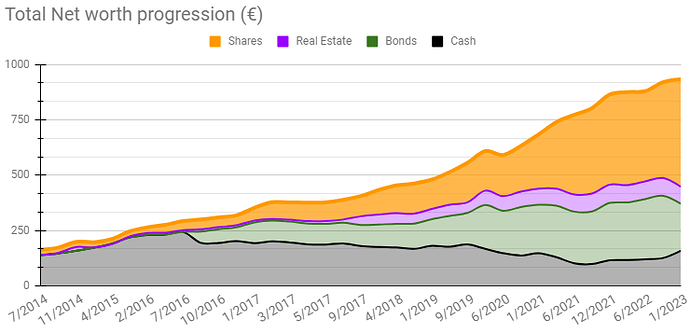

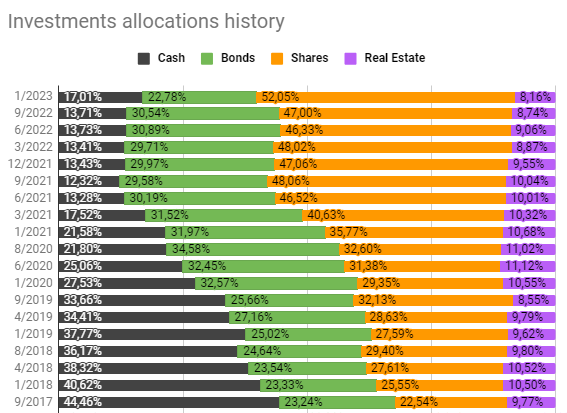

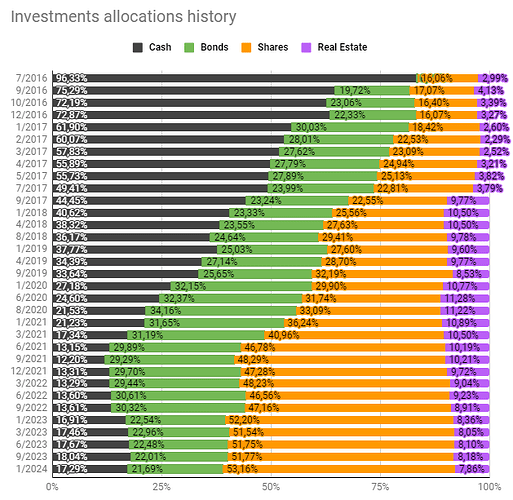

Since 2016, I worked on my risk tolerance and allocate my stash from cash to a more balanced portfolio:

Bonds: I started to be expose to investment world through French Life Insurance that offer Fond Euro with no risk and also low interest gains (1-2% in 2020). I consider them as bonds as well as my LPP2.

Shares: I progressively moved my extra cash to LPP3 equivalent (PEA, PME-PEA) which are now useless as Switzerland resident. I discussed the point in French corner of the forum with @nabalzbhf. I am not sure about converting all those euro investment back to CHF. I will keep them open and may be useful if one day I cross border again. I will rebalance them to invest only in physical Euro ETF instead of CFDs. My future investments are now with IB to be more currency efficient (CHF > USD), invest with physical US ETF and to ease my tax declaration for 2022.

End goal of 2021 will be to balance 10% of cash to Shares.

I have been more active on the forum in the past month due to our move to cross the border to Geneva last year. All my French fiscal and tax knowledge became obsolete and I am still learning a lot. I am starting an IB account and invest in US ETF like VT with Mr MP referral link.

We haven’t got any Wealth number in mind as my wife is happy working and do not wish to retire or travel the world. We are quite happy with 5 to 6 good weeks on holidays but I won’t mind taking a low stress job with less constraint.

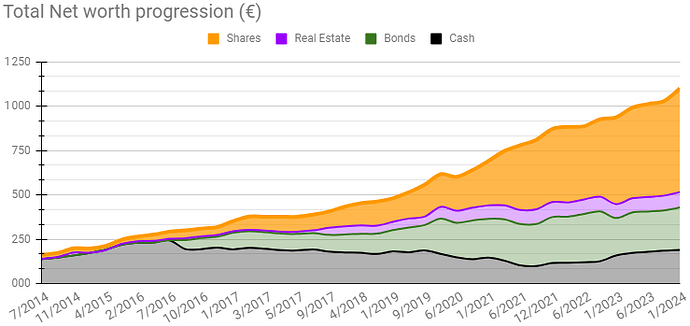

My Total Net Wealth increased since I track it and also the portfolio mix

It is now worth 14 years of savings including LPP2, LPP3.

Another objective for 2021 will be to start a joint account and help my wife get her stash going.

We will contribute to common expense with 1/3rd for her and I will take the rest.

Will she be able to invest in a LPP3 as an US citizen? Or should I start to look for an IB account?

Owning va renting :

I am not someone that necessarily want to own my place while working. I do not think it is always a good deal as buying is overpriced where we live and do not want long commute. I am happy renting as long it is well located and not too expensive.

Long term, we will ideally own our place and my idea will be to bought it when we can currently borough the money to the bank and rent it until we retire or decide to go to a low pace/small job. Ideally the city will not be in an overpriced capital necessiting High wages, still attractive with some jobs, making connections easy (Airport or trains),close to France to visit family, not a total tax killer…

Still looking…

Thank you for reading.