Totally agree with you ![]() It’s also a reason it was always in my experimental portfolio with a small amount.

It’s also a reason it was always in my experimental portfolio with a small amount.

If you would not buy it today - sell it immediately. There is ZERO rational reason to hold it until it‘s positive again.

Sounds like you bought near the top? I’d agree with Tonyleet. In any case factor tilts are very long time plays.

There is reason if you assume that retail can be worse at market timing than random chance. Buy high, sell low.

Exactly pretty much at it’s peek, and as @Tony1337 says it would make more sense to sell immediately.

Well on second thoughts, if it’s a not insignificant amount of money…dunno. I could be inclined to consider it spent and keep it in. You’re not paying any TER right, unlike the mutual fund stock?

You are talking about an actively managed fund of stocks, right?

0.9% OCF… see the factsheet here: Fund Factsheet | Smithson

Hmmm yeah, missed that, for some reason in my mind I had SSON as a holding company like BRK, while the Fundsmith fund as a classic mutual fund. That’s three times “fund” in a paragraph. Four now.

Just because they don’t have to write down a precentage number and name it TER doesn’t mean that there are no managers, brokers, admin, services, etc. getting their cut.

In every book and article about factor investing, it says, you might have to be very very patient. That’s exactly why I never considered it. I would not have the strength to wait for the factor to show up, while it’s constantly underperforming ![]()

Not sure I am getting you, when there’s a TER it’s clearly written and you know that your real performance will be whatever the market makes minus the TER.

What you’re describing is a combination of broker fees (which are transparent and one-offs, if you’re talking about costs to us, not to BRK buying and selling stock), and internal running costs of BRK, taxes, claims etc etc down to whoever is mopping and hoovering and filling the infinite Coca Cola machine outside Buffett’s office. That’s no different from any other publicly-traded company. Their running costs are visualized in Sankey diagrams (I just learnt the name for these by the way!) but they are not passed on to us any more than holding any other public company. And that’s the point and the difference, BRK is not a fund, it’s “just” a company issuing stocks to the public, running costs are a factor reflected in the price, we’re affected by these costs via the stock price, but we’re not explicitly paying them like we do with TERs.

Sorry for the long response, maybe I am missing something, it’s been a busy weekend and even busier week before it.

Arguably no different than an ETF (or an Investment Trust like Smithson), is it? ![]()

Running costs are even less reflected in BRK‘s price than an ETF‘s, since BRK can trade at considerable premium or discount to NAV and move differently than the investments they’re holding. Whereas an ETF will usually trade at NAV - or performance of underlying index less costs. We’re not explicitly paying ETFs‘ costs - they’re just reflected in the stock price.

You are describing tracking error, not TER. TER is a big factor here, but not the only one.

That is the only thing I had in mind. In a fund they take something for managing the assets (salaries, broker fees, etc.). They often make (parts of) it a contractually fixed percentage of the total assets.

Many similar expenses are required in a holding company. As far as I know their subcompanies still require proper managers. There should be some synergies, of course. But I guess there is also a big market segment that is better served by comparatively cheap fund management and direct investors.

So, explicitly or implicitly, you will still pay.

Personally I see a difference, in any case it’s unimportant.

We’re not paying them as in having a bill by the broker for the end of the year, but we are paying them by the fact they are explicitly stated, something that’s not the case with individual stocks. Ignore me, this is likely my autistic and tired side talking.

Let’s get slightly autistic then…

Since the Smithson Investment Trust has been mentioned above, it may be useful to point that British investment trusts are subject to certain distribution requirements and reporting requirements (in exchange for favourable tax exemptions from corporation tax) by law.

Prospective investors should note however that they are traded very much like BRK stock, meaning…

![]() In Smithson’s case you don’t.

In Smithson’s case you don’t.

They do report an OCF figure - basically (albeit though not exactly) the same as a TER.

But that doesn’t mean you know real performance. Not even if you knew their full portfolio and trades.

Smithson are traded like a stock whose performance can diverge from the (NAV of) investments it holds.

Example:

The underlying investments can return 0% over a year.

The trust can have 0.9% OCF in operating costs and no other costs.

Yet its share price can still go down 5% or 10%. Or up.

In fact, it kind of did: Smithson is currently trading at a 13.9% discount to NAV.

The Smithson 2023 annual letter to shareholders is on the website and it explains that the discounts on UK Investment Trusts vs. Net Asset Value are currently very high.

Smithson Fund Managers are also very bullish about the future.

My plan was to own Fundsmith and Smithson in a 67% - 33% ratio. I am currently deciding if I was too greedy and if if something like 80 - 20 would have been more appropriate for me.

Smaller companies are less predictable and volatile. See recent allegation against Temenos which was the 3rd biggest holding in January then dropped out of the top 10. On the other hand if smaller companies continue to out-perform over the long term (especially in up markets) and SSON management continue to meet or exceed the benchmark then now could be the worst moment to lower my allocation.

Fund provider wanting to sell you their fund is bullish about the future. What a truly unexpected revelation!

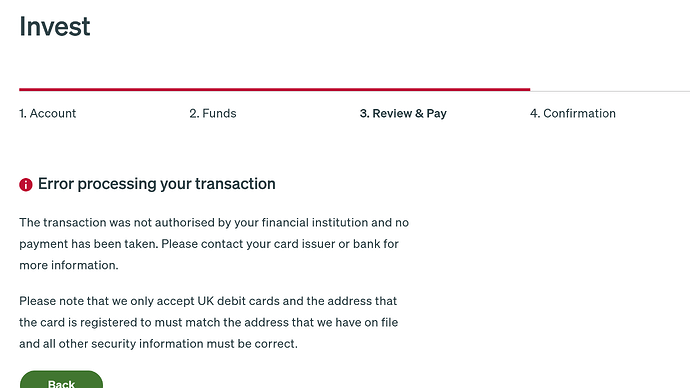

Does anyone else have issues transferring money to Fundsmith via their web portal (Debit Card option) using a virtual card in Revolut? I used to do that each month with a small amount but this month it simply fails…

Here’s the link to the Smithson AGM: https://www.youtube.com/watch?v=dKCalbTR-yA

I am often thinking of building a small position in Smithson, but I am not sure if it’s the right moment.