If you are convinced of the fund’s strategy, the time to invest is now. The right moment to invest can only be known in hindsight.

Its a small cap play and its very sensitive to interest rates so theres a timing element

The video gives me further doubts whether the Fundsmith model can be reapplied to Smithson and outperform the smaller companies benchmark with the same degree of success.

Fundsmith Investment strategy:

- Buy good companies

- Don’t overpay

- Do nothing

The fund manager seems to be having difficulties on 1 and 3.

It makes sense to me that the Munger approach “buy a great company for a fair price and hold for 40 years” would seem more difficult for smaller companies …

For me they have a problem with overpaying and not a general problem with the quality of the companies

I really like(d) Fundsmith for so long.

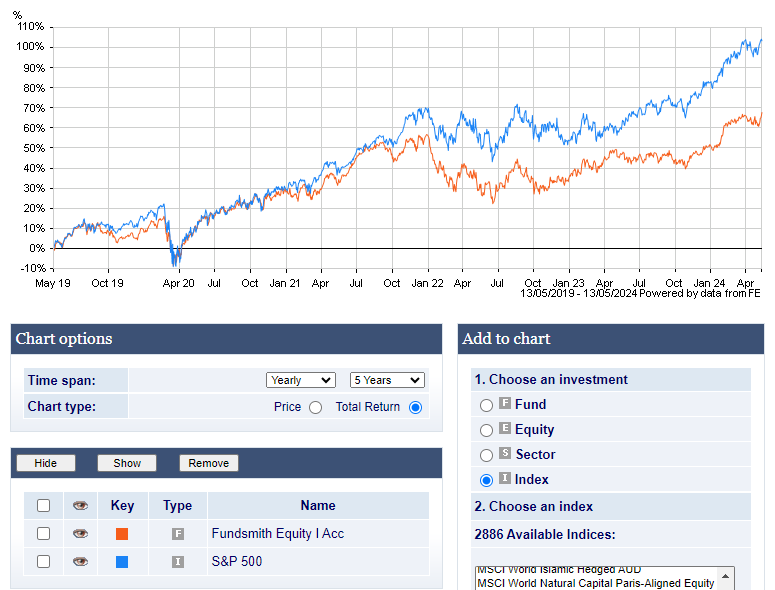

But then again, there hasn’t been a single year in the last 5 where they could beat the SP500.

why exactly are we paying a premium here? ![]()

The question is whether Smithson was representative for Fundsmith or not. But at least on Smithson, the above AGM clearly calls for a hard SELL. Why?

- they buy quality companies with tremendous profitability / ROIC

- they however buy them at terrible prices, their Free Cashflow Yield is below the Index

- they don‘t show a metric to what extent (and whether) their companies can“internally“ re-invest their ROIC vs. the Benchmark (why didn’t they focus on this?)

- they admit that they can’t hold the companies long term

Why does this matter? Upon purchase of the share, the only thing that matters is the Free Cashflow Yield at which you buy. You buy bellow the Index (as they do) => you lose vs. the Index. Now a year later, what matters is how much of the free cashflow the company can re-invest into the same profitabiliy. IF your company re-invests a larger piece of the FcF yield than the Index - your FcF yield grows faster than benchmark. Profided you hold the company long enough so that compounding can start. Otherwise, you trail the market. So why the heck didn’t they mention anything about that?

In my view, they have an acute Problem of overpaying their acquisitions and even though they focus on Profitability aka Quality; they have a blind spot on whether the Quality actually could / would be re-invested at better than Index‘s FCF Yield (whether that was the companies themselves or through them buying other shares low) or if all its benefit has already gone to the one they bought the share from when paying a hefty purchase price.

Fundsmith overperformed MSCI World in two of the last five years.

Then again, a fruit eater is of course free to substitute apples for the oranges in his or her diet.

why would you measure it against a total world index and not the best of the best, aka SP500?

Different investment universes.

Fundsmith is a developed world index - so is MSCI World.

S&P 500 is a one-country index that cannot include many securities that Fundsmith may invest in.

Huh? Isn’t the MSCI Denmark much better…?

EDIT: Sweden, Hong Kong, Switzerland, …

Let alone NASDAQ 100.

I could probably find 10 indices that run circles around the s&p.

That‘s not a good approach to comparison.

It just happened to be that the US was very dominant over the last 15 years and any funds with significant ex-US holdings, more than likely underperformed.

If you are paying premium to Fundsmith to beat S&P 500 then I think it’s not a good decision.

If that’s your objective, you should try Active funds in US who have this target. The chances are low but at least try the fund which is trying to do so.

it’s a “one-country” index, with the biggest companies on earth that are all active globally.

that index has happened to beat anything in the last 100 years though, didn’t it?

or I can just buy SPY passively and come out cheaper and probably better in the long run.

let’s see them! ![]()

if possible, at least the last 50 years please.

Exactly. It is like saying “this bond ETF underperformed S&P500, wHat Am i pAyiNg fOr?!”

But the OP is looking to beat S&P 500. You can’t do that by buying S&P 500 ![]()

I just realised , you were the OP …

So yeah if index performance is fine with you , then it’s best to stick with SPY or VOO

Not South Africa, Australia or Denmark, apparently. Let’s not make reddit out of this forum because it’s awfully boring.